Remote Work and Other Job Benefits You Shouldn't Overlook

When it comes to hunting for a new job, salary can seem like the main selling point, but it isn't everything. Salary usually only accounts for about 68 percent of an employee's total compensation package; the remaining 32 percent is made up of benefits, according to the Bureau of Labor Statistics. Workers have changed their priorities during the COVID-19 pandemic, making certain benefits like remote work much more important. Don't overlook the other valuable workplace benefits that could boost your bottom line. Take advantage of these perks—whether you're negotiating for a new job or checking in with your HR department after years with your current employer.

Related: 10 International Work Benefits Americans Wish They Had

A solid health insurance plan can save you thousands of dollars in out-of-pocket medical costs. If your employer contributes a hefty chunk toward your premiums, you'll have to pay even less. in 2018 the Employee Benefit Research Institute (ERBI) found that 60 percent of workers rank health insurance as extremely important when deciding whether to stay or find a new job. If your company offers a generous health plan with a small deductible, factor that savings into your overall compensation.

Related: 5 Tips to Save Money on Health Insurance

Healthcare coverage (and savings) can also apply to your extended family. Adult children can often remain on a parent's health insurance plan until they are 26, even if they're married. In 2020, annual premiums for employer-sponsored family health coverage reached $21,342, with workers paying on average $5,588 toward the cost of their coverage, according to the Kaiser Family Foundation.

Perks like employer contributions to health savings accounts or reimbursement accounts can help offset deductibles and costly prescriptions or lab fees. Insurance policies like employer-provided disability insurance and short-term disability coverage could replace all or a portion of your income if you can't work due to an accident, illness, or maternity leave. Before accepting a new job offer, calculate any increase in out-of-pocket insurance costs.

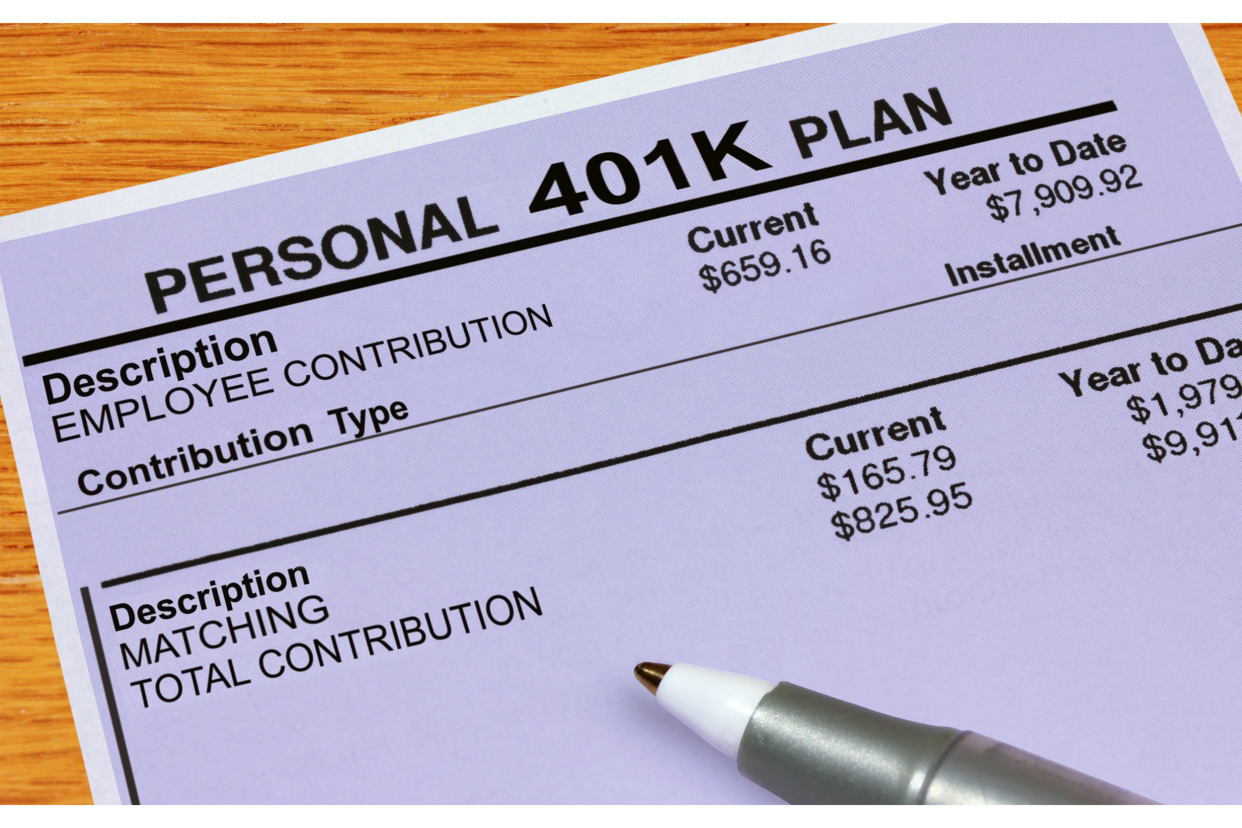

Employer-sponsored retirement plans — through benefit plans like a pension or contribution plans like a 401(k), 403(b), 457(b), or Thrift Savings Plan (TSP) — make it easy to save for retirement. Still, only 72 to 80 percent of workers who have access to a retirement plan at work participate, according to the Congressional Research Service 2017 fact sheet. Sign up and make sure you're not leaving money on the table.

