Dude, Gen X is totally unprepared for retirement, survey finds

For the so-called Slacker Generation, their retirement reality bites.

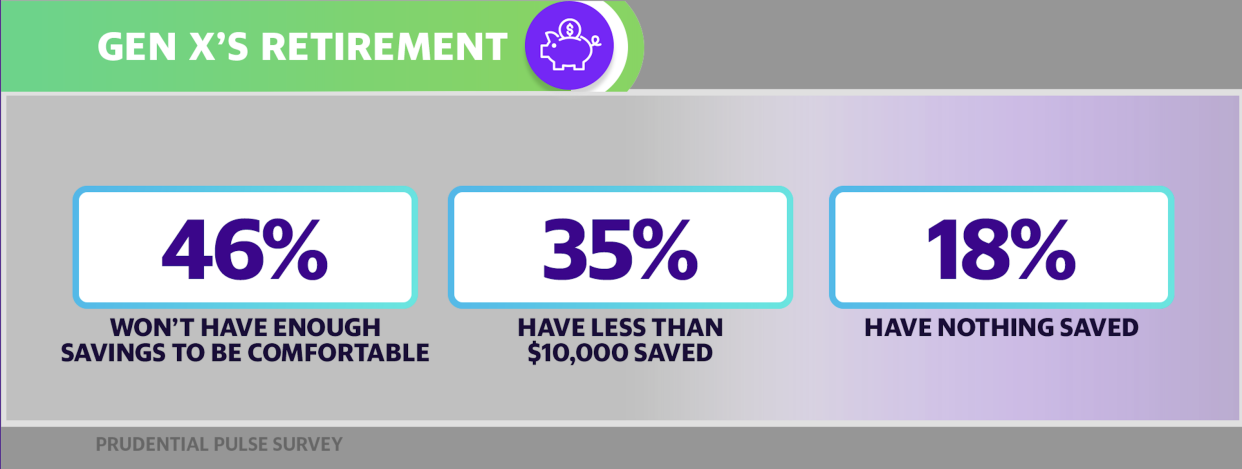

Just over half of Generation X — born between 1965 and 1980 — have little to nothing socked away for retirement, according to research by Prudential Financial of 2,000 pre-retiree Gen Xers conducted between March 31 to April 6, 2023. Thirty-five percent of the 65 million US Gen Xers have less than $10,000 saved, and 18% have no savings.

How to choose the right high-yield savings account for you

The results, echoed in two other recent surveys, reflect the burdens this generation faces and are a big wake-up call — especially for the oldest members who are about a decade from retirement age.

“Gen X is staring at one of the most complex landscapes for retirement readiness in decades,” Prudential Vice Chair Rob Falzon told Yahoo Finance. “Due to the decline in defined benefit pension plans, which often supported previous generations’ retirement, as well as uncertainty about the economy and long-term Social Security benefits.”

‘Gen Xers have less confidence in their financial future’

The Prudential research comes on the heels of the latest study from Allianz Life Insurance Company of North America published last week and Northwestern Mutual's 2023 Planning & Progress Study published in mid-May, both of which raised serious concerns about Gen X’s future financial outlook.

It’s a trifecta of gloomy news for Gen Xers.

In Allianz’s report, 64% of Gen Xers worry they won’t have enough saved for retirement, up from 55% in 2021. That’s even higher than what the Prudential report clocked and also tops Northwestern Mutual’s finding that 55% of Gen Xers say they won't be financially prepared for retirement when the time rolls around.

If that wasn’t enough, nearly half believe they could outlive their savings, according to the Northwestern Mutual survey conducted among 2,740 U.S. adults between February 13 and March 2, 2023.

“A notable finding in our report was that Gen Xers have less confidence in their financial futures than other generations,” Kelly LaVigne, vice president of Consumer Insights at Allianz Life, told Yahoo Finance.

Overall, only 55% of Gen Xers believe they are better off than previous generations at their age, versus 70% of boomers and 61% of millennials, Allianz found. And 69% of them said they are confident in their ability to financially support all the things they want to do going forward, down from 73% last year and lower than the 76% for millennials and 86% for boomers.

Allianz Life conducted the online survey of 1,000 adults who either had $150,000 or more in investable assets, or incomes of $50,000 a year if single and $75,000 a year if married in February and March of 2023.

Why is Gen X so behind on retirement saving?

While it could be easy to blame apathy or disengagement — characteristics that Gen Xers have often been saddled with by onlookers — there are several underlying economic issues making it harder for this cohort to save.

“The goal for retirement planning is to enjoy today without feeling like you’re sacrificing tomorrow’s dreams, but Gen X is clearly more anxious than other generations about what lies ahead,” Christian Mitchell, chief customer officer at Northwestern Mutual, told Yahoo Finance.

“Many in this generation are simultaneously taking care of kids and aging parents. When so many people count on you, it’s easy to deprioritize yourself,” he said. “But as their retirement age gets closer, pressure for Gen X builds.”

Adding to those responsibilities is higher consumer prices.

More than two-thirds of working Gen Xers are concerned about reaching their savings goals due to inflation, and nearly three-quarters say the current economic environment makes it hard to plan beyond day to day, according to the Prudential research.

In fact, 67% of those canvassed by Allianz say their income is not keeping up with the rising cost of living, up from 54% just last year.

