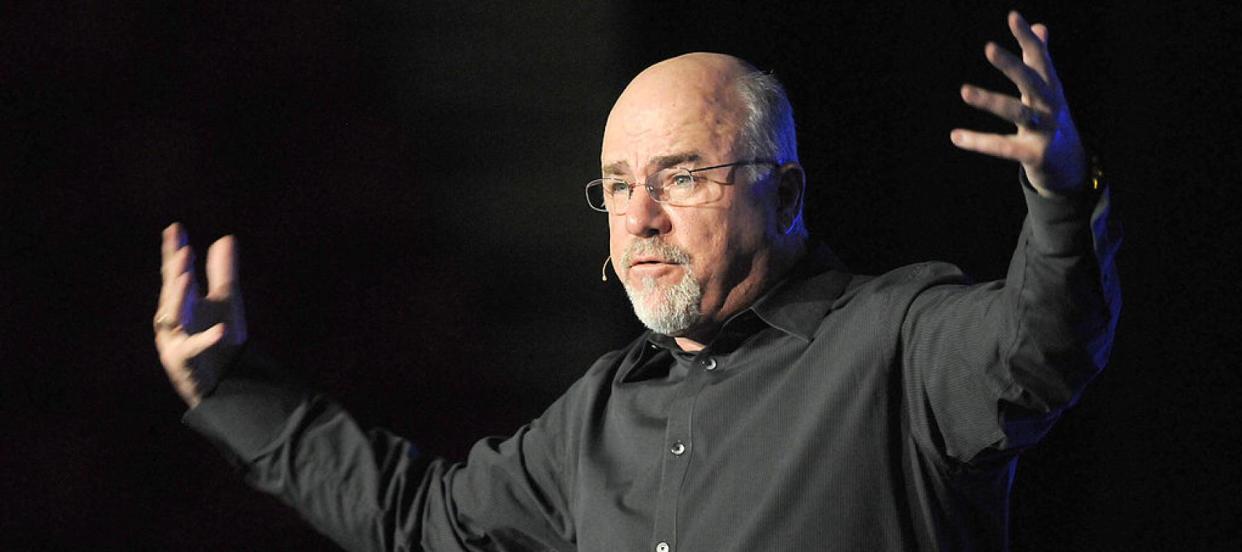

‘I'm embarrassed to ask this question': This 50-year-old Illinois widow says she put her kids through college — but now has nothing saved for retirement. Here's what Dave Ramsey told her

A recent episode of "The Ramsey Show" addressed a conundrum that many Americans face: approaching retirement with little to no savings.

This is the unfortunate situation of Jodi from Springfield, Illinois, who called into Dave Ramsey’s financial advice show to ask for some help. “I’m embarrassed to ask this question,” said the 50-year-old widow. “I have no retirement. I’m ready to start retirement and I don’t even know where to start or how to begin.”

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Find out how to save up to $820 annually on car insurance and get the best rates possible

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

Jodi also said she used the insurance money she received after her husband’s death to pay off the mortgage and put her kids through college. Now she owns her house free and clear but she has only $1,000 in emergency funds, and earns just $36,000 after taxes as a social worker.

Her situation is familiar to many. About half of Americans between the ages of 55 and 66 have no personal retirement savings, according to the U.S. Census Bureau.

“I’m scared,” Jodi admitted. “It’s to a point that sometimes I cry.”

Ramsey, however, was much more optimistic about her future. “There’s nothing to be embarrassed about any of that!” he told her. Jodi’s lack of debt and fully paid-off house impressed him, and he gave her a three-step plan to get her finances back on track.

Step 1 - Invest $1,000 a month

Jodi’s lack of debt allows her to put a large proportion of her income toward savings. Ramsey recommends she set aside $1,000 a month to save for retirement, starting right away. That implies a savings rate of 33% on after-tax income.

A double-digit savings rate is nearly impossible for most Americans. The U.S. personal savings rate was just 3.4% in September 2023, according to the Bureau of Economic Analysis. But Jodi has the advantage of being an empty nester with no consumer debt and no mortgage. Saving a third of her income is feasible.

Step 2 - Deploy funds in a Roth IRA

Ramsey recommended a Roth IRA for Jodi’s monthly savings. This popular individual retirement account enables tax-free growth. Account holders who have held funds in this vehicle for more than five years can start withdrawing cash tax-free at 59 and a half years old.

Ramsey had a longer time horizon in mind for Jodi. He told her that if she maintains the $1,000-a-month contributions for 15 years, she’ll have $500,000 in her Roth IRA at 65.

Read more: Owning real estate for passive income is one of the biggest myths in investing — but here's how you can actually make it work

Step 3 - Focus on investing in mutual funds

The final step is to focus on stocks and mutual funds. Ramsey says his personal mutual fund investments have averaged 12% annually. Meanwhile, the S&P 500 has averaged 10.7% per year since 1957, per Insider. So a double-digit annualized return is certainly possible.

Ramsey estimated that 10% compounded annual growth, having already turned Jodi’s monthly $1,000 contributions into half a million dollars, could yield more annual retirement income from capital gains than Jodi’s current $36,000 income, enabling a stress-free retirement.

To be fair, past performance is no indication of future returns. The S&P 500 has had some decades with flat or negative returns in the past. Another “lost decade” for stocks cannot be ruled out. Nevertheless, saving $1,000 a month would put Jodi in a much better financial position even without capital gains along the way.

Simply put, it’s never too late or too difficult to secure your retirement.

What to read next

Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.