Since many companies have abandoned pension plans, a 401(k) is a way to contribute to employees' retirement savings. Some companies even offer matching funds. Surprisingly, many workers don't sign up for their benefit plans, which is like turning down free money. To collect it, simply contribute to your 401(k) yourself.

Related: 11 Ways to Jump-Start Your Retirement Savings If You've Been Procrastinating

Companies that offer personalized and trusted financial support through one-on-one, in-person consultations with enrollment representatives or free financial education workshops can help employees feel more financially secure. Be sure to look into these programs or one-off opportunities.

The pandemic has altered the work-life balance landscape, introducing many to the concept of working from home for the first time. MetLife's study reported that 76 percent of employees are now interested in alternative work arrangements such as remote work or flexible schedules.

Related: 15 Mistakes to Avoid When Working Remotely

According to MetLife's study, 80 percent of employees are interested in increased paid leave or paid time off. If a company offers a considerable amount of time off, you won't have to worry about losing pay if you need to take time off during the year for personal reasons. You can also use the time off to recharge with a vacation, volunteer, or extend maternity or paternity leave, or even moonlight on the side for extra income. Some companies offer PTO specifically for volunteering at local organizations, floating holidays for your birthday, or even to run errands during holiday season.

Many companies help employees stay healthy through wellness programs, which can give you access to free or discounted gym memberships, weight-loss and smoking-cessation programs, wearable fitness tracking gadgets, and in-office yoga classes or massages. You might even lower your medical insurance premium for taking a health-risk assessment or earn rewards ranging from $10 to $500 for completing healthy tasks like logging your food intake and exercise. Taking control of your health can save you money in the long run, so don't underestimate the value of these extras.

Perks attract new employees and promote employee retention. Discounts to local businesses, restaurants, amusement parks, entertainment venues, and even special events like sports games, plays, and concerts can be useful bonuses for employees, particularly those with families.

While not universal, some companies offer on-site services like child care, gyms with a personal trainer, health clinics, laundry services, or grocery shopping delivery. For overloaded employees who spend much of their time at the office, these benefits can make it easier to stay on top of personal errands. If your company offers any of these benefits, consider how it might enhance your quality of life and save you money and time.

Related: 15 Companies With Unusual Employee Perks

Workplace perks like free coffee and lunches, free parking or shuttle rides from the nearby train station, pet-friendly office environments, well-equipped coworking spaces, and reimbursed dinners and late night car services home from the office shouldn't be overlooked if they keep you stress free.

Employee assistance programs, one of the most overlooked benefits, make employees' lives a little bit easier to manage. Programs can range from concierge services like 24-hour travel assistance to free referrals for recommended local doctors, lawyers, and plumbers to short-term counseling services to help you overcome stressful personal issues and be more productive.

Pre-tax spending accounts allow you to set aside money to pay for healthcare, dependent care, and commuting costs with pre-tax dollars. These flexible spending benefits can help alleviate the costs of commuting by offsetting the price of a monthly public-transit pass or caring for an aging parent if they require a paid caregiver while you work. If you drive to work, consider asking your employer for mileage, tolls, gas, or parking reimbursement, or a company car if your role requires travel.

Related: Essentials You Can Buy With an FSA Now to Keep the Money From Going to Waste

Your experience helped you score your new gig, but evolving your skills for the latest phase of your career could be a costly undertaking. Many companies will budget professional development perks on a per-employee basis — from classes in specific disciplines to conferences, seminars, and tuition reimbursement. There might be strings attached, like only reimbursing for job-related educational opportunities and staying a minimum number of years at the company (otherwise you might have to pay back the tuition), but this commitment can lead to greater job satisfaction and future promotions.

Some companies offer employer-provided student loan repayment assistance programs, a work benefit where your employer makes additional payments on your student loans. Using services like SoFi and Fidelity, these programs can help employees reduce the cost of their debt by consolidating all existing loans into a single loan with one monthly payment and even provide a welcome bonus for choosing to refinance through your employer's choice service.

Related: Should You Refinance Your Student Loans?

Many companies encourage their employees to donate time and money to nonprofits in their communities, and will even match those efforts with dollars and other types of support. Companies sometimes match their employees' charitable donations through employee matching gifts, and donations through Payroll Deductions can also be set up for employees who wish to give to a worthy cause on a regular basis.

Volunteer support programs (or "Dollars for Doers") reward employees who volunteer by giving stipends to nonprofits for a certain amount of time an employee volunteers there. In addition, organized "team building" activities at a nonprofit are often accompanied by a larger corporate donation. For those passionate about giving back to their communities, these programs can help employees feel good about the work they do and their companies.

Related: 37 Volunteer Programs That Give You A Chance to Travel

For those who've wanted to work abroad, global mobility programs can be a tremendous benefit. Companies typically ensure a hassle-free relocation process for international assignments with expatriate compensation and benefit plans, coupled with allowances for housing, schooling, and home visits. Forward-thinking companies focus on their employees' long-term development needs with strategic opportunities, learning experiences, and commodity jobs for different types of employees.

Many companies reward employees for their loyalty. These rewards can come in many different forms, from verbal recognition to company swag, cash, or extra time off. Celebrating workplace milestones for those employees who reach their 1-, 3-, 5-, 10-, and 15-year marks and other significant accomplishments can boost company morale and employee engagement.