What do Gen Xers expect in retirement?

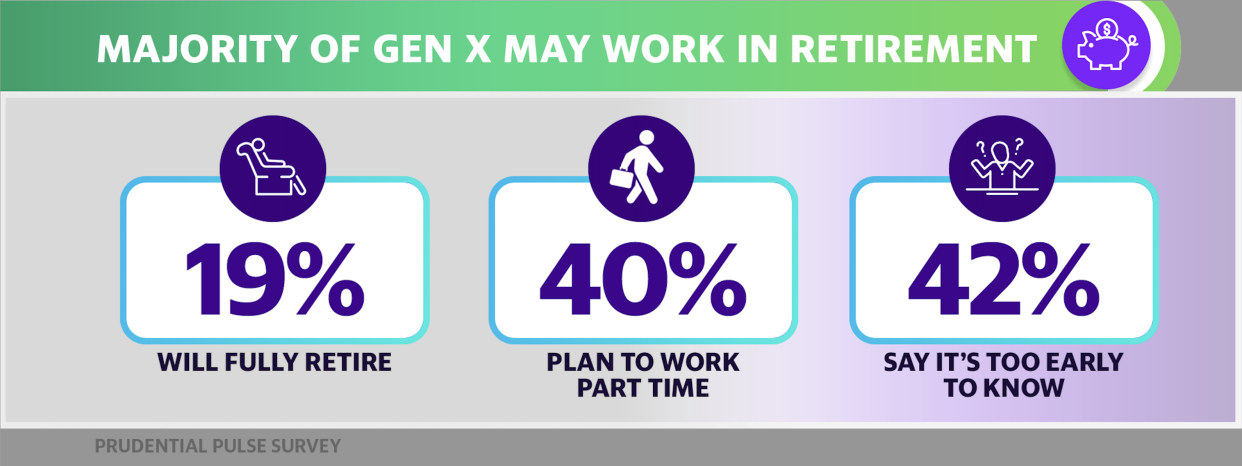

Their solution: Almost half (47%) of all working Gen Xers expect to retire later than anticipated to make up for that, and another 2 in 5 plan to work part time after retirement, Prudential reported.

While the Prudential survey found that 58% expect to rely on Social Security as their primary source of retirement income, the Northwestern Mutual one found that just 45% were “very or somewhat confident” that Social Security will be there to support them when they need it.

That makes sense because the current projections are that, if no policy action is taken, the Social Security trust fund reserves will be depleted by 2033 when the oldest Gen Xers hit full retirement age. At that point, Social Security will be able to pay out only 77% of benefits.

Pensions are also a thing of the past. Only 20% of Gen Xers plan to use traditional pensions as a source of retirement income and a tiny 11% say they will mainly rely on a pension, Prudential reports.

“It’s a new era we are entering into, where folks are dependent on their defined contributions plans for retirement and very few lucky folks — excluding government employees — have defined benefit plans which they can use in retirement,” Tricia Rosen, a certified financial planner with Access Financial Planning in Andover, Mass., told Yahoo Finance.

And while in the past, home equity was often a kitty to fund retirement lifestyles, a slim 16% of Gen X plan to use their home value to support their retirement years.

No financial plan in place

Many Gen Xers also have their heads in the sand when it comes to even focusing on their future.

Although they know they are admittedly not financially in good shape for retirement, nearly half spend no time a week thinking about retirement, according to Prudential’s survey, while two-thirds have no retirement strategy, a real sticking point, according to many financial advisors.

“Gen Xers have not taken the time to get a financial plan in place,” Barbara Pietrangelo, a certified financial planner with Prudential in Ada, Michigan, told Yahoo Finance. “Those that have a plan tend to feel in a much better place.”

But a quarter surveyed by Allianz say “retirement is too far away for me to start worrying about it now,” while nearly half say they can’t even think about saving for retirement right now and are just trying to take care of day-to-day expenses.

To be fair, it may not be that they are blithely tuning out. There are indications that Gen Xers are, in fact, concerned and they’re increasingly cognizant that time is not on their side. Only a quarter of Gen Xers say they have plenty of time to save money for retirement later, down from 43% in 2021, the Allianz Life study found.

“They’re starting to reach that critical window in preparing for retirement, which is usually about 10 years before leaving the workforce,” Allianz’s LaVigne said. “At that point, many people are at a life stage to really focus on retirement –their kids are grown, they are likely making more money, and have already made big purchases like a home. This is the time when many people can really start buckling down.”

It can start by taking action and simply setting goals, then prioritizing those goals, and reviewing regularly, Pietrangelo added. Maxing out retirement plan contributions — including catch-up ones when they hit 50 — is also imperative.

The Prudential survey found that many Gen Xers are taking steps, with 56% saving 10% or more of their income, 40% upping retirement contributions, and 86% adjusting their lifestyle so they can save more.

“The bottom line is this: While time to plan is running out, there is still time to act,” Mitchell said. “The data represents an opportunity for Gen X to mobilize and get organized.”

Kerry Hannon is a Senior Reporter and Columnist at Yahoo Finance. She is a workplace futurist, a career and retirement strategist and the author of 14 books, including "In Control at 50+: How to Succeed in The New Work of Work" and "Never Too Old To Get Rich." Follow her on Twitter @kerryhannon.

Read the latest financial and business news from Yahoo Finance