Cathie Wood's ARKK is worst-performing US equity fund in Q1 2022: Morningstar

Market watchers were taken aback when Cathie Wood’s flagship Ark Innovation fund fell 24% in 2021. This year, the widely popular ETF logged an even bigger loss in just the first quarter alone.

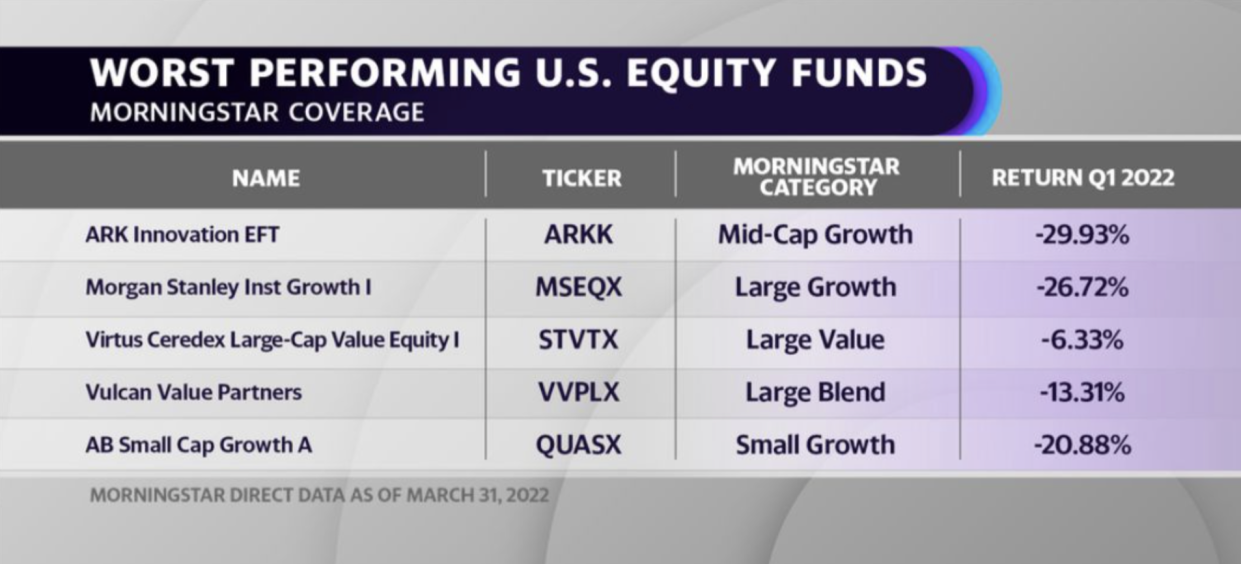

According to financial analytics firm Morningstar, Ark Innovation (ARKK) was the worst performing U.S. equity fund in its universe of coverage during the first quarter of 2022. The exchange-traded fund registered a loss of 29.9% in the three months ended March 31, dragged down by a sell-off in high-growth, technology stocks during the period.

U.S. tech funds bore the brunt of declines last quarter at an average loss of 13.7% — the worst quarter since 2018, per Morningstar data. Still, ARKK fared worse than its stylistic peers. By comparison, the QQQ Nasdaq 100 ETF, used as a proxy for tech stocks, was down roughly 9.7% through the same period, and the Russell Midcap Growth Index registered a 12.6% drop.

ARKK was dragged down by sharp losses in some of its biggest holdings: streaming company Roku (ROKU), which represented 6.5% of the fund as of March 30, lost more than 45% for the year-to-date; Zoom Video Communications (ZM), a 6.3% holding, fell more than 40%; and Shopify (SHOP), comprising a 2.7% stake, was down more than 50%, per Morningstar.

Tesla Inc. (TSLA), which at 9.8% makes up ARKK's biggest position, has been a relative outperformer, closing the quarter out only 1% lower year-to-date as of March 31, though holding onto gains from 2021 and masking the performance of some of Ark Innovation's smaller components. The picture could have been much worse without ARKK's stake in Tesla.

Inflationary pressures, subsequent Federal Reserve interest rates increases, and Russia’s invasion of Ukraine weighed more broadly on U.S. equities to start the year, but value stocks held up far better than shares of growth companies. The Morningstar US Value Index gained 2.4%, while the Morningstar US Growth Index lost 12.0%, the firm indicated.

On top of its struggling performance, Morningstar downgraded its analyst rating on ARKK from Neutral to Negative last week, citing issues with the fund's risk management and ability to navigate the space it aims to explore.

“The firm favors companies that are often unprofitable and whose stock prices are highly correlated,” Morningstar strategist Robby Greengold wrote in a note. “Rather than gauge the portfolio’s aggregate risk exposures and simulate their effects during a variety of market conditions, the firm uses its past as a guide to the future and views risk almost exclusively through the lens of its bottom-up research into individual companies.”

Despite losses and criticism of her approach, Wood has stayed the course and continues to promise that her bets on disruptive, innovation-focused companies will pay off in the long term.

“Manager Cathie Wood has since doubled down on her perilous approach in hopes of a repeat of 2020,” Greengold wrote, when high-growth stocks helped the fund notch a return of more than 150%. He notes, however, that Wood’s reliance on her instincts to construct the portfolio is a liability.

Also adding to its reason for the downgrade, Morningstar pointed out that Ark has a poor succession plan for Wood, 66, the firm's majority owner and lone portfolio manager. The firm’s director of research Brett Winton is in line to succeed Wood if needed but lacks the portfolio management experience, posing a “key-person risk.” Moreover, Morningstar pointed out that Ark Invest struggles to retain talent and sees analysts come and go, many of which “lack deep industry experience.”

“Wood has suggested that risk management lies not with her but with those who invest in ARK’s funds,” Greengold wrote. “It’s tough to see why that should be so.”

“ARK could do more to avert severe drawdowns of wealth, and its carelessness on the topic has hurt many investors of late,” he added. “It could hurt more in the future.”

ARKK was down 5.45% to $66.66 as of 1:40 p.m. ET on Tuesday.

—

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter @alexandraandnyc

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn