The Fed's 'bumpy' inflation picture could be about to get bumpier

Hotter-than-expected inflation readings have some Fed officials describing the path down to their 2% inflation target as "bumpy."

New data due out Thursday morning will determine whether that picture is about to get bumpier.

Economists expect the Fed's preferred inflation measure — the "core" Personal Consumption Expenditures (PCE) Index that excludes volatile food and energy prices — will clock in at 2.8% for the month of January on a year-over-year basis.

That would be a hair lower than the 2.9% year-over-year increase registered in December. But the month-over-month increase expected by economists is 0.4%, up from the 0.2% seen in December.

That could stoke fears that inflation is not moving down quickly enough. It could also bring the six-month and three-month annualized inflation numbers back above the Fed’s 2% target, according to Bank of America.

The new PCE reading is important for investors as they try to determine how quickly the central bank will begin loosening its monetary policy following the most aggressive campaign to cool inflation since the 1980s.

Markets began the year betting on six cuts starting in March, only to revert to three cuts starting in June following cautious commentary from Fed Chair Jerome Powell and a bevy of other Fed officials, along with higher-than-expected readings on inflation.

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

The Consumer Price Index (CPI) in January was hotter than economists expected, as was the Producer Price Index (PPI), which tracks the prices businesses pay to manufacture products and services.

Because there is a correlation between PPI and PCE, "there is a risk" that PCE "does come out higher" when the number is released this Thursday, according to Wilmer Stith, bond portfolio manager for Wilmington Trust.

If the PCE number is indeed high and US jobs numbers continue to outperform expectations, it’s possible the Fed could decide to keep rates higher for longer, Stith added.

"I don't think they're going to raise rates," he said. "[But] maybe the Fed walks it back a little bit to two cuts instead of three."

Several Fed officials last week cited the recent inflation data as evidence that the path down to 2% is going to be "bumpy," with both Fed vice chair Philip Jefferson and Fed vice chair for supervision Michael Barr using that exact word.

Fed governor Chris Waller raised the question of whether the January data was a more serious "pothole," emphasizing the central bank should take its time when it comes to rate cuts.

"I am going to need to see at least another couple more months of inflation data before I can judge whether" a hot inflation reading in January "was a speed bump or a pothole."

He said he still expects cuts will happen "sometime this year" but that the interest-rate setting committee "can wait a little longer."

"What's the rush?" he asked.

Fed officials tossed out more notes of caution this week in the days leading up to the PCE release.

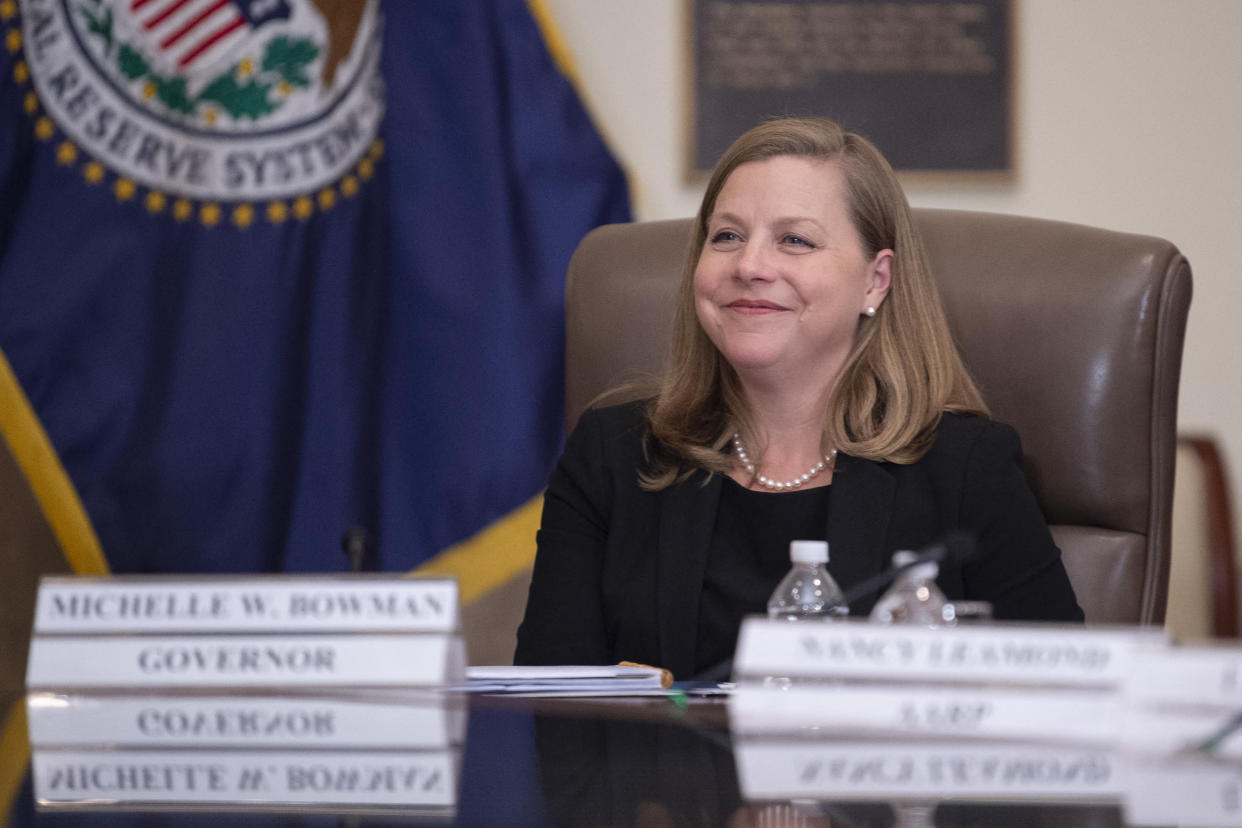

Fed governor Michelle Bowman said Tuesday that the Fed isn’t at a point yet where it would begin lowering rates and that reducing rates too quickly could require a rate hike later.

She added that she is also willing to raise rates if progress on inflation stalls or reverses.

Kansas City Fed president Jeff Schmid said Monday night in his first-ever speech since taking the role last year that "when it comes to too-high inflation, I believe we are not out of the woods yet."

The decline so far, he said, has been driven by a drop in the prices of goods as supply chains have healed from the wounds of the pandemic. He said he thinks the prices of services — which comprise two-thirds of consumer spending — continue to rise quickly amid a strong job market and higher wage growth.

"With inflation running above target, labor markets tight, and demand showing considerable momentum, my own view is that there is no need to preemptively adjust the stance of policy," he said.

Matt Luzzetti, US chief economist for Deutsche Bank Securities, said he expects PCE to have risen 36 basis points month over month in January while declining year over year to 2.8%.

That data, he said, is already already embedded in Fed officials’ views.

"A number of officials are sounding more cautious about imminent rate cuts in response to the stronger-than-anticipated data releases to start the year," he said. "These data have given us greater confidence in our baseline view that the first cut will occur at the June meeting and not before."

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance