More Americans are tapping their life insurance amid market and economic uncertainty

More Americans are tapping their life insurance policies to help them weather inflation and avoid drawing on retirement accounts battered by the stock market’s volatility this year.

Data from Massachusetts Mutual Life Insurance Co. showed a 31% year-over-year increase in the third quarter of Americans taking out life insurance loans and/or withdrawals, totaling nearly $700 million.

The increase underscores the liquidity options offered by permanent life insurance — another supplemental retirement vehicle — which allows for both loans and withdrawals without canceling the policy.

“In this inflationary time, people are tapping into their permanent life insurance policy’s cash value,” Paul LaPiana, head of product at MassMutual, told Yahoo Money. “At the same time, we are not seeing any upticks in policy surrenders, signaling that people value the coverage that their life insurance policy provides.”

Cash value offers liquidity during the policyholder’s lifetime

Unlike term life insurance, a permanent life insurance policy lasts your lifetime and earns cash value tax deferred in addition to the death benefit. The cash value can be used during the policyholder’s lifetime in the form of a loan or withdrawal.

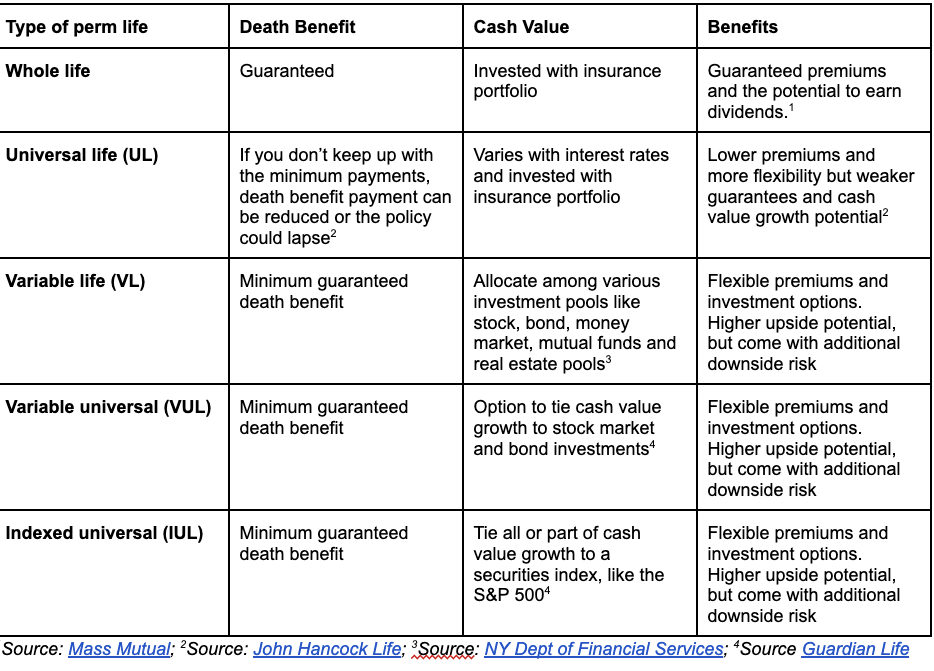

The main difference with permanent life insurance products is how the cash value grows. Whole and universal life insurance products are invested with the insurance company’s portfolio, while variable life and indexed universal life cash value are invested in stocks and indexed funds.

“One of the greatest benefits of permanent life insurance is the ability to accumulate cash value that grows tax deferred," Mark Williams, CEO of Brokers International, told Yahoo Money, "and can be accessed in the form of loans, withdrawals, or surrender for the life of the policy.”

When consumers become cash strapped or need to cut spending, some cancel their permanent life insurance to get the cash value out, known as cash value surrender.

“Many people surrender their permanent life insurance because they need liquidity and weren’t fully educated on options like a loan or a withdrawal,” LaPaina said. “Some think they can’t afford the policy not knowing that there are options to keep the policy with a reduced base amount.”

If you need a cash infusion in the short term, consider a loan on your cash value rather than surrendering. It also is easier than trying to get a bank loan.

“There’s no loan qualifications, minimal paperwork, you receive the money within a week, and there are no prepayment penalties,” LaPiana said. “Additionally, the interest rates on life insurance policy loans are typically more favorable and there are no tax consequences.”

A loan is better for those who still have a need for death benefits because once you repay your loan, your death benefit is restored to the full amount. But if you don’t mind a reduction in your death benefit, then you can consider a withdrawal from your cash value instead.

“Unlike a loan, a withdrawal is a permanent transaction and because you are not putting the money back, there’s no interest cost,” LaPaina said. “However, a withdrawal is a permanent reduction in your death benefit and may have tax consequences. If you have a variable or indexed policy, there may be some equity depreciation.”

Insurance ‘models are priced considering inflation’

As the Federal Reserve works to tamp down inflation to manageable levels, most life insurance policies have a buffer for when consumer prices skyrocket, according to Chuck Bremer, vice president of product and life insurance at Nationwide.

“Life insurance models are priced considering some inflation,” Bremer told Yahoo Money. “An increase in market rates leads to an increase in the yields."

Specifically, he said, increased investment yields mean bigger customer dividends for whole life insurance, decreased prices for universal products, guarantees and increased crediting parameters on indexed universal life (IUL) products.

"Sustained increases in rates can have an impact on pricing leading to more competitive products longer term," Bremer said.

Variable and VUL products aren’t as impacted by rising rates since the policyholder funds are typically invested in their fund selections, Bremer said.

Also, if you have a universal life policy, the rise in interest rates also means your cash value will grow.

“If you bought a [universal life] policy two years ago at 1%, now that interest rates are going up your cash value will grow faster,” Williams said.

Recession fears

As recession talks increase, if you are looking for liquidity or worried you can’t afford your premiums, do not make a rash decision to cancel your permanent life insurance. You may benefit from a loan, withdrawal, or request a reduced base policy.

When it comes to the cash value, Williams has four recommendations:

Don’t touch your cash value and let it grow; or

Use some of the cash value to reduce premium payments; or

Increase the face amount of your death benefit using the cash value; or

If rates continue to stay high over time, you could skip premium payments.

"Most people shouldn’t panic or make changes based on the short term," Williams said. "Life insurance is a long-term financial vehicle, so short-term fluctuations in the market should not be a reason to change."

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Money.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn