'Social Security is broke beyond belief': This Boston University economist warned the government safety net is full of holes — here's how to make sure you stay afloat in retirement

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Many Americans aren’t saving enough for retirement — and they’re relying on Social Security benefits to get by . But that may not be a sound strategy.

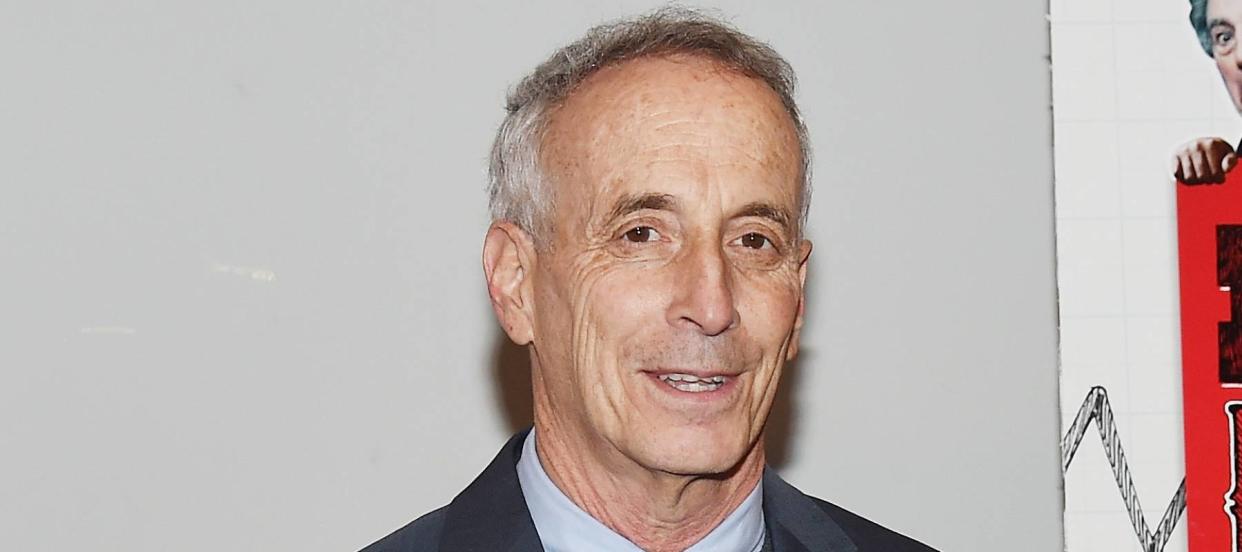

“Social Security is broke beyond belief,” Laurence Kotlikoff told The Brink, Boston University's research news website. “Its unfunded liability is $65.9 trillion — twice the size of official government debt.”

The "retirement planning evangelist" and professor of economics at Boston University says that paying for all projected benefits through time requires “an immediate and permanent hike” in the employer-employee The Federal Insurance Contributions Act (FICA) tax from 12.4% to 17%. Without the hike, Social Security payments are on track to be reduced as soon as 2034.

Don't miss

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Older Americans are already getting anxious. A new AARP survey shows 61% of Americans age 50 and over worry they won’t be able to financially sustain themselves during their retirement years.

Given these issues, it might be a good idea to reduce your dependence on Social Security and take charge of your own retirement — here are a few ways you can do that.

Secure your retirement fund

“Even after Social Security contributions, and after 401(k) contributions, they should probably be saving another 15% of their take-home pay, which is very tough,” Kotlikoff said. “Most people are saving nothing.”

According to the AARP survey, his statement rings true. About 20% of Americans age 50 and over do not have anything saved for retirement.

If you are in the market for a retirement account to help grow your existing nest egg or to start building up your retirement savings, opening a gold IRA with the help of American Hartfold Gold has a few advantages.

Billionaire hedge fund manager Ray Dalio has called the yellow metal “timeless and universal.” Amid surging inflation and geopolitical instability, gold prices have reached new heights, now standing at over $2,300 per ounce.

Gold IRAs allow investors to hold physical gold or gold-related assets within a retirement account, combining the tax advantages of an IRA with the inflation-hedging benefits of investing in gold.

One of the country’s most trusted precious metals companies – with an A+ rating from the Better Business Bureau – American Hartford Gold has helped thousands of clients protect their retirement.

Read more: Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Plan, invest, save for the future

Even if Social Security benefits are still paid out in full, many Americans face complicated hurdles in the system.

“For far too many of America’s seniors, with any but the simplest situations, negotiating the complexities and outright scams of the Social Security system on their own is nigh impossible,” Kotlikoff told The Brink. “Kafka could not have designed a more complex set of provisions with hidden catch-22s that can haunt you — in the form of clawbacks — decades after you start collecting benefits.”

The Brink article lists tips for retirement savings that include: plan within your means, save in addition to your retirement program, use planning tools, and wait longer to collect Social Security benefits.

If you want to invest and save in addition to your chosen retirement account and lessen your dependence on Social Security, you have multiple options.

Invest

Real estate is an intriguing option for retirees and can be especially appealing when compared to investing in the sometimes volatile stock market. This asset class has strong potential to generate long-term income that you can use during retirement or to add to your savings.

For example, Arrived makes it easy to fit rental properties into your investment portfolio without all the barriers and hassles that come with purchasing and managing a property yourself.

Backed by world-class investors like Jeff Bezos, Arrived’s easy-to-use platform offers SEC-qualified investments such as rental homes and vacation rentals.

Start by browsing a curated selection of homes, vetted for their appreciation and income potential.

Arrived’s flexible investment amounts and simplified process allow everyday investors to take advantage of this inflation-hedging asset class as part of their retirement plan.

If you aren’t sure which assets are best for your portfolio or you just want to take the work out of investing for retirement, you can let the experts at Wealthfront do it for you.

Wealthfront has an automated investing platform that can help you grow your money in a way that best aligns with your retirement goals.

By answering a few questions, Wealthfront helps you determine your risk tolerance and optimal asset allocation. It then crafts a diversified portfolio for you, spanning a range of ETFs — from stocks and bonds to real estate.

Sign up now and they'll help jumpstart your nest egg with an extra $50.

Save

Kotlikoff describes the economics-based approach as determining a sustainable living standard based on your resources, and adjusting your spending as circumstances change, so you don’t outlive your savings.

It’s always a good idea to make a budget and stick to it — now and in retirement. But the reality is you will need to spend money. Fortunately, there’s a way to spend money and invest it at the same time with Acorns.

When you make a purchase on your credit or debit card, Acorns automatically rounds up the price to the nearest dollar and puts that amount into a smart investment portfolio. This way, even the most essential spending translates to money saved for the future.

Sign up for a free account now and receive a $20 bonus investment to get you started.

Plan

Given that Social Security is, in Kotlikoff’s words, “broke beyond belief,” it’s worth exploring other options. It could be a good idea to consult a financial planner to determine which options are best for you.

If you’re unsure how to begin investing and create a long-term financial plan for your retirement, WiserAdvisor can assist you.

WiserAdvisor is an easy-to-use online platform that connects you with vetted financial advisors. After sharing some information about yourself and your finances, WiserAdvisor’s easy-to-use online platform matches you with two to three FINRA/SEC registered financial advisers best suited to help you develop a plan to achieve your retirement goals.

From there, you can view the advisors’ profiles, read past client reviews, and schedule a free consultation with no obligation to hire.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

‘Most investors are not aware’ — the secret to keeping your retirement portfolio stable amid a volatile market

‘Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.