Housing: Jason Oppenheim's advice for the current real estate market

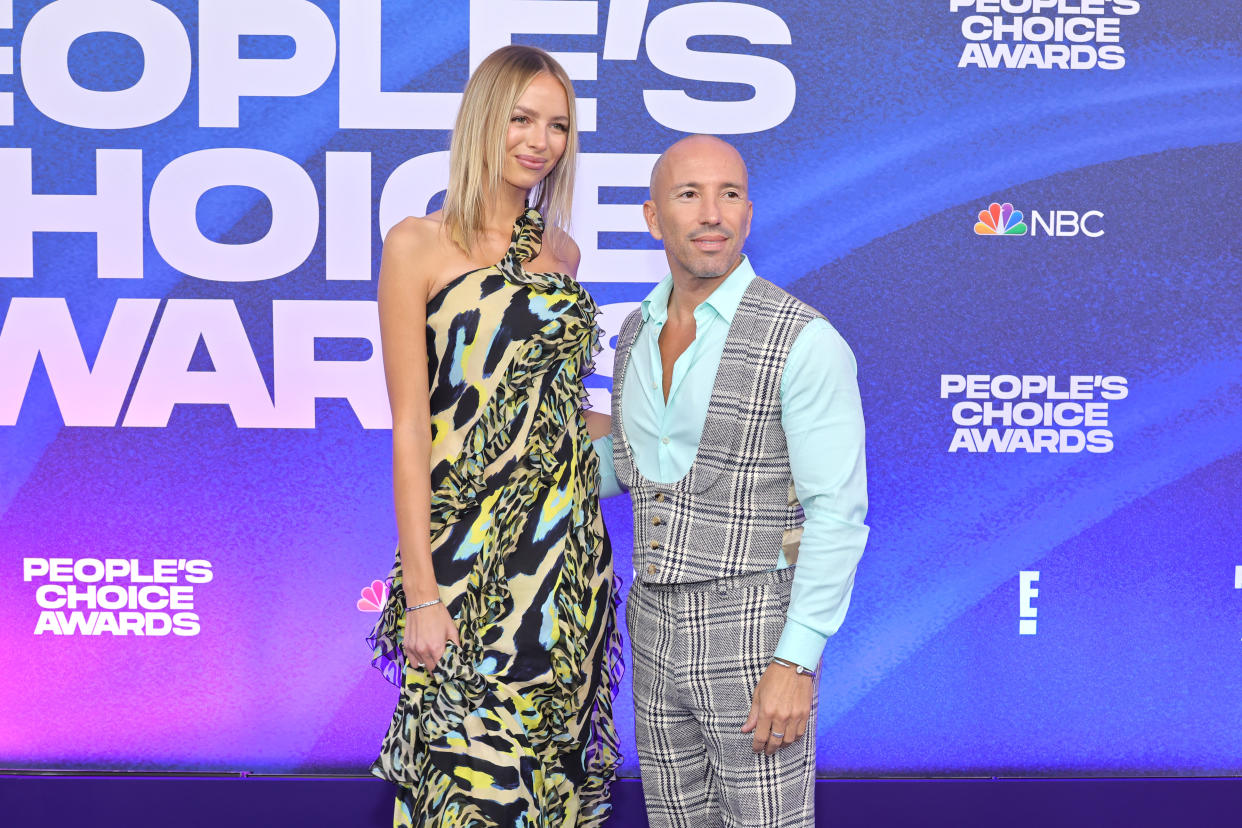

On Netflix's (NFLX) popular reality series "Selling Sunset," star real estate broker Jason Oppenheim leads a team of glamorous agents as they sell homes to Los Angeles' elite.

But amid rising interest rates, consumers elite and otherwise are finding themselves reluctant to buy (and sell) homes. Recently, the National Association of Realtors reported that existing U.S. home sales totaled 5.03 million last year, 17.8% lower than in 2021 and the worst year for home sales since 2014.

Yahoo Finance's Allie Garfinkle recently sat down with Oppenheim to discuss the current housing market and whether now is a good time to buy.

The verdict: It might be, but it's complicated.

"I think we probably saw the bottom of the market at the end of 2022, probably saw the height of interest rates at the end of 2022, so I'm generally optimistic," Oppenheim said. "But I don't want to pretend that that means the real estate market's gonna be on the ascent. I'd say we're probably in for some type of homeostasis."

The 30-year fixed-rate mortgage hovered around 6.15% at the end of last week. That's compared to roughly 3.5% a year ago.

Oppenheim said rising rates affect everyone but hit lower-income buyers harder. "Interest rates largely transcend income brackets, although, I think, affect more the lower-income brackets. ...People talk about affordability of homes. I mean, really, it's the down payment. You've got to come up with a down payment. That's always been difficult. But now, not only do you have the down payment, now you've got to pay a 5% or 6% interest rate even on a 5- or 10-year fixed," he said.

Nevertheless, Oppenheim is optimistic about where interest rates will land in the next few years – and he doesn't think an extended period of incredibly high rates is likely.

"I think [rates] will come down in the next couple of years," he said. "So, I don't think it's a big deal if someone goes in and buys a house and has a 5% interest rate."

But buying isn't uniformly the answer right now

Oppenheim added that buyers could always refinance a few years into their mortgage deals. He also noted the benefits of owning instead of renting a home long-term.

"Buying is always better than renting if you can hold the asset and you can ride the ups and downs and you can take advantage of the appreciation over a decade or two decades or, hopefully, three decades, then I think buying really always makes sense," he said.

Still, Oppenheim said that buying doesn't always make sense in the short-term.

"You've got transaction costs and you're limited in your mobility when you're an owner," he said. "You're dealing with a lot of hassles. When it comes to the roof leak, it's not the landlord's fault anymore, now it's your problem. So, if you're looking to own just for a couple of years, probably consider renting."

COVID-19 and the advent of remote work have drawn people away from major cities, altering the home-buying landscape in those cities, he added. Though some cities are experiencing comebacks, nearly 70% of large urban counties saw their populations decline in 2021, according to a recent report by the Economic Innovation Group (EIG).

"You don't have to live in LA. You don't have to live in San Francisco. You don't have to live in New York. You can now live in these other cities," he said. "I think that's going to be a draw away from some of the big cities if we can't get a handle on some of these macro issues."

Dylan Croll is a reporter and researcher at Yahoo Finance. Follow him on Twitter at @CrollonPatrol.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube