Nike has a key advantage over upstart running shoe brands: Analyst

Nike (NKE) reported quarterly results after the bell on Monday, beating expectations despite the effects of the Russian invasion of Ukraine and pandemic supply chain issues.

Furthermore, according to one analyst, the Oregon-based footwear giant has a clear advantage among consumers over upstart running shoe competitors like Swiss-based On and France-based Hoka One One.

“95% of the consumers that buy Nike running shoes do not use them to run, they use them for more aesthetic, casual... everyday purposes,” BTIG Managing Director Camilo Lyon told Yahoo Finance Live (video above). “When we’re talking about On… [or] Hoka, we’re talking about more technical running footwear."

As for actual headwinds that Nike is facing, Lyon noted that supply chains remain problematic.

"The situation that we find ourselves in with Nike and really a lot of the stronger brands today is not a demand issue," Lyon said. "It's really more a supply issue or that's what it's been for the last two years."

He added that "we do have new pressures on the consumer that we're all trying to figure out the duration of like inflationary pressures, rising rates, and... rising prices pretty much across the board, which Nike is going to do in the back half of this year."

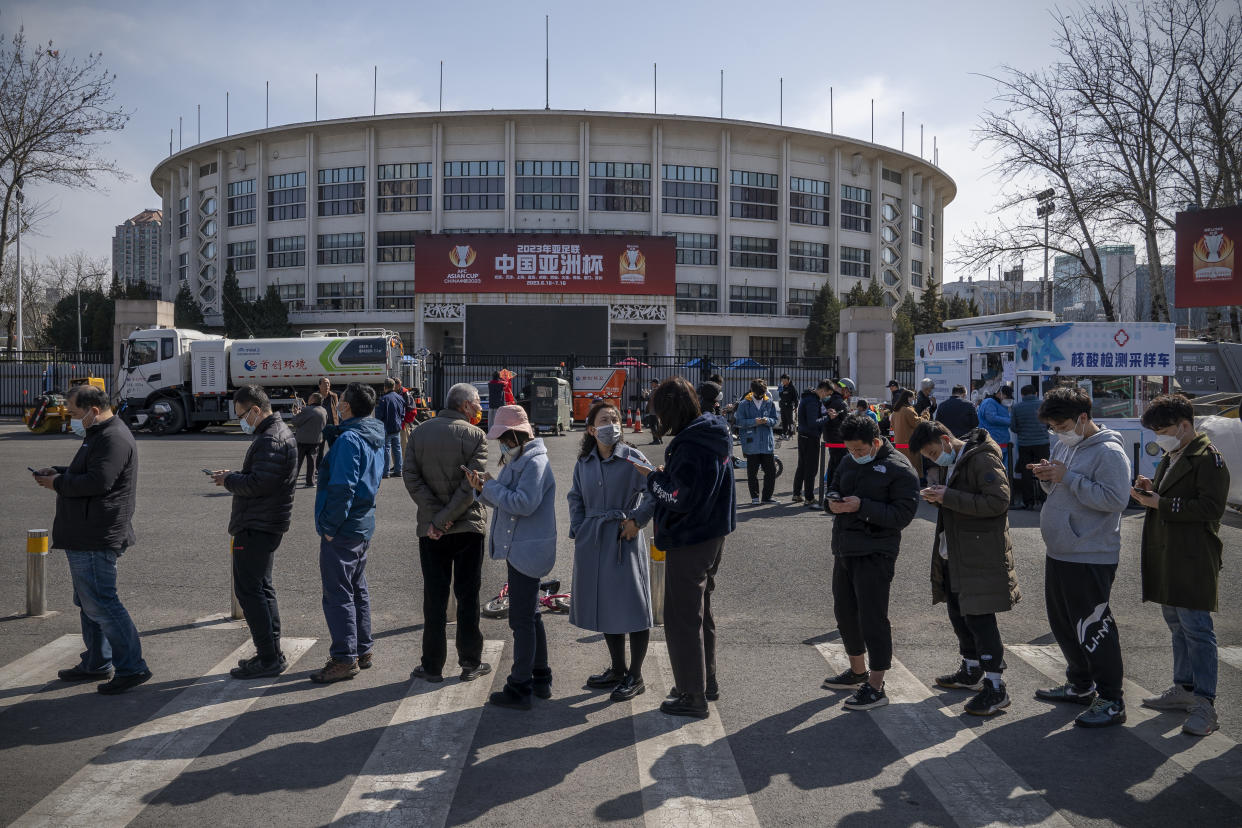

Nike, the world’s largest sportswear company, saw two months of no unit production in Vietnam when two of its footwear suppliers stop manufacturing in July. The halt in production impacted inventory and sales in regions like Greater China, an area that is now facing new COVID-19 lockdowns.

"COVID has exacerbated issues from a production perspective, but... we're talking about Nike being a battleship and someone like On or Hoka being speedboats," Lyons said. "So the time it takes to turn those businesses around is very different from a production perspective."

Nike and China

The impact of the latest shutdowns in China could continue to hinder the global supply chain recovery as U.S. companies post financial outlooks that bank on recovery across Asia.

The average number of new infections reported each day in Mainland China rose by more than 1,900 over the last 3 weeks, 42% of its previous peak, according to Reuters COVID-19 Tracker.

Last quarter, Nike reported revenue of $11.26 billion for Q2, up 1% from a year before, but those gains were offset by supply chain problems. The discussion remains if Nike will explore other countries to ramp up production.

"Diversification has been happening for years now, and that's come at the behest of its manufacturing partners, a lot of whom are Chinese businesses that have diversified outside of China, largely due to labor pressures that have been pretty systemic and structural in nature for the past five or so years," Lyon explained.

While it's impossible to predict what will happen in the next couple of months, Nike can at least count on the continued athleisure boom. During the pandemic, athleisure became the global stylish trend in the fashion game as consumers sought comfortable, fashionable clothing that suited every pace and place.

Appealing to consumer interest in both wellness and fashion, Lululemon (LULU), known for its leggings and sports bras, has ventured into the sneaker world with its first-ever running shoe for women, called Blissfeel, that will be available this week.

"We're not really dismissing the competitive environment, but we're also not really concerned with it too much because Nike does have this brand halo above it that casts a wider net than the other competitors around it," Lyon said.

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter: @daniromerotv

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn