Congress sends Biden a measure to stop 'woke' 401(k)s

The U.S. Senate on Wednesday passed a measure to block retirement account managers from considering environmental, social, and corporate governance principles (ESG) when evaluating investments in retirement plans.

The joint resolution measure, approved in a 50-46 vote, aims to overturn a Labor Department rule that currently allows fiduciaries to consider those factors. But it's set to be blocked when it arrives at the White House in what would be President Biden’s first veto since taking office.

The Wednesday afternoon vote was the highest-profile swipe yet from Republicans who are aiming to reverse a decades-long trend in Corporate America of taking factors like environmental impact into consideration when it comes to investment decisions in addition to just profits.

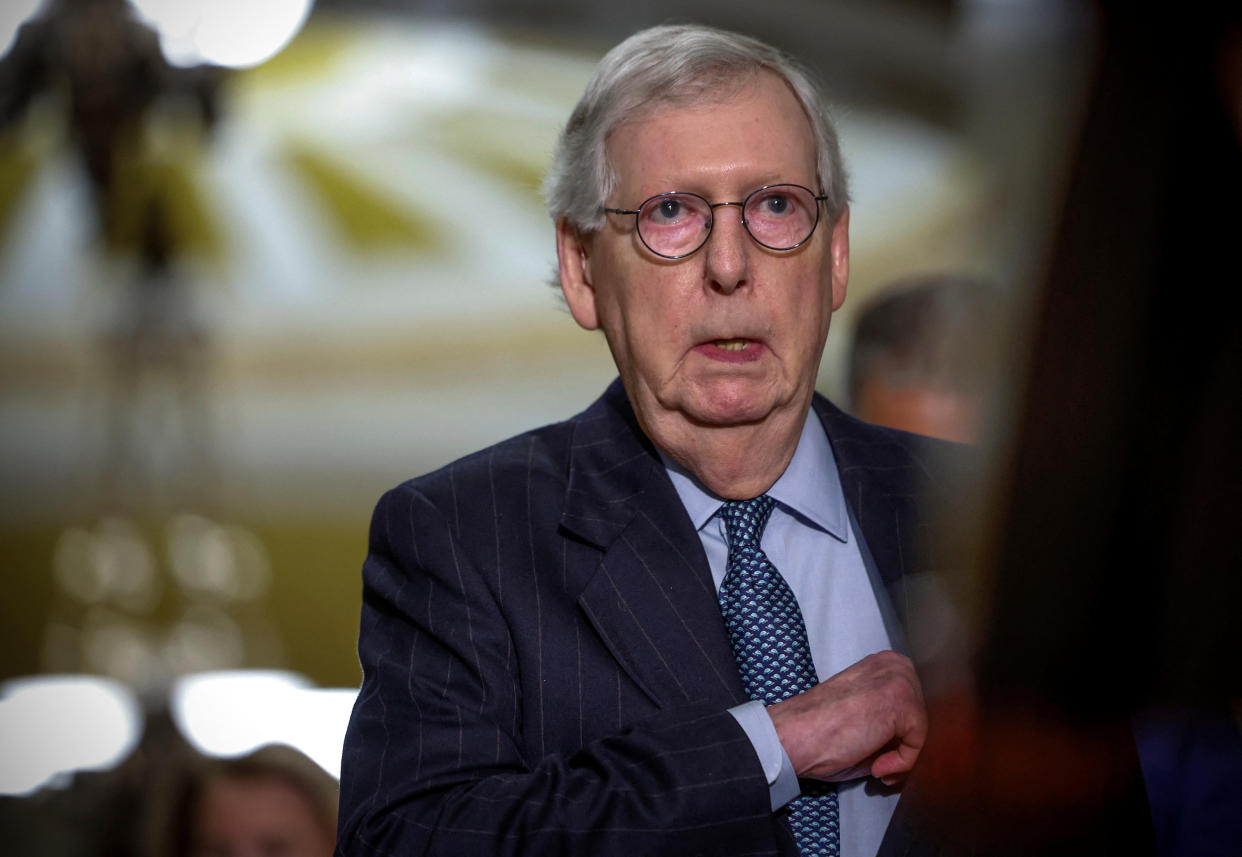

In a recent speech, Senate Minority Leader Mitch McConnell (R-KY) strenuously argued for the measure saying “in effect, we are talking about letting financial companies garnish the retirement savings of workers without their permission in order to pursue unrelated liberal political goals.”

Most Democrats counter that the charges against the rule are overblown because it doesn’t require retirement plans to include ESG considerations. It simply allows the option.

"I come to the floor sort of confounded," Senate Majority Leader Chuck Schumer (D-NY) said Wednesday as voting got underway claiming that "the hard right has made a lot of noise trying to make ESG their dirty little acronym."

In a Wall Street Journal op-ed published Tuesday, Schumer expanded on his argument and noted that Republicans have also advocated making money managers “consider factors that don’t strictly relate to financial returns” such as ties to Russia or China.

The Biden administration had previously promised to veto the measure with Press Secretary Karine Jean-Pierre reiterating that pledge to reporters on Wednesday afternoon.

'A political wedge issue'

During a recent Yahoo Finance Live interview, Stance Capital Founding Partner Bill Davis said the political efforts around ESG have been a drag on the sector.

"It's basically, frankly, a political ploy funded by a web of dark money or a network of dark money funders that is seeking to kind of make ESG or values aligned investing a political wedge issue," he said.

But he added that, in the end, "I don't actually think that the political headwinds are going to amount to much, other than just simply a lot of noise."

As of 2021, according to an analysis from PricewaterhouseCoopers, asset managers globally had over $18 trillion in ESG-related assets, a number that is estimated to grow to almost $34 trillion by 2026.

This week's joint resolution originated in the House of Representatives and was first brought forward by Sen. Mike Braun (R-IN) and Rep. Andy Barr (R-KY). It passed the House of Representatives on Tuesday in a vote of 216 to 204. Rep. Jared Golden (D-ME) crossed party lines to vote yes.

In the Senate, it passed the Democratic-controlled chamber largely thanks to the support of Sen. Joe Manchin (D-WV) who co-sponsored the measure along with 48 GOP senators and then crossed party lines to vote yes Wednesday. He was joined by Sen. Jon Tester (D-MT) who also voted yes to give the measure the required votes for passage.

The legislation was considered under the Congressional Review Act, which allows the Senate to overturn regulatory decisions by a simple majority vote instead of the usual 60 votes required for regular bills.

An issue that isn’t going away

Even with President Biden’s veto all but assured, the issue is unlikely to go away anytime soon.

The House Financial Services committee, under Chair Patrick McHenry (R-NC), has recently announced a Republican E.S.G. Working Group with hearings promised in the months ahead.

The issue is also likely to come up during upcoming confirmation hearings for Biden’s Labor Secretary nominee, Julie Su. The president formally unveiled his choice at a White House event Wednesday morning, saying he wanted the Senate to act quickly on her nomination to replace outgoing Secretary Marty Walsh.

And the issue is quickly permeating the 2024 presidential race as well. Potential candidate Mike Pence weighed in on this week’s vote and another candidate, Vivek Ramaswamy, is already in the race largely running on a platform of opposition to “woke” capitalism.

I considered running for Senate in 2021, just as I finished writing “Woke, Inc.” The political class told me our base didn’t know or care about “wokeness” & I needed to find a new issue. Now they train candidates with bullet points to say “woke” as many times as they can. Funny.

— Vivek Ramaswamy (@VivekGRamaswamy) February 26, 2023

Ramaswamy — the author, former investment partner, and executive at Roivant Sciences — entered the race last month with a background heavily focused on the issue. He is currently trying to garner enough support to qualify for the upcoming debates and ensure that ESG investments are discussed on that high-profile stage.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube