Jobs report and July 4th: What to know this week

Investors kick off a new week, month, quarter, and half of the year in the week ahead with the crucial June jobs report capping what will be an abbreviated and disjointed week of trading.

Economists expect job growth slowed in June while the unemployment rate is forecast to decline again. Friday's report will serve as one of only a few crucial data points that fall between now and the Federal Reserve's next policy announcement, which is set for July 26.

Markets will be open for a half day on Monday, with US markets closing at 1 p.m. ET and remaining closed on Tuesday in observation of the Independence Day holiday.

Outside of the key June jobs report, investors will track weekly jobless claims data and the monthly read on private payrolls from ADP, both due out Thursday. The monthly look at job openings on Thursday will also garner investor attention.

S&P Global and the Institute for Supply Management will release their monthly looks at manufacturing activity on Monday and the services sector on Thursday in what will be a fairly busy week of economic data.

The minutes from the Fed's June meeting, after which the central bank elected to keep interest rates unchanged, will be released Wednesday afternoon.

On the corporate earnings front, Levi Strauss (LEVI) will be the week's headliner.

Stocks enter the week having capped one of the more surprising first half rallies in recent memory, with AI-focused hype powering the Nasdaq Composite (^IXIC) to a gain north of 31% while the S&P 500 (^GSPC) rose more than 15% in the year's first six months.

The Nasdaq's rally marked the best start of the year for the tech index since 1983, according to data from Bespoke Investment Group.

Crucial jobs data

When the Federal Reserve elected to leave its benchmark interest rate unchanged last month, many observers noted just a few key data points stood between that call and its July rate decision.

One of those data points will be Friday's June jobs report.

Economists expect the US economy added 225,000 jobs last month with the unemployment rate set to fall to 3.6%, down from 3.7% in May. And while this would signal a slowdown in the pace of hiring, robust job growth continues to shape expectations the Fed will need to raise rates again later this year.

The latest data from the CME Group shows markets pricing in an 86% chance the Fed raises rates by another 0.25% on July 26.

Speaking at an event held by the Bank of Spain last week, Fed chair Jay Powell said the labor market "remains very right," adding in prepared remarks: "While the jobs-to-workers gap has declined, labor demand still substantially exceeds the supply of available workers."

Strong markets, strong economy

Last week, a strong run of economic data prompted economists that had seen a recession in the first half of 2023 as a likely outcome to move back their projections.

Still, strength in the housing market, newfound confidence from consumers, and a sharp upward revision to first quarter GDP weren't enough for economists to give the all clear for their 2023 recession watch.

"The economy has proven more resilient than we previously expected owing largely to consumption," Bank of America US economist Michael Gapen wrote on Friday. "However, we do not expect such robust prints to continue. Momentum in the economy should slow as the lagged effects of tighter monetary policy and financial conditions start to take hold."

Oxford economics lead US Economist Oren Klachkin admitted the strength of the consumer in the first half of the year "surprised us," but, among other factors, sticky inflation will "leave consumers with little choice but to cut back on spending" in the latter half of the year.

"We have seen some commenters looking at the upward revision to Q1 GDP as a sign that the economy is on firmer footing than previously thought, driven by the strength of the consumer," Jefferies economist Thomas Simons wrote.

"However, we see the strength of Q1 as setting a very high bar for continued growth in Q2 and we remain of the view that the consumer is running out of steam."

The stock market tracked with the economy in the first half of 2023, surprising to the upside and leaving investors to wonder if the resilience can continue.

