Housing analyst moderates price decline forecast because of a 'resilient' market

Don’t expect a big drop in home prices this year.

A Goldman Sachs analyst is softening his call for home price declines this year as the shortage of homes for sale will help keep a floor under prices.

"The housing market has proven even more resilient than we had expected, driven by a supportive supply backdrop as well as a material decline in mortgage rates that transpired between November 2022 and February 2023," Goldman Sachs Macro Strategist Vinay Viswanathan wrote in a note to clients this week.

As a result, Viswanathan now forecasts home prices will fall 2.2% for 2023, versus the previous decline estimate of 6.1%, before increasing 2.9% in 2024, up from an estimated 1.0% gain previously. The new predictions imply a peak-to-trough decline of 5.7%.

Still, the inventory challenges aren't enough to prevent any declines.

“While we are cognizant of the tailwind from tight housing supply, we expect affordability will likely stay poor, ultimately pushing prices lower in 2023,” Viswanathan wrote.

Homebuyers have borne the brunt of tighter monetary policy. In the Federal Reserve’s quest to dampen inflation, the national average for a 30-year fixed rate mortgage soared and now sits north of 6%. That's also convinced many homeowners that it's best not to sell and give up the ultra-low mortgage rate they have on their current mortgage.

It’s unlikely that mortgage rates will provide “additional relief” because the strategist expects elevated Treasury yields and "substantial" volatility in the mortgage-backed securities market.

The strategists anticipate inventory to remain limited and estimate the average 30-year-fixed rate reaching 6.4% at the end of 2023, “keeping affordability in place as the largest headwind for home prices.”

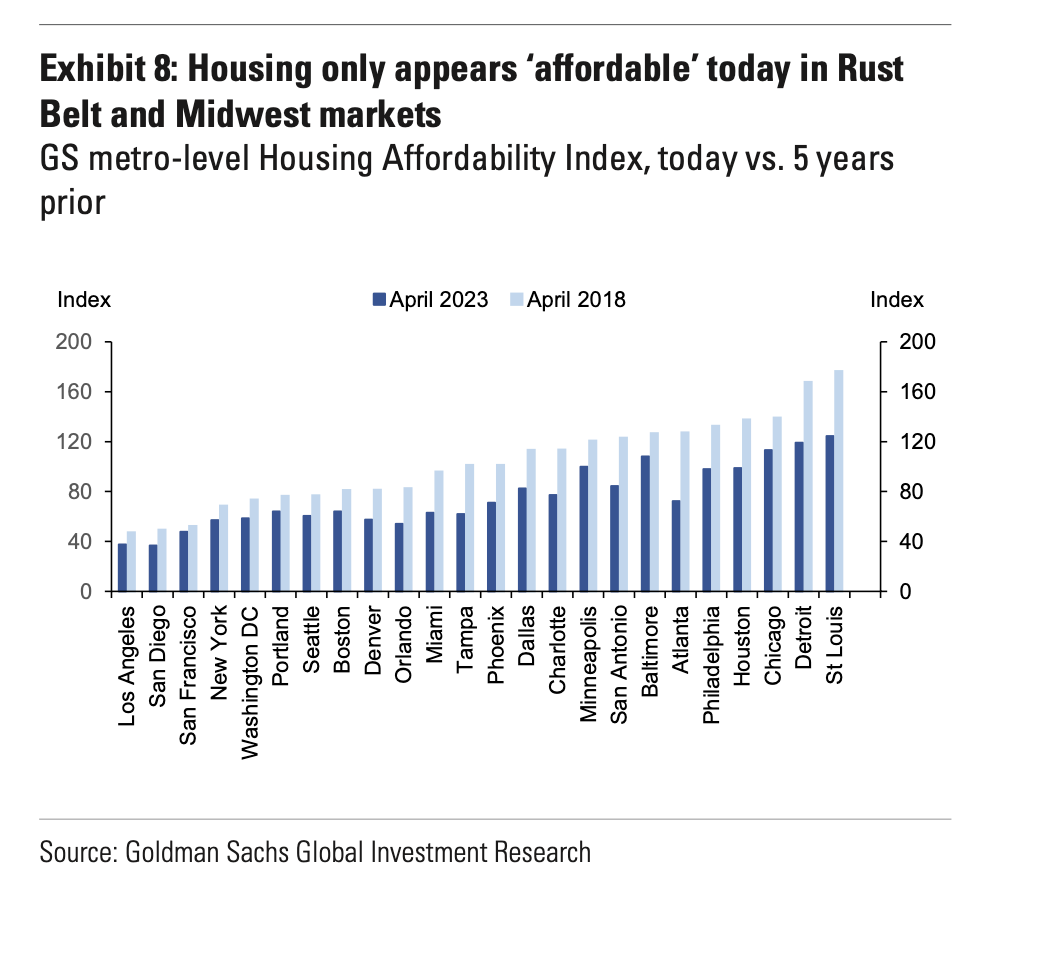

It’s getting tougher for house hunters to find a home to buy as the inventory of available homes remains scarce. For instance, there are only four affordable cities out of the 25 largest markets and price declines may fade by the end of the year, according to Goldman Sachs.

Regionally, St. Louis, Detroit, Chicago, and Baltimore are considered affordable, Goldman found. Monthly payments in these markets on new mortgages are less than 25% of monthly household income.

Still, Americans left on the sidelines have watched their rent costs rise, median home prices soar, mortgage rates double and the pool of available homes shrink, leaving speculation on where homes prices could be headed.

“Beyond 2023, we expect a rebound in home prices as the impact of policy tightening subsides,” wrote the strategist at Goldman Sachs.

In addition, historical trends from 1995, 2000, and 2018 show that home prices tend to grow after the end of the hiking cycle, and the firm’s economists expect the Fed is done with policy tightening.

“While the velocity of policy tightening in this cycle could have lingering impacts over the medium term, we think the worst of the home price correction is behind us and believe nationwide home price declines will dissipate by year-end,” Viswanathan added.

Separately, the Federal Housing Finance Agency released data that showed home prices climbed 4.3% in the first quarter compared to a year ago.

“While we think modest home price declines are still likely through year-end given the limited scope for improvement in housing affordability, risks to our home price forecast are skewed to the upside in light of the supportive supply picture,” Viswanathan wrote.

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter @daniromerotv

Read the latest financial and business news from Yahoo Finance