Credit card debt jumps by largest amount in two decades, Fed report says

Credit card balances surged from July to September as Americans continued to sink deeper in debt amid rampant inflation, the Federal Reserve Bank of New York said Tuesday.

Credit card balances increased $38 billion in the third quarter to $930 billion, the New York Fed found, with balances once again matching the pre-pandemic peak of $930 billion in the fourth quarter of 2019. Year over year, credit debt grew by 15%, the largest jump in more than 20 years.

The figures underscore Americans' growing dependence on credit cards even as recent Fed rate hikes push interest rates to record highs, placing a heavier burden especially on lower-income households and younger adults.

“New purchases adding to the credit card balance reflect robust demand amid higher prices of goods and services,” a group of New York Fed researchers said in a blog post. “The Consumer Credit Panel sheds light on the more rapidly increasing debt burdens and delinquency of younger and less wealthy card holders, and may suggest disparate impacts of inflation.”

Younger borrowers take on higher debt levels

Younger borrowers — defined as those under 30 years old — registered the highest balances during the third quarter, surpassing pre-pandemic levels, the New York Fed found. Younger adults also saw the smallest reduction in their average balances in absolute terms.

This group was followed by 30- and 59-year-olds, which saw balances inch closer to levels seen in the fourth quarter of 2019. For older borrowers — those between 60 and 79 — their average balances rose modestly, but remained below pre-pandemic levels.

Pandemic stimulus payments and aid distributed during the last two years made a significant impact on the financial stability of borrowers across the U.S., researchers said in a press call. Now that the financial cushion is “largely gone,” it’s likely that Americans will continue to take on higher levels of credit, especially younger adults, as they attempt to offset inflation.

Delinquency levels increase the most among lower earners

Ballooning consumer prices have added greater burdens on U.S. households, New York Fed researchers found, particularly on lower-earning households. These borrowers had a harder time paying back balances and were at larger risk of slipping into delinquency.

For instance, those in the highest-income areas had an average balance that was $300 lower in September 2022 than in December 2019. By comparison, lower-income borrowers saw their credit card balances surpass the average from December 2019.

Likewise, the share of credit card borrowers in the highest-income areas that were likely to transition into delinquency remained well under historical trends. Meanwhile, the percentage of low-income borrowers flowing into delinquency is now over the pre-pandemic level.

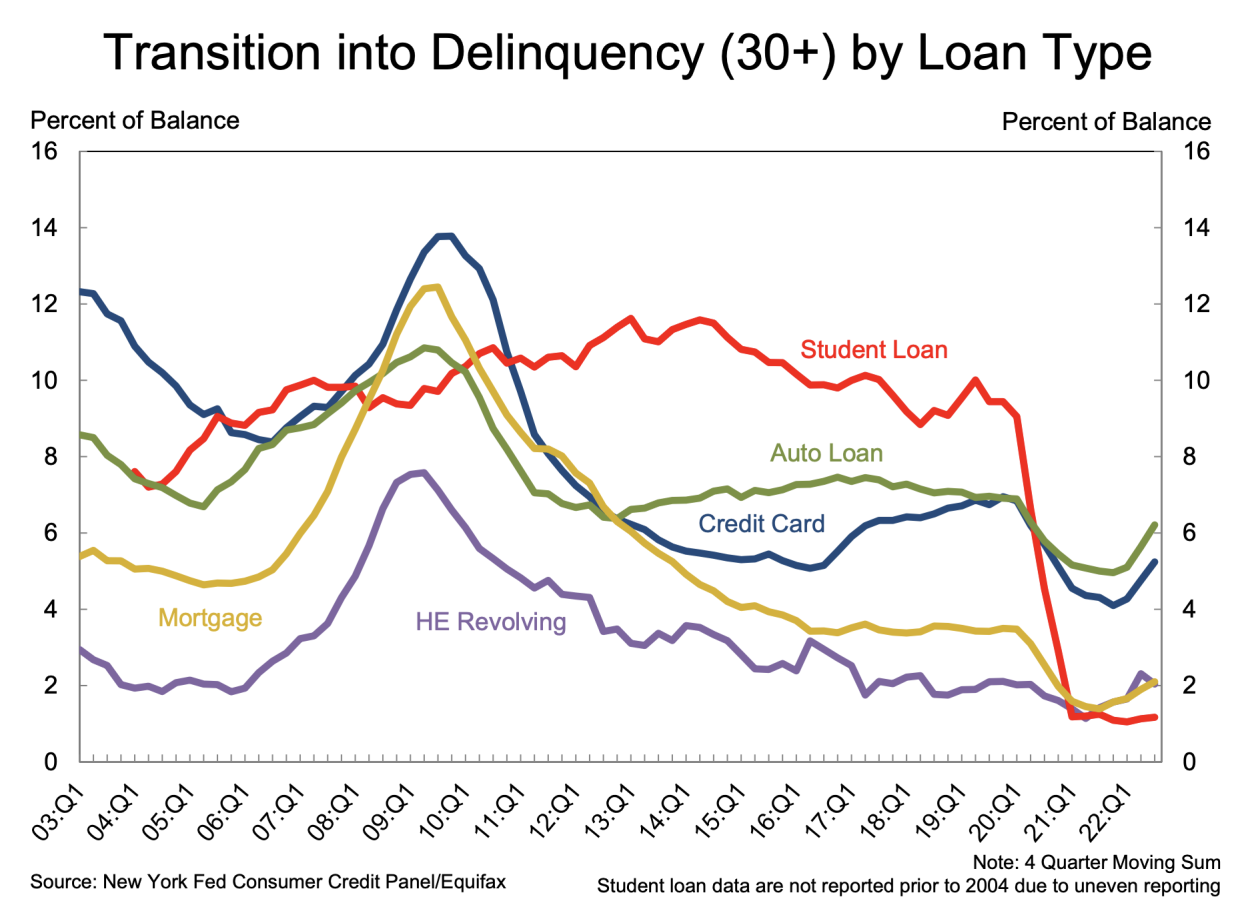

Still, delinquency levels remain low compared with the Great Recession and through the period preceding the COVID pandemic, the New York Fed noted, suggesting that consumers are still able to “manage their finances” through this period of price increases.

“With prices more than 8% higher than they were a year ago, it is perhaps unsurprising that balances are increasing,” New York Fed researchers reported. “Notably, credit card balances have grown at nearly double the rate since last year. The real test will be to follow whether these borrowers will be able to continue to make the payments on their credit cards.”

Editor's note: This version corrects the total amount of credit card debt in the third quarter of 2022.

Gabriella is a personal finance reporter at Yahoo Money. Follow her on Twitter @__gabriellacruz.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube