Dave Ramsey Says His Emergency Fund Guidance Is ‘Not Enough’

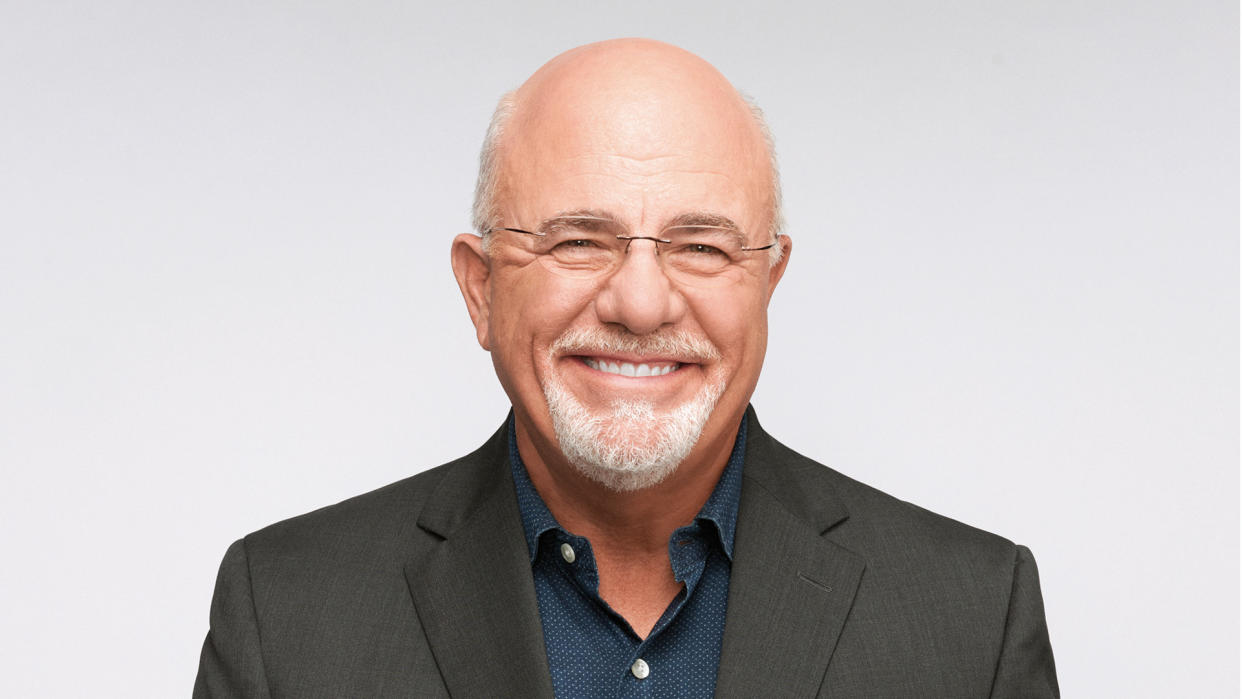

Financial personality Dave Ramsey is famous for his “Baby Steps,” which are a process to get out of debt and build solid wealth throughout life. Ramsey’s very first baby step is to build a $1,000 starter emergency fund.

Check Out: I’m a Self-Made Millionaire: I Followed These 3 Dave Ramsey Rules To Get Rich

Read Next: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

But in 2023, Ramsey told an audience member at a live event that a $1,000 starter emergency fund is “not enough.” Does this mean that Ramsey is changing his tune? Read on to learn the philosophy behind the $1,000 starter emergency fund, how Ramsey’s Baby Steps function and what other experts think about the concept.

What Is the Philosophy Behind the $1,000 Starter Emergency Fund?

Dave Ramsey’s guiding philosophy is to keep people out of debt. One of the main reasons Americans go into debt is that they don’t have any readily available money to cover emergencies. Without some level of cash reserves, every little surprise may force you to fall into debt, and that’s a cycle that’s hard to get out of. For this reason, Ramsey’s Baby Steps begin with setting aside $1,000 to ensure that small expenses don’t immediately drive you into debt.

Step 2 of Ramsey’s Baby Steps is to aggressively pay off all non-mortgage debt. He puts the $1,000 starter emergency fund as his first step so that you’re less likely to incur additional debt, but before you direct more money to other aspects of your financial life, his belief is that getting out of debt is of paramount importance.

Explore More: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Why Did Ramsey Say It Is Not Enough?

A $1,000 emergency fund is clearly not enough to cover every possible surprise expense you may face, and Ramsey addressed this in his response to the audience member’s question. Ramsey came right out and said that a $1,000 emergency fund is “not enough,” but that it was never intended to be enough to cover all of life’s financial emergencies. As Ramsey put it, $1,000 is enough to buy an alternator or a few tires for your car, or to take your kid to the pediatrician, but it’s not “enough” for everything.

This doesn’t mean Ramsey was “wrong” in suggesting an emergency fund of just $1,000. What’s critical to note is that the $1,000 starter fund is only step 1 in Ramsey’s Baby Steps. Step 3 is to “save 3-6 months of expenses in a fully funded emergency fund,” so it’s not as if the guru is overlooking the value of a larger emergency fund. He just recommends having enough set aside for minor emergencies before tackling the more important issue of outstanding debt. Once you’ve knocked out your debt, the very next Baby Step is to beef up your emergency fund to cover those larger financial emergencies.

What Do Other Experts Recommend?

Ramsey is well-known for recommending a $1,000 starter emergency fund, but some other experts agree with him as well. Erin Lowry, author of the Broke Millennial book series, suggests that $1,000 is a good place to start, but that it “wouldn’t cover the basic needs of most people.”

Like Ramsey, she suggests that after you’re free of debt, your target for your emergency fund should be at least three to six months of living expenses, although that figure can vary based on a number of variables.

Many other experts skip right over the idea of the $1,000 starter emergency fund and recommend that you should start saving three to six months of expenses. In fact, that target range has become something of the industry-standard recommendation. But it’s important to note that just like most financial recommendations, the three-to-six-month emergency fund is more of a guideline than a rule. You should use this amount as a suggestion and tweak it according to the specifics of your personal financial situation.

For example, if you’re a freelance worker and are constantly out hustling for new clients, you might want to bump up your emergency fund to a full year’s worth of expenses, as your income is less regular. The same is true if you’re approaching retirement, as you don’t want to have to withdraw living expenses from your retirement accounts if their value is down during a bad year.

But if your financial situation is more secure, perhaps three months of expenses in your emergency fund is sufficient. Andrea Osorio, senior wealth advisor at Citi Personal Wealth Management, told CNET that you ask yourself questions like these to help you determine how large of an emergency fund you really need:

Do you have a dual-income household?

How many dependents do you have?

Are you someone with minimal obligations and no dependents?

Do you have a mortgage or other large recurring debts?

Should you lose your job, how difficult is it to find another job?

The Bottom Line

Ramsey’s suggestion to start with $1,000 in an emergency fund is as timely as ever, as it’s a good way to avoid taking on debt to pay for small financial emergencies. But he, along with the majority of financial experts, recommends boosting that to at least three to six months of expenses once you’ve gotten out of debt.

More From GOBankingRates

How Much Does the Average Middle-Class Person Have in Savings?

5 Reasons You Should Consider an Annuity For Your Retirement Savings

This article originally appeared on GOBankingRates.com: Dave Ramsey Says His Emergency Fund Guidance Is ‘Not Enough’