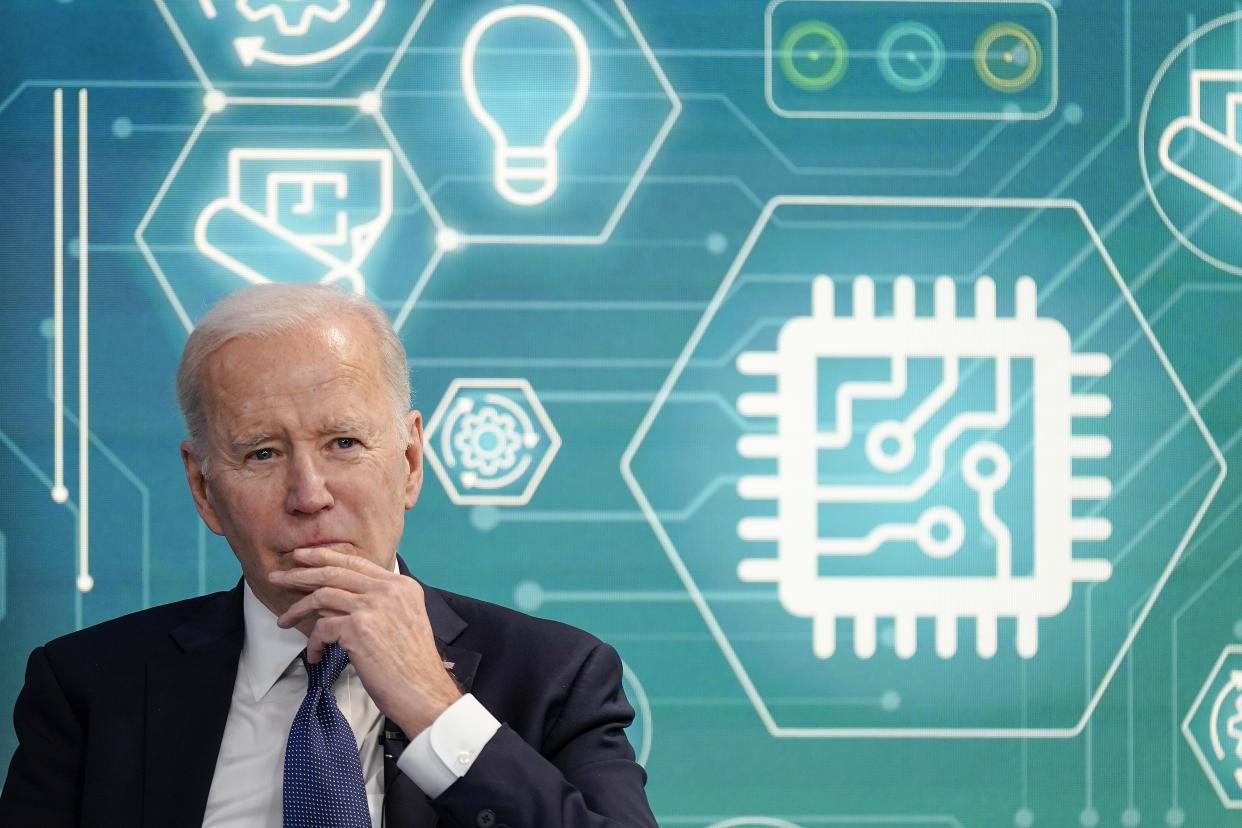

Semiconductors: U.S. manufacturing won't be a 'silver bullet' for the industry, analyst says

An ongoing chip shortage has raised calls to bring semiconductor manufacturing back to the U.S.

But given the fact that chipmaking is currently a highly complex global operation, with certain countries specializing in a small part of a chip’s overall production, manufacturers hoping to fix supply chain tie-ups are finding that there is no one-size-fits-all solution to deglobalize supply chains.

“Trying to duplicate this chain where the big designers and suppliers are scattered all over, and the customers are scattered all over, I think it's a very long and expensive process,” Vivek Arya, a senior semiconductor analyst at Bank of America Securities, told Yahoo Finance (video above). “It's just going to take a lot of IP and expertise, so I don't think there is a silver bullet here.”

'A three- to five-year journey'

The lack of processors has created a ripple of challenges for automakers and makers of consumer electronics. Much of the chip manufacturing has shifted to Asia while just 12% of chips are made in the U.S.

“You have companies in Japan that are producing the raw wafers,” Arya explained. “Then you have the big foundries in Taiwan that are doing a lot of the leading-edge manufacturing, then you have other parts of the supply chain tied to assembly and testing that are in other parts of Asia, and then you have over half of the chips designed in the U.S. and Europe.”

The global semiconductor supply chain has taken decades to be put into place, Arya added. And although the goal of turning semiconductor manufacturing into a domestic operation is worthwhile, he added, “it’s probably a three- to five-year journey, assuming it is funded as soon as possible.”

That funding has yet to be released as lawmakers work on legislation that would subsidize domestic production and help alleviate some of the logistical bottlenecks exposed by the pandemic

One version, the CHIPS act, was approved by the Senate earlier this week and, if approved by the House, would provide $52 billion in subsidies for domestic chipmakers.

For now, mutual dependency is set to continue.

"The reality is that the East and the West have learned to live with this kind of mutual interdependency and the symbiosis," Arya said. "The designers are in the West, a lot of the manufacturing is in the East, and both need each other equally."

Additionally, the chip industry is not the only industry that has faced calls to bring manufacturing back to the U.S. amid supply chain shocks.

Other sectors have found the transition to domestic production easier. For instance, New Balance, an athletic shoe company with both domestic and global operations, recently opened a new production facility in Methuen, Massachusetts.

New Balance CEO Joe Preston told Yahoo Finance Live that the company has been able to eke out margins by quickly turning out new products while lowering logistics costs.

“Certainly there is a labor cost difference between the wages here in the U.S. versus anything overseas,” Preston said. “You need to make up for that in terms of innovation and speed to market.”

Mike Juang is a producer for Yahoo Finance.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube