Your Guide to Daily ATM Withdrawal Limits and Debit Purchase Limits

All banks and credit unions place limits on the amount of money that a person can withdraw from their account at one time.

Why Do ATM Withdrawal Limits Exist?

Consumers with money deposited in a bank and credit union face limits on ATM withdrawals and debit card purchases as a way of protecting the financial institution and the consumer.

If a debit card and PIN are stolen, daily ATM withdrawal and debit card purchase limits ensure that an account isn’t wiped clean by fraudsters. Financial institutions also want to ensure they have enough cash on hand to meet the demands of cash withdrawals for other customers on the same day.

If you have a large amount of money in a bank account and want to make a withdrawal, plan ahead. You may need to give your financial institution advance notice so it can order additional cash for your request. Alternatively, you may accept a cashier’s check or money wire for the balance in your account.

What Is Your ATM Withdrawal Limit?

ATM limits vary for each bank or credit union. Daily limits on cash withdrawals typically range from $300 to $3,000 per day, depending on your account type and agreement with your financial institution.

Can I Withdraw $5,000 From an ATM?

In most cases, the answer is no. Allowing withdrawals of $5,000 from an ATM would mean refilling the machine more frequently and requiring a bank branch to have more cash on hand.

Alternatives to using an ATM to access $5,000 in a single transaction or over the course of a day include:

Going into a bank branch

Using a debit card to make a purchase

Transferring via an automated clearing house (ACH) to another account

Requesting to wire money for a payment

What Is Your Debit Card Purchase Limit?

Purchase limits on a debit card are usually higher than ATM withdrawal limits and may even allow you to spend the entire balance in your checking account. Debit card limits vary greatly based on rules set by the bank or credit union.

Consumers who need a temporary increase for a one-time large purchase should call their financial institution. Banks and credit unions often lift limits for a short time and on a case-by-case basis.

Factors that affect a person’s withdrawal and purchase limits include:

Type of account

Length of time as a customer

Average daily balance

History of overdrafting or exceeding your account limit

Credit score and credit history

Daily ATM Withdrawal and Debit Card Purchase Limits at Major Banks and Credit Unions

Here’s what you need to know about the limits at various banks and credit unions around the country. Numbers in the chart are accurate as of June 20, 2022.

Bank or Credit Union | Daily ATM Withdrawal Limit | Daily Debit Card Purchase Limit |

|---|---|---|

$500 in first 90 days, then $1,010 | $500 in first 90 days, then $5,000 | |

Varies | $5,000 | |

$1,000 for 360 Checking; $600 for non-360 accounts | $5,000 | |

Depends on the account type and a case-by-case basis | Depends on the account type and a case-by-case basis | |

$1,500 to $2,000, depending on the account type | $5,000 to $10,000 depending on the account type | |

$1,000 | $3,000 to $5,000, depending on the account type | |

$500 | $2,000 for PIN transactions, $5,000 for non-PIN transactions | |

$808 | $5,000 | |

$1,005 | $4,000 |

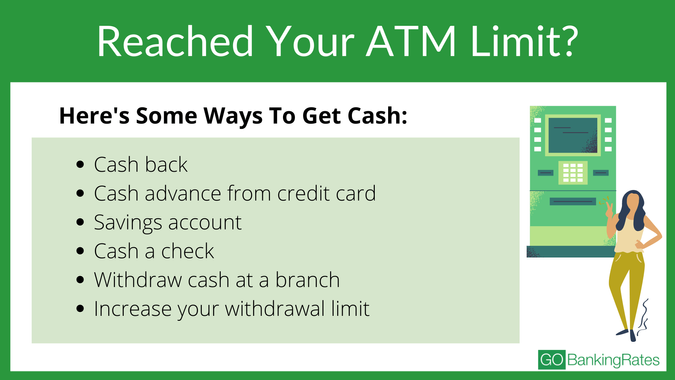

In the event you reach your daily ATM withdrawal limit and still need more cash, you can make a PIN-based purchase at a retailer. Many retailers allow up to $100 cash back with a purchase.

Credit Card Cash Advance

Another way to access more cash after reaching a withdrawal limit is to utilize the cash advance option on a credit card. Be careful using this feature too often because of high interest rates on cash back. Be prepared to pay back the cash advance quickly to avoid overpaying in interest and fees.

Write a Check

Although consumers use checks less and less, it’s still possible to use one to access cash in a bank account. Depending on the financial institution, you may be able to cash a personal check to access more money in a pinch.

Withdraw Money From a Savings Account

If you have extra money in savings, you can transfer funds from your savings account to your checking account. Alternatively, you can have an ACH payment debited from your savings account.

Keep in mind that Federal Regulation D limits the number of convenience transactions on a savings account to six per statement period, so this is best reserved for emergencies. While Regulation D has been suspended in light of the COVID-19 pandemic, some banks will still impose penalties on customers who exceed the limit.

It’s important to weigh the pros and cons of accessing extra cash past a daily limit. Can a purchase wait until the next day? Is there another way to pay for a product or service other than cash?

How To Increase Your Withdrawal and Purchase Limits

Some banks and credit unions are willing to work with customers to increase limits permanently. Whether this is an option for you depends on your bank’s policies and procedures and your relationship with the financial institution.

Maintaining a higher average daily balance and avoiding overdrafts will increase the likelihood of your bank approving a limit increase. Keeping your accounts in good standing shows that you know how to manage money and spend within your means.

Final Take

ATM withdrawal and debit card purchase limits are in place for a reason. If you find yourself hitting, or even exceeding, your limits, you may want to talk to your financial institution to request higher limits — or rethink the way you structure your spending.

Sean Dennison and Daria Uhlig contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: Your Guide to Daily ATM Withdrawal Limits and Debit Purchase Limits