Your Cash Stuffing Savings Plan May Be Costing You Free Money — Here’s Why

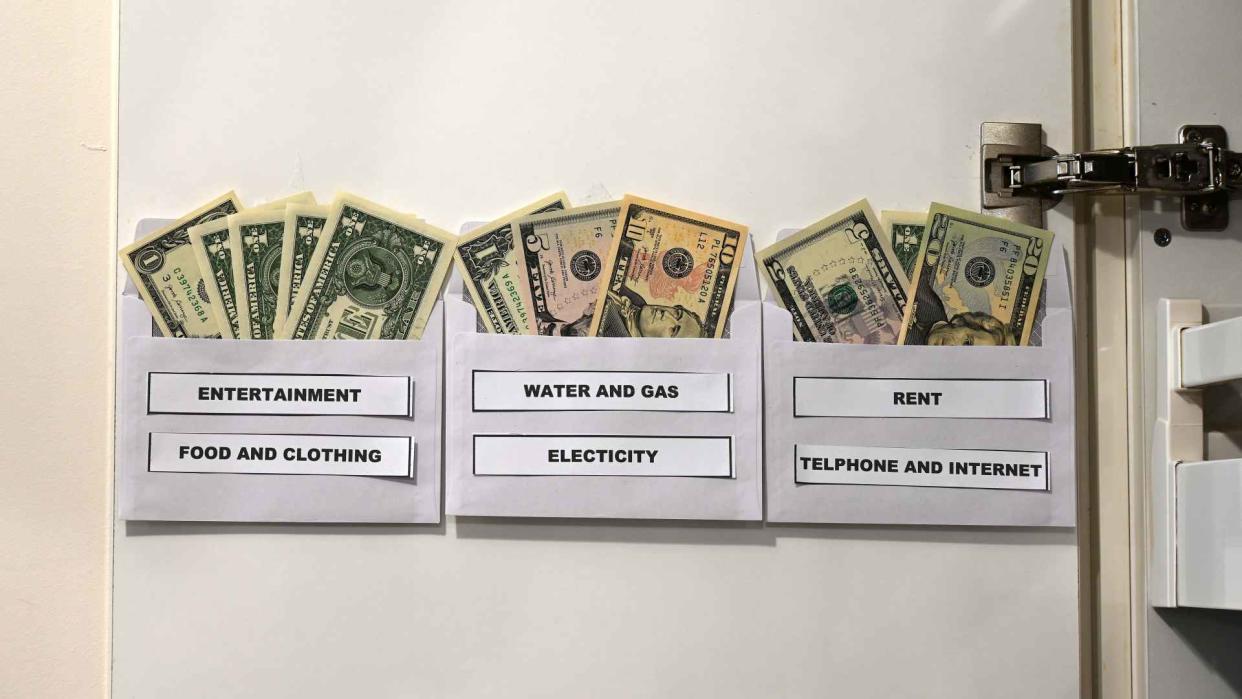

A popular TikTok trend might have you using a small binder with several labeled envelopes to stuff cash from each paycheck for specific uses. The idea behind this budgeting strategy is that you’ll avoid overspending when you only have a specific amount of physical cash to use. In addition to keeping you more disciplined, the envelope system could help you avoid debt and save more money.

See: 8 Frugal Habits of the Past To Save Money Today

Find: How To Get Cash Back on Your Everyday Purchases

But while you might better control your finances, you could miss out on the free money you could get thanks to currently high interest rates. If you kept your spare cash in a high-yield savings account, you could earn a 5% or higher return. With a $1,000 initial deposit and 5% APY, this would add up to around $51 in free money the first year. By contributing regularly, you can maximize your return and reach your savings goals more quickly.

Inflation Damaging Cash Holdings

Cash stored in envelopes is actually losing purchasing power due to year-to-date inflation, which is currently 3.7%. A savings account earning a higher rate than that will make you come out ahead. You can shop around for different options through banks and credit unions, especially online institutions that tend to offer the best rates. Make sure to seek options that avoid monthly fees or minimum balance requirements.

Keep in mind that cash has other risks that make using bank accounts ideal. Whether you carry the cash or leave it at home, a thief could take it, or you might simply misplace it. Plus, if a fire or other disaster destroys the money, you’d have to rely on insurance coverage, which may not cover the incident — or the whole amount. You won’t need to worry about losing cash at an insured bank, and you should also have protection from fraud.

A cash stuffing plan also comes with inconveniences. You have to take the time to physically count, sort and use the cash — plus make trips to withdraw money when needed. And if you want to buy something online or book a hotel room, that becomes difficult unless you turn to a credit or debit card.

Also: Which Bank Gives 6% Interest on Savings Accounts?

Digital Banking and Cash Stuffing Envelopes (or Buckets)

Instead of stashing away physical cash, consider the digital alternative. Digital cash stuffing is more convenient and still helps you manage your spending. For example, Ally Bank includes spending buckets with its checking account, and Qube Money integrates digital envelopes into its online bank account. There are also simple spreadsheets and other money management apps that imitate the traditional envelope budgeting method.

Alongside using these tools with a debit card for everyday spending, deposit your leftover cash into a high-yield savings account to start getting free money. Plus, look into any debit card rewards or account bonuses available for chances to get even more free cash.

More From GOBankingRates

Suze Orman: 3 Things You Must Do If You Receive an Inheritance

Experts: Here's Why Nearly Every Purchase Should Be On a Credit Card

This article originally appeared on GOBankingRates.com: Your Cash Stuffing Savings Plan May Be Costing You Free Money — Here’s Why