What is the Berkshire Hathaway Annual Meeting? Here are the basics of Warren Buffett's big event

Berkshire Hathaway's (BRK-A, BRK-B) 2021 Annual Shareholders Meeting is taking place on Saturday, May 1 and will be live streamed exclusively here on Yahoo Finance.

The event features Chairman & CEO Warren Buffett and Vice Chairman Charlie Munger recounting the company’s performance over the past year, along with a series of Q&As from reporters and shareholders. For the first time, they will also be joined by Vice Chairmen Gregory Abel and Ajit Jain, widely seen as possible successors at Berkshire.

Though the meeting typically takes place in Omaha, Nebraska, home to both Buffett and the company, this year's event will be held in Los Angeles. (Due to the coronavirus pandemic, it will be closed to the public, just like last year’s meeting.)

We'll be live-blogging and live-tweeting throughout the day, starting at 12:30 p.m. ET.

WATCH the Berkshire Hathaway 2021 Annual Shareholders Meeting exclusively on Yahoo Finance

'Your best investment is yourself'

Berkshire Hathaway initially began as a textile company in 1839.

In 1962, Buffett began buying stock in the company and assumed control within three years. Munger came along as vice chairman in 1978 and the two investors haven’t looked back since then.

Over the years, the two men have built an empire with a focus on the insurance business, and, more recently, a $36 billion investment in Apple (AAPL).

“Your best investment is yourself,” Buffett said back in 2013. “There is nothing that compares to it.”

Read more: Warren Buffett's 25 best quotes about business, investing, and life

Munger has consistently provided similar advice, telling the 2020 meeting that the best strategy for the "great mass of humanity" is to specialize in one area.

“Nobody wants to go to a doctor that’s half proctologist and half dentist, you know?" he said at the 2019 meeting. "So, the ordinary way to succeed is to narrowly specialize.”

The meetings have also included personal finance advice. Back in 2010, following the Great Recession, Buffett wrote in his letter to investors about the importance of cash.

"We pay a steep price to maintain our premier financial strength," he said. "The $20 billion-plus of cash equivalent assets that we customarily hold is earning a pittance at present. But we sleep well."

The Berkshire Hathaway empire

Berkshire is also a multinational holding company, meaning that it’s a conglomerate of numerous smaller companies.

These include businesses like GEICO, See’s Candies, Berkshire Hathaway Energy, Dairy Queen, Duracell, PacifiCorp, and Fruit of the Loom.

“It takes character to sit with all that cash and to do nothing," Munger once said. "I didn’t get to be where I am by going after mediocre opportunities.”

Read more: 21 brilliant quotes from legendary investor and polymath Charlie Munger

Berkshire also holds shares in 41 publicly traded companies, including: Apple, Coca-Cola (KO), Kraft Heinz (KHC), American Express (AXP), Bank of America (BAC), and BNY Mellon (BK).

Berkshire is famous for its management philosophy, which focuses on a decentralized, trust-based, and hands-off relationship between Buffett and other executives who work within the company.

“What we do is not beyond anyone else’s competence,” Buffett once said. “I feel the same way about managing that I do about investing: It’s just not necessary to do extraordinary things to get extraordinary results.”

Coca-Cola is the company’s oldest stock position, with 23 million shares initially purchased back in 1988.

Since then, Coca-Cola stock has been up over 2,000%, and Berkshire now holds 400 million shares.

WATCH the Berkshire Hathaway 2021 Annual Shareholders Meeting exclusively on Yahoo Finance

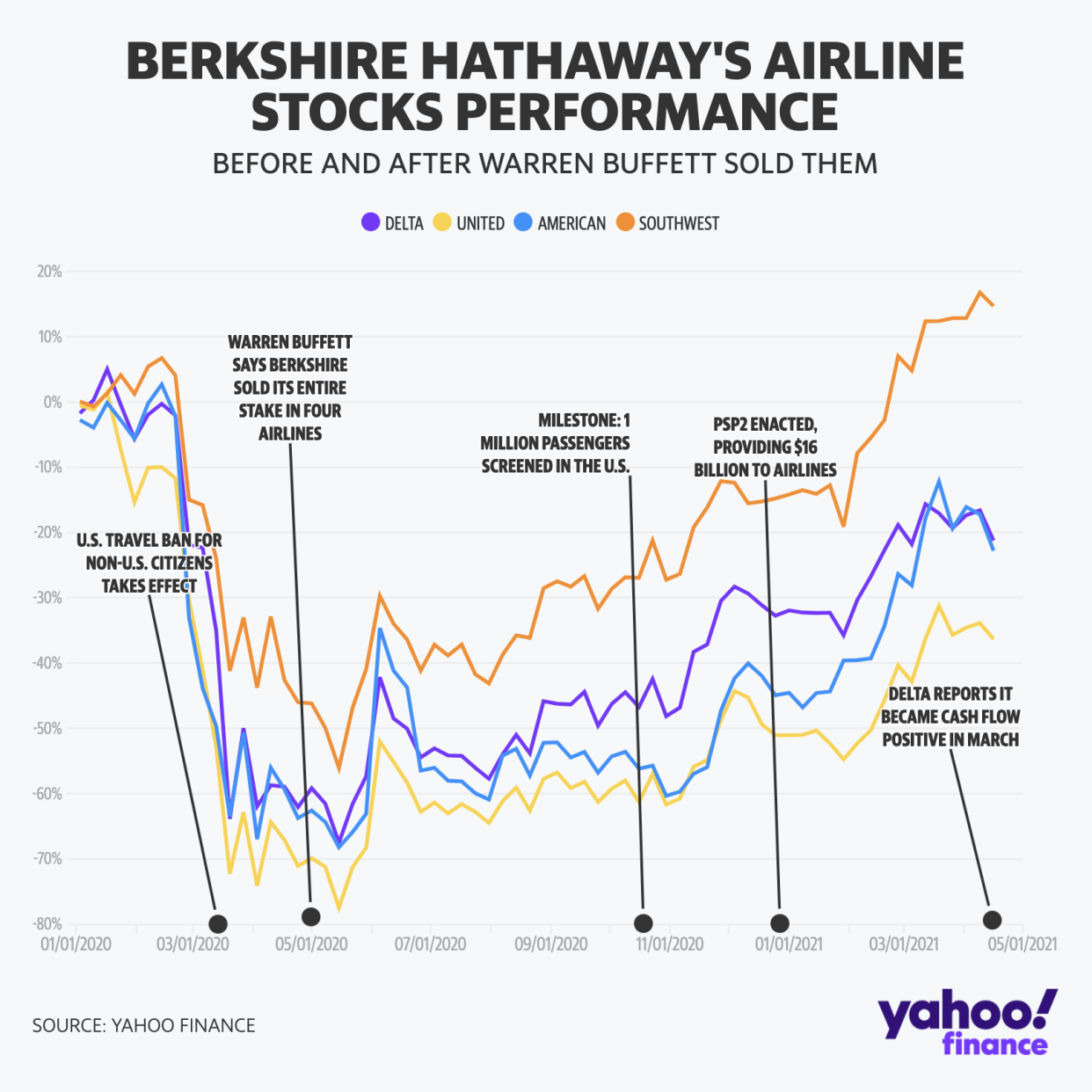

The company previously had holdings in four of the major airlines — Delta (DAL), Southwest (LUV), United (UAL), and American Airlines (AAL) — after spending between $7 billion-$8 billion on stakes back in 2016.

However, Berkshire revealed in May 2020 that it had elected to dump all four holdings as a result of the stocks tanking due to the coronavirus pandemic.

Berkshire also dipped its feet into the health care space, forming a joint venture with Amazon (AMZN) and JPMorgan (JPM) to create Haven, an attempt at reforming the health care system.

The endeavor fizzled by the beginning of 2021.

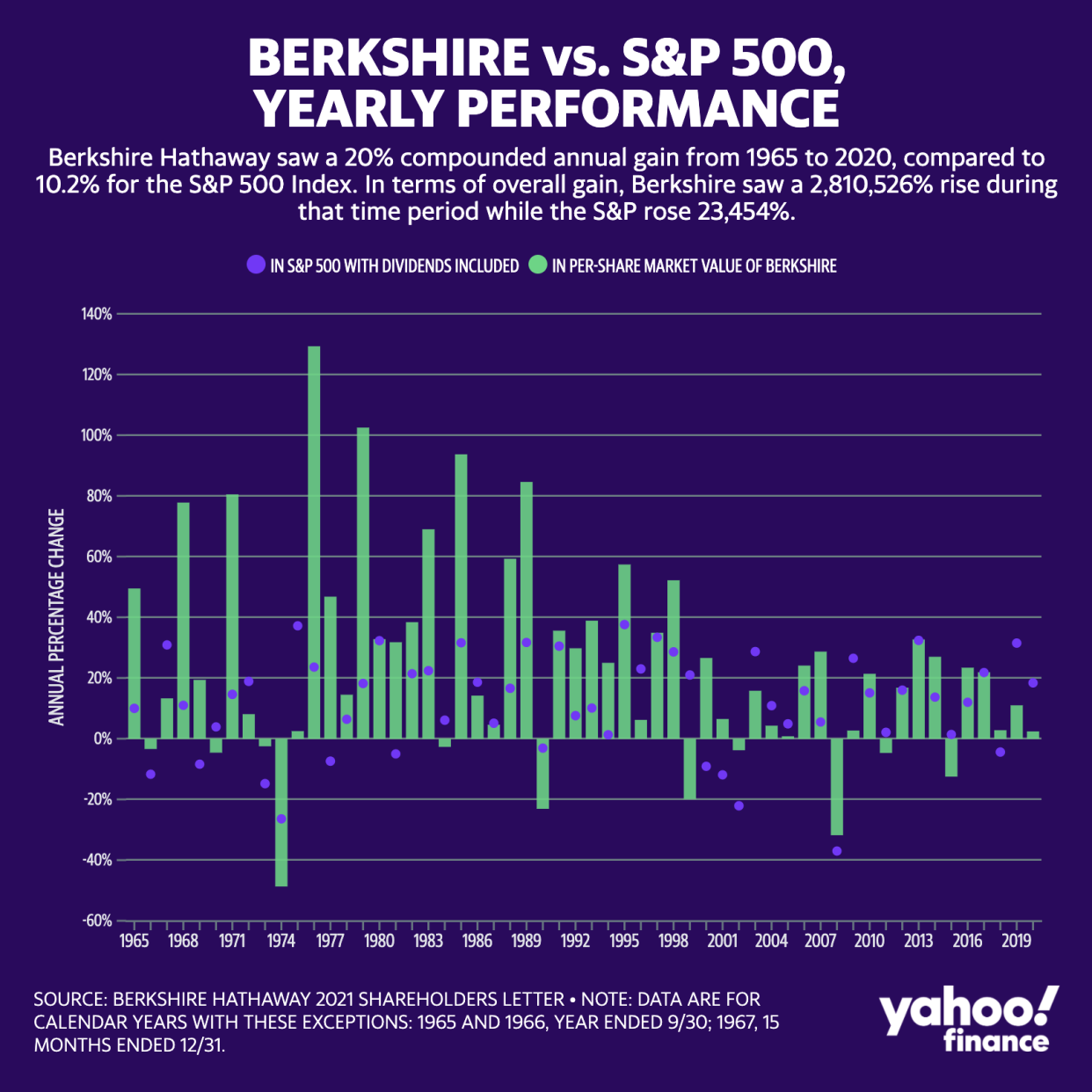

Despite some failures, the company is one of the most successful in the history of America.

'Berkshire shareholders need not worry: Your company is 100% prepared for our departure'

It’s still unclear who will take the reins once Buffett retires as CEO of Berkshire Hathaway.

Buffett has previously stated that his successor has already been decided on.

In his 2019 annual shareholder letter, the Oracle of Omaha wrote: “Berkshire shareholders need not worry: Your company is 100% prepared for our departure.”

WATCH the Berkshire Hathaway 2021 Annual Shareholders Meeting exclusively on Yahoo Finance

Vice Chairmen Gregory Abel and Ajit Jain’s names have been floated around as potential candidates. Notably, Abel filled in for Munger during the 2020 Annual Meeting as a result of the pandemic.

Abel is an insurance expert who services as chairman at Berkshire Hathaway Energy and vice chairman for Berkshire Hathaway's non-insurance operations.

Jain, a Harvard Business School graduate who previously worked at McKinsey, serves as vice chairman for Berkshire Hathaway's insurance operations.

Buffett’s current net worth is estimated to be at $102.8 billion, as of April 30, 2021, though he’s vowed to give away nearly all of it. Munger is estimated to be worth roughly $2.2 billion.

WATCH the Berkshire Hathaway 2021 Annual Shareholders Meeting exclusively on Yahoo Finance

Adriana Belmonte is a reporter and editor covering politics and health care policy for Yahoo Finance. You can follow her on Twitter @adrianambells and reach her at adriana@yahoofinance.com.

READ MORE:

'The first rule of a happy life,’ according to 97-year-old Charlie Munger

Buffett on the best time and place of all time to be born: 'You would pick today'

Warren Buffett muses on the difference between IQ and wisdom: 'It’s interesting'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.