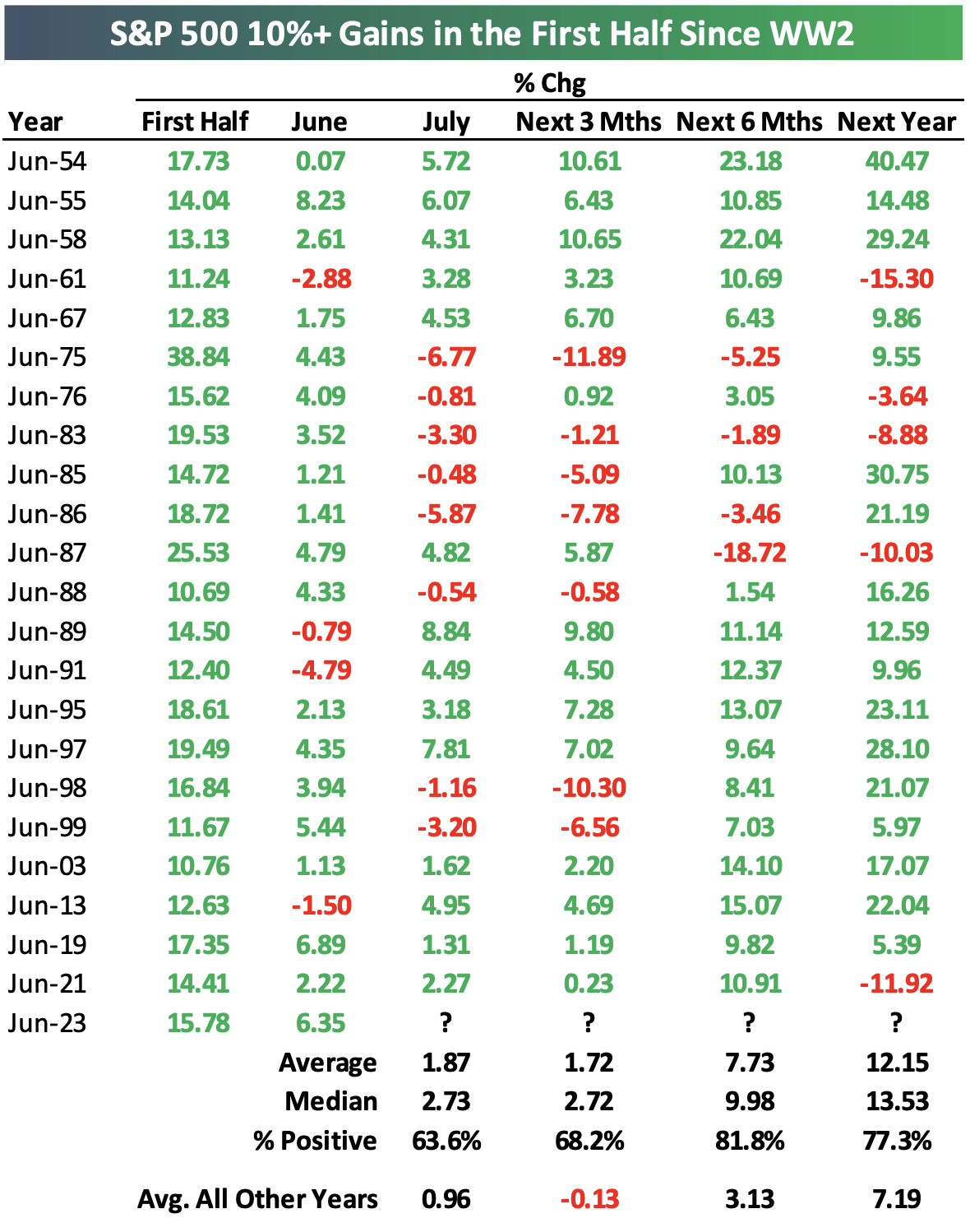

In a note last week, the team at Bespoke Investment Group highlighted stocks do better than average in the second half of the year after seeing outsized gains in the first half.

In years the S&P 500 rises more than 10% through June, the index has returned an average of 7.73% over the next six months. When the index comes into July with more modest returns, the average return is just 3.13% for the rest of the year.

The AI-infused rally to start 2023 sent Wall Street forecasts for the S&P 500 higher. But with the S&P 500 standing at 4,450, the index still remains at or above where most strategists see the index finishing the year — even with these revised outlooks.

"You are in an environment where momentum markets, they take on a life of their own," Evercore ISI senior managing director Julian Emanuel told Yahoo Finance Live on Friday.

"We raised our price target a month ago to 4,450 thinking that it might would take seven months to get there, not seven days. And now, we're revisiting that number as we get to 4,450."

Emanuel pointed out that AI started what appeared to be a narrow rally in March and April. But by June that shifted, with 415 S&P 500 companies posting positive returns and 115 companies up at least 10%, per data from S&P Global. All 11 sectors were positive for the month, too.

"The positivity of it all," Emanuel said, "is this idea that you've got greater participation now."

Weekly Calendar

Monday

Economic data: S&P Global US Manufacturing PMI, June final (46.3 expected, 46.3 previously); Construction spending month-over-month, May (+0.5% expected, +1.2% previously); ISM Manufacturing (47.2 expected, 46.9 previously).

Earnings: No notable results set for release.

Tuesday

Markets closed for Independence Day.

Wednesday

Economic data: Factory orders, May (+0.8% expected, +0.4% previously); Durable goods orders, May final (+1.7% expected, +1.7% previously), FOMC meeting minutes, June 14.

Earnings: No notable results set for release.

Thursday

Economic data: ADP private payrolls, June (+236,000 expected; +278,000 previously); Challenger jobs cuts, year-over-year, June (+2867% previously); Weekly initial jobless claims (245,000 expected, 239,000 previously); JOLTS job openings, May (9.97 million expected, 10.1 million previously); S&P services PMI (54.1 expected); ISM services PMI (51.3 expected, 50.3 previously)

Earnings: Levi Strauss & Co. (LEVI)

Friday

Economic data: Nonfarm payrolls, June (+225,000 expected, +339,000 previously); Unemployment rate, June (3.6% expected, 3.7% previously); Average hourly earnings, month-over-month, June (+0.3% expected, +0.3% previously); Average hourly earnings, year-over-year, June (+4.2% expected, +4.3% previously); Average weekly hours worked, June (34.4 expected, 34.4 previously); Labor force participation rate, May (62.6% expected, 62.6% previously)

Earnings: No notable results set for release.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance