When could the U.S. default? Here are the latest projections.

Since the Congressional Budget Office (CBO) released new information on government finances last week, outside groups have been poring over the data to try and give Washington, and Wall Street, a clearer indication of when the government might not be able to pay its bills.

But the the picture remains very murky.

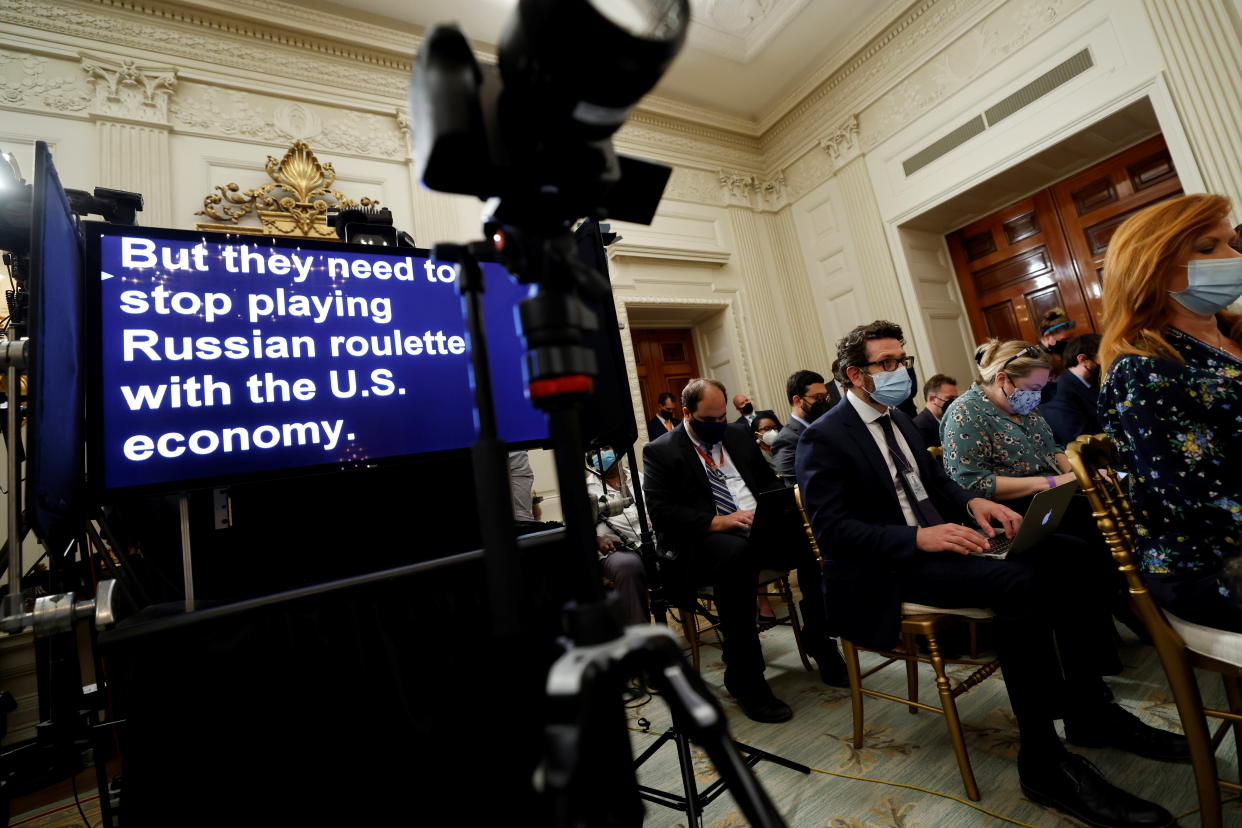

In recent days, observers have presented an array of options - including some that see the risk ratcheting up in June - for when default is on the table. That is, unless lawmakers and the White House can come together on a deal to raise the U.S. government's borrowing authority. The stakes are enormous—even the threat of a default will rattle U.S. and global markets and could also send the economy into a recession.

The latest projection was announced Wednesday morning by the Bipartisan Policy Center. Their verdict: default is likely to arrive in summer or early fall of this year.

Shai Akabas, the BPC’s director of economic policy, citing things like rising interest rates and persistent inflation, unveiled the updated projection Wednesday morning. "Most of those factors have worked in the direction of pulling the X date forward relative to expectations last spring," he said.

This week’s report adds that U.S government is set to spend more than $3 trillion between now and June while bringing in about $2.5 trillion. The uncertainty as to when the government could run out of money stems from how even small variations - which are likely during the coming tax season - could move the dates of default, also called the X date, quickly.

4 more projections of the 'crunch date'

The uncertainty seen at the BPC is evident across the spectrum.

The CBO offered their own projection last week that projects the government will likely no longer be able to pay its debt obligations fully “between July and September 2023" without action from Congress.

Another group that closely tracks the cash heading in and out of the Treasury is a data company called Wrightson ICAP. The analysts there - who specialize in Federal Reserve operations and Treasury financing - have a slightly narrower window at the moment with a recent note published on Feb. 20 maintaining a “baseline forecast of a crunch date in late July or early August.”

But both the CBO and Wrightson ICAP were quick to note that they can’t rule out the X date possibly arriving as early as June.

And in yet another recent analysis, this time from Goldman Sachs in a note released Monday, the economic research team there says they “expect the debt limit deadline to hit in early to mid-August.” The bank's analysis this week said they expect Congress to act to avoid catastrophe. But, they added, even debt limit uncertainty has historically led to heightened volatility and dislocations in the bond market.

Over at the Treasury Department, the most recent guidance came in the form of an early January letter from Treasury Secretary Janet Yellen projecting that "it is unlikely that cash and extraordinary measures will be exhausted before early June."

The U.S. formally hit the debt limit on Jan. 19 with Yellen and her aides beginning a process known as "extraordinary measures" in response. Those accounting maneuvers essentially allow the government to move money around in the vast U.S. Treasury and stave off an actual default, but for only a limited time.

But to make matters even more complicated, Akabas also laid out a “too close for comfort scenario” where simply the fact of nearing the X date could have a destabilizing effect on the economy by this June “where the Treasury will be sending alarm bells.”

The wait for more data from tax season

It all puts a premium, experts said, for lawmakers to get the issue resolved as soon as possible. "Obviously they already had one meeting,” said Akabas referring to a meeting earlier this month between President Biden and House Speaker Kevin McCarthy (R-CA) "but that seems to have stalled and our hope is that this will help spur the process."

There has been little public activity in the negotiations since Biden and McCarthy sat down at the White House on Feb. 1. Both sides said the discussions were productive with McCarthy saying a follow-up meeting was in the offing, but the timing of the next face to face hasn't been announced.

In the meantime, analysts will be closely watching the coming tax season as observers clamor for more specific guidance on a possible default.

Wrightson ICAP said the most important indicator to watch is average size of individual refunds that come in in the coming weeks and months. They note that bad news for individuals - in the form of a smaller average refund size - would be good news for Treasury’s books and push the X date a bit further out.

Added Akabas: "We will likely have a good sense of what tax season has looked like sometime in early May, so it's going to be a while."

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube