Pro teams are becoming ‘a highly attractive new asset class,' sports exec says

Chelsea F.C’s $5.3 billion sale on Wednesday marked the largest of a sports team ever, but some believe the NFL’s Denver Broncos could sell for even more.

As sports teams fly off the billionaire shopping shelves at higher prices than ever before, Monumental Sports and Entertainment (MSE) President Zach Leonsis told Yahoo Finance Live that buying a team is becoming an attractive alternative investment for the world's elite.

“We are starting to see sports emerge as a highly attractive new asset class,” said Leonsis, whose company owns the Washington Capitals, Washington Wizards, and the Washington Mystics.

Leonsis' father, Ted, bought the Capitals for $85 million in 1999. In 2021, Forbes estimated the team’s net worth at $930 million. That $845 million unrealized return is more than double what an $85 million investment following the S&P 500 would've returned in that same time period.

It’s not just the Capitals or the NHL, either. The average value of an NFL team increased from $423 million in 2002 to $3 billion in 2020, per Statista. The NBA and MLB have seen similar jumps as well.

“We are going to continue to see private equity come into the space,” Leonsis said. “It wouldn’t surprise me to see the Denver Broncos sell for over $5 billion. If you’re interested in holding something for the long term, I think there are plenty of funds and clearly plenty of high net worth individuals who are willing to do that, sports have proven to drive incredible returns.”

'An inflection point' in sports

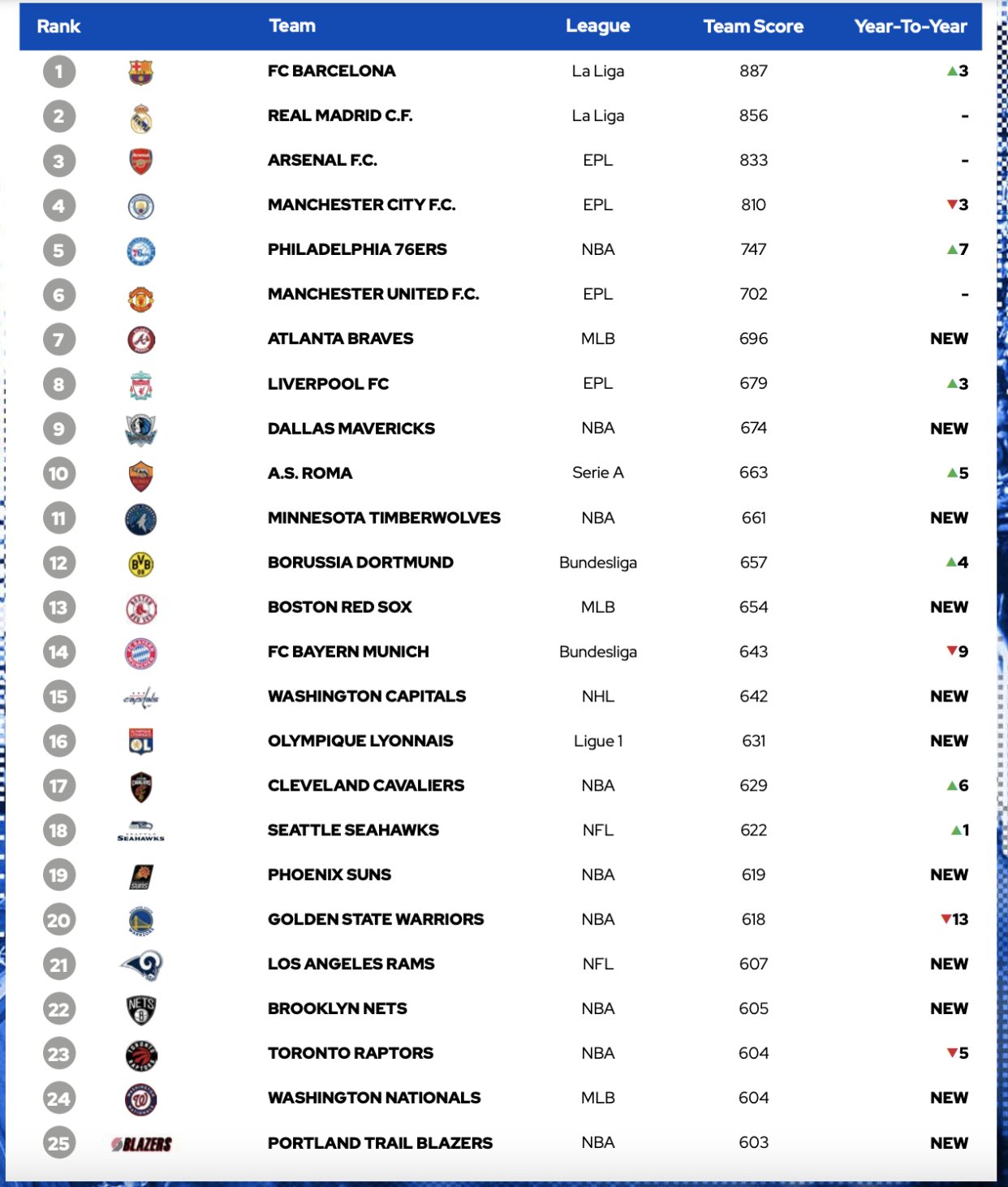

The rising valuations come as sports teams are reimagining their operations. The Capitals ranked 15th overall and first in the NHL in Sports Innovation Labs Top 25 Most Innovative Teams list released on Wednesday.

Sports Innovation Lab takes into consideration three main pillars when conducting research: Revenue diversification, technology enablement, and organizational agility. Sports Innovation Lab told Yahoo Finance that the Capitals scored highly in the technology sector due to their emphasis on fan engagement through an exclusive NFT deal with FTX and a direct-to-consumer OTT platform, Monumental Sports Network, where streamers can subscribe to watch live games and exclusive content surrounding MSE-owned sports teams.

MSE branched into other revenue streams as well, adding a sportsbook inside Capital One Arena. In the first four months of the year, the sportsbook produced nearly $2 million in gross gaming revenue, according to the District of Columbia Office of Lottery and Gaming.

Those added revenues aren’t what’s driving the current franchise pricing wars, though, according to Abe Stein, Sports Innovation Lab’s head of innovation. Stein, who led research on the recent report, attributed the current run-up in valuations to large broadcast deals (Amazon is paying the NFL $1 billion to stream one game a week) over the past decade.

At the same time, Stein believes the sports industry has reached an “inflection point,” as more content shifts to streaming and the battle for consumer attention intensifies. That’s why teams broadening their reach beyond traditional linear channels will benefit in the long run, he said.

“The most forward-looking teams are exploring a lot of that direct-to-consumer space,” Stein said. “Exploring a lot of that new behavioral space, where it's through betting, or owning, tokenization, which has its own complications. They're exploring new models, co-watching, owning their own media channels, which is a big part of it as well. If they become less dependent on big broadcaster media rights and they can do their own media, I'd say that's a big part of that mix.”

With several professional sports franchises, a live events venue, and eSports team, Leonsis and his family are long on the sports industry and its continued growth. They’ve invested in the future that innovators like Stein believe will bring sports into its next era.

Still, when asked why sports are such an ideal investment, Leonsis pointed to brand loyalty.

“The [brands] identify so deeply with the core of people’s identities and who they are,” Leonsis said. “We take that very seriously. Who knows if we’ll be using Apple iPhones in 10 years, but I’ll bet you’ll still be a fan of your favorite team. If you have a family, if you have children, you want your children to be fans of that team.”

Josh is a producer for Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn