A key stimulus program for small businesses is now largely out of money

The Paycheck Protection Program has distributed over $780 billion since it began last year and given out nearly 11 million forgivable loans. Now in the few weeks before the program officially closes to new applications on May 31, it is reportedly largely out of money and closed through most lenders.

The PPP, a centerpiece of Washington's response to the coronavirus pandemic, had expired and been resuscitated by lawmakers multiple times – including as recently as this March. But interviews with leaders in the Biden administration and on Capitol Hill suggest this coming deadline really is going to be the end of the line for the program.

“I think we have to recognize how important the PPP program was,” Sen. Ben Cardin (D., Md.), one of the creators of the program, told Yahoo Finance last week.

Cardin is now focused on using his role as Chair of the Senate Committee on Small Business and Entrepreneurship to support what he called "fine-tuned" programs to help business. “We do think there's going to be additional help needed for small businesses, but not the broad plan such as the PPP,” he said.

Small Business Administrator Isabella Casillas Guzman echoed that sentiment in an interview on Yahoo Finance's “All Markets Summit+: Small Business Recovery.” “I think, overarching, what's important to note is that now in our final days of PPP is that we've been able to assist a lot of small businesses across the board to stay alive,” she said.

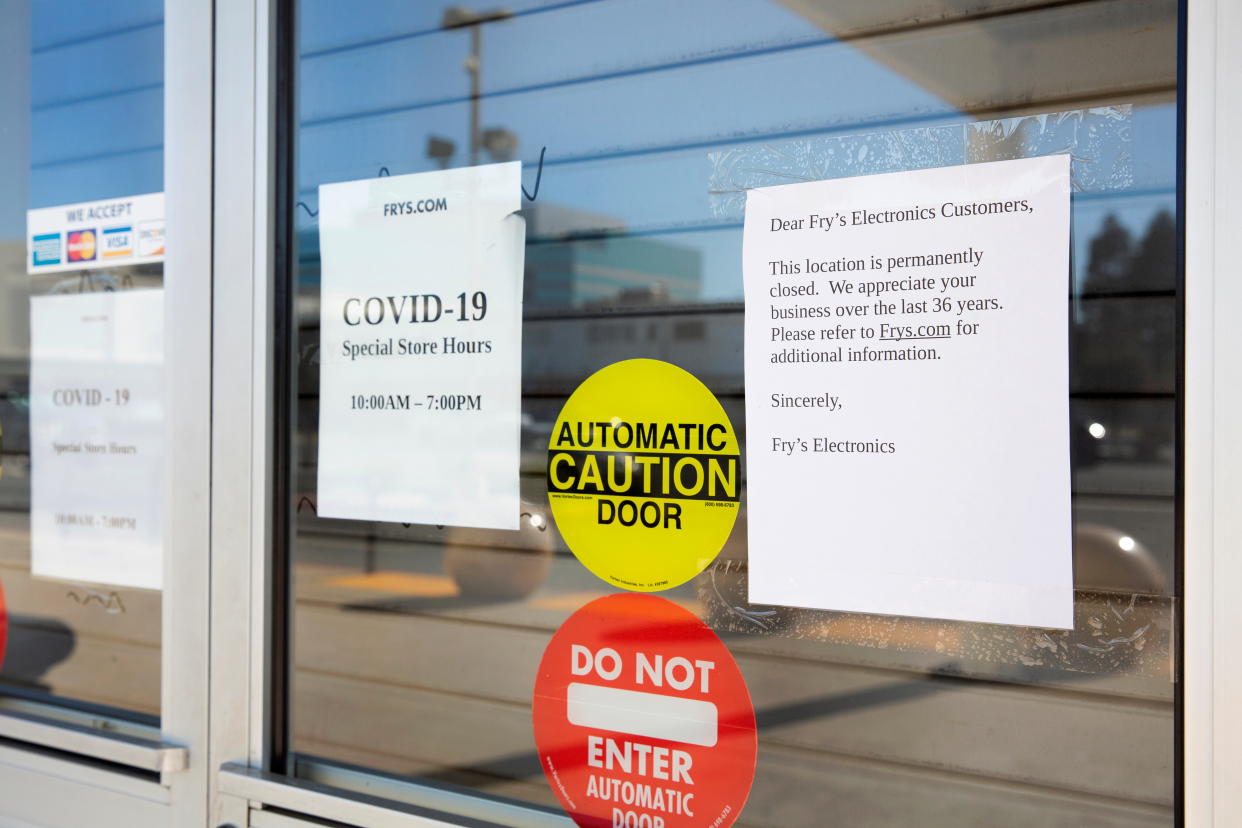

Despite the unprecedented financial assistance meant to sustain small businesses forced to shut down at the onset of the pandemic, many were unable to survive. According to a new report by the Federal Reserve Bank of New York, 35% of businesses that were active prior to the pandemic are still closed, and that most have been inactive for 20 weeks or longer.

Cardin and Guzman both said small business aid will continue – just in more targeted ways. An example cited by both is the Restaurant Revitalization Fund created in President Biden’s American Rescue Plan.

The program, overseen by Guzman, offers over $20 billion in direct grants, as opposed to the forgivable loans offered by the PPP. The restaurant program offers funds equal to a restaurant's pandemic-related revenue loss, up to $10 million per business and no more than $5 million per physical location.

Restaurants were allowed to participate in the PPP, but aid to struggling small businesses were often overshadowed by loans that were approved for big restaurant chains like Shake Shack, Ruth's Chris Steakhouse, and Potbelly.

How the PPP made the SBA 'a new agency'

As the PPP winds down, Guzman noted how it has transformed her agency. “We've gone from a $40 billion average portfolio to over a trillion,” she said. “The amount of lenders and partners that we engage with is at unprecedented levels.”

Guzman previously served as the SBA’s Deputy Chief of Staff and as Senior Advisor during the Obama administration before returning this year to lead the agency under President Biden. Prior to the pandemic, the SBA was often focused on providing targeted assistance – in the form on standard loans – to small business after events like a hurricane.

The PPP was created and housed at the SBA during the intense early months of the pandemic. Cardin helped create the program alongside Sen. Marco Rubio (R., Fla.). In a recent Yahoo Finance interview, Rubio said it was created during “an unprecedented time of tremendous uncertainty,” where lawmakers weren’t even sure how long they’d be able to stay on Capitol Hill as the pandemic spread.

There was “a lot of certainty about how long businesses were going to find themselves under these restrictions,” Rubio said of drafting the program in 2020. “We were operating under that sort of environment and with the need to create something that had never existed before.”

As for now, the PPP’s general fund has been tapped out, although some money is still available, as part of a portion set aside for institutions that generally focus lending efforts to businesses run by underserved populations, according to a trade group.

“We want businesses to be able to access those funds in these final weeks,” said Guzman.

Ben Werschkul is a writer and producer for Yahoo Finance in Washington, DC.

Read more:

Senate votes to extend PPP for two months

Biden administration announces changes to the PPP, stimulus program for small businesses

We are in a contest with China ‘about the most fundamental questions facing the world’: Biden ally

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.