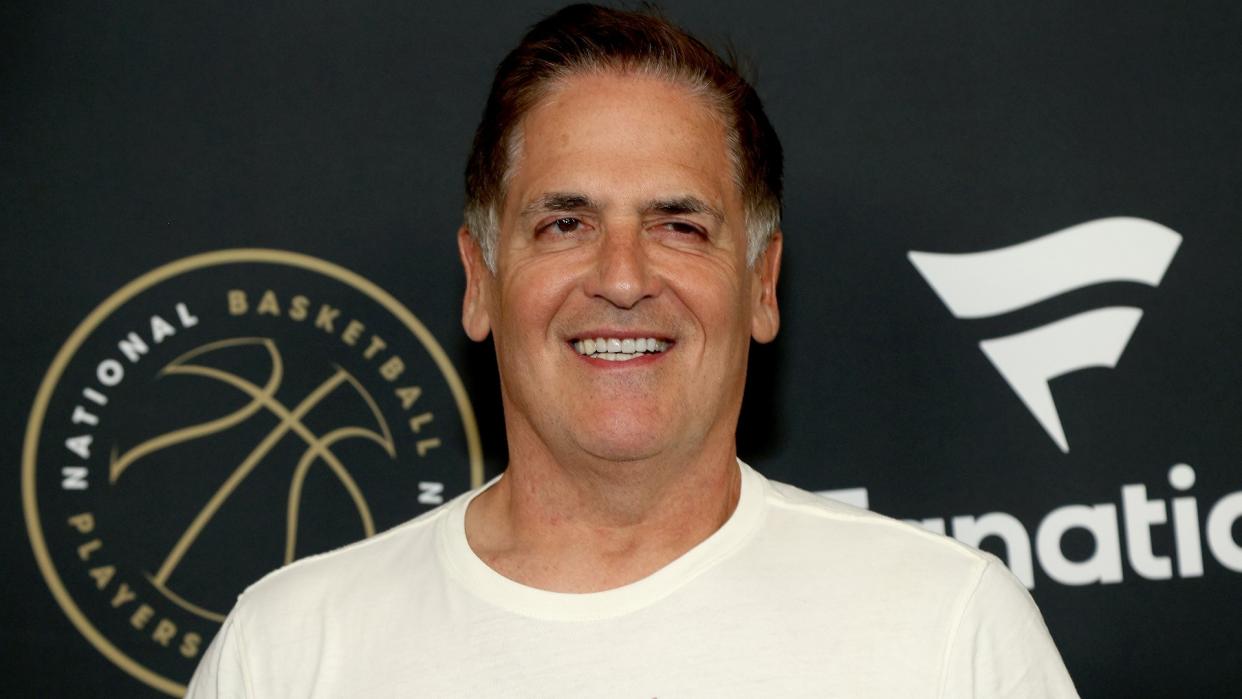

Mark Cuban Would Buy Bitcoin Over Gold ‘All Day Every Day’ — Here’s Why It’s a Stronger Investment

Earlier this week, Bitcoin surpassed its all-time record of $69,044.77. So it’s no wonder that Bitcoin bulls are getting more bullish by the minute, including billionaire entrepreneur Mark Cuban — a longtime Bitcoin aficionado — who recently said he would buy the asset “all day, every day” over gold on CNBC.

Learn More: 8 Best Cryptocurrencies To Invest In for 2024

For You: 6 Genius Things All Wealthy People Do With Their Money

As of the afternoon of March 8, Bitcoin was at $68,570, up 210% in the past year, and up 57% in the past month, according to CoinGecko data.

Cuban said his preference for Bitcoin partly stemmed from its supply and demand dynamics — Bitcoin has a hard cap set at 21 million coins — and its potential as a store of value.

The asset has been buoyed by several factors lately, chief among them, the approval by the Securities and Exchange Commission (SEC) of spot Bitcoin exchange-traded funds (ETFs) on Jan. 10 — which have attracted enormous interest, with the 10 U.S. spots Bitcoin ETFs reaching $52.5 billion on March 5, according to Blockworks.

Another factor: the upcoming halving next month. Indeed, experts said that historically, halvings have led to price appreciation, adding that this year should not be an exception.

Against that backdrop, is Cuban’s assessment that Bitcoin is stronger than gold valid? It depends on who you ask.

Cuban is Right

“Of course, I would buy Bitcoin before buying gold,” said Trevor Filter, co-founder of digital payments platform Flexa. He added that Bitcoin has real utility behind its capacity as an investment, and it’s perhaps the most promising asset today for digitizing value.

Several other experts echoed the sentiment, such as Austin Alexander, co-founder of LayerTwo Labs, who argued that Bitcoin is better than gold as it’s more divisible and more transmissible, durable, scarce and portable.

“With Bitcoin, you can basically carry around $1 billion using what you’ve memorized in terms of your seed phrase,” he said. “To ship around large amounts of gold, you need basically an armada for protection, and that gets very, very expensive.”

Of course, the scarcity aspect Cuban mentioned is also agreed upon by experts who said there is a lot more upside to having from an investment perspective.

“The more people that buy and the fewer people that sell that means the price is going to go up that’s just the nature of it,” Cuban said in the interview. “It’s a great store of value that’s why I have an investment in it, you know, because I do feel that the demand is going to exceed the number of people selling.”

And other experts argue that gold is an investment of the past, while Bitcoin is “Gold 2.0.”

According to Evander Smart, founder of Bitcoin University and author of The Book of Bitcoin, gold was the best retail investment of the 19th century, real estate was the best retail investment of the 20th century, while Bitcoin is the best retail investment of the 21st century.

“Why? You can take it anywhere in the world, for free- there are no holding costs, no management fees, the appreciation is unlimited, and proven.,” said Smart. “You don’t need a brokerage account, or to be an institutional or accredited investor. You can keep it in your home without a thief taking it from you. It basically does everything Gold can never do. It is Gold 2.0, and the right investment to get started with, today.”

Cuban’s Partly Right

Lucas Kiely, chief investment officer of digital wealth platform Yield App, noted that some investors now consider Bitcoin a better alternative to gold.

For instance, he said, it has seen much stronger price growth – 44% per annum over the past decade over gold’s 2%. It is often also considered a better hedge against inflation, earning it the title “digital gold.”

“However, Bitcoin is also significantly more volatile,” he added. “While gold has remained relatively stable since the 1980s, Bitcoin’s price soared nearly tenfold between January 2020 and the last halving in April 2021 and then plunged 53% the following month.”

In turn, he argued that Bitcoin and gold have advantages and disadvantages. The amount each investor allocates to each will depend on their goals, time frame and risk appetite.

“Bitcoin is a high-risk investment and would fit in a different risk bracket in a balanced investment portfolio,” he noted.

Both Bitcoin and Gold are Right

Some experts note that this is not an either-or decision.

For instance, Joe Cavatoni, market strategist at the World Gold Council, said there is no demonstrated evidence of any switch trades taking place between gold and Bitcoin.

“We’re more focused on Bitcoin’s volatility and how it makes the case for a safe haven asset, like gold,” he said. “If you’re adding risk to your portfolio by adding Bitcoin, then an increased allocation of gold can help hedge that risk – it doesn’t have to be one over the other, these assets are not competing against one another and the investment case is distinctly different.”

Finally, some experts said that Cuban is right in his assessment — in the current economic landscape of falling inflation.

“Gold is a hard asset typically held as a hedge against inflation,” said Thomas Hogan, Ph.D., senior research faculty, American Institute for Economic Research, and former chief economist for the U.S. Senate Committee on Banking, Housing and Urban Affairs. “The price of gold rose during the pandemic recovery, but with inflation falling, it is not widely expected to appreciate significantly in coming years.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Mark Cuban Would Buy Bitcoin Over Gold ‘All Day Every Day’ — Here’s Why It’s a Stronger Investment