'Bear down' and 'be as frugal as you can': Here are 3 ways to ride out a recession according to boomers

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. All links marked with an asterisk ( * ) are paid links.

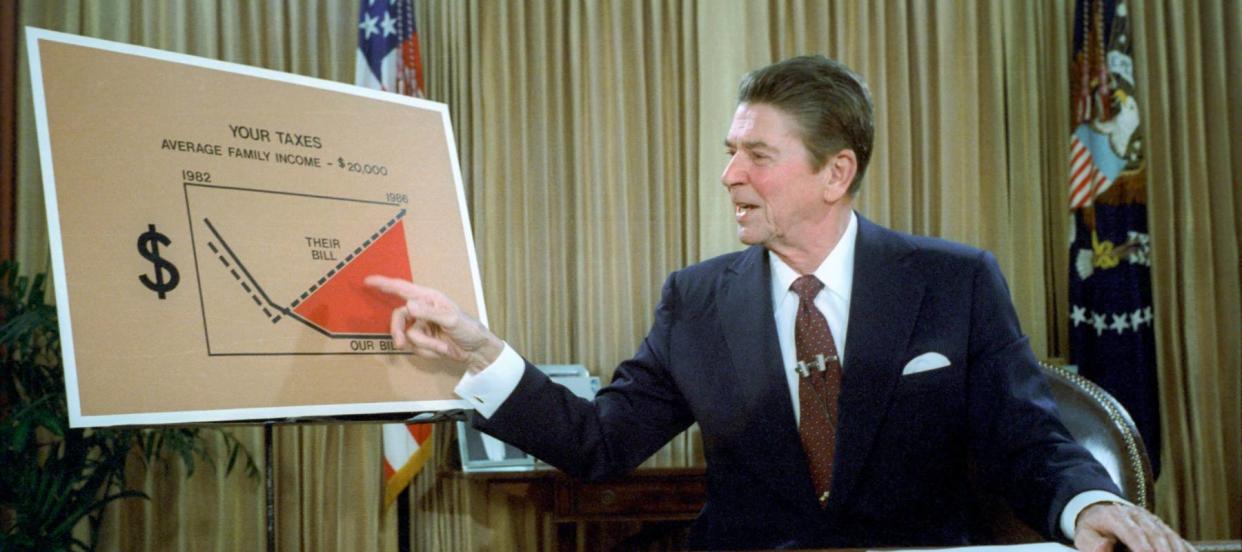

It was a time of big hair, shoulder pads and the Cold War. But something often less thought of when feeling nostalgic about the ’80s was the interest rates that were high enough to make you dizzy.

Though today’s rates still look small in comparison to the 20% of that decade, there’s a lot that can be learned from people who’ve been through sky-high inflation.

Experts have drawn parallels between the high inflation of five decades ago and what’s happening today.

According to the Consumer Price Index, consumer prices have increased by 3.4% from December 2022 to December 2023, and people who remember the ridiculously high interest rates that followed the high inflation of the ’70s say you should buckle down and be prudent, because we’re in for a long haul.

Regardless of the circumstances, being mindful of your money management is essential during these trying times, and boomers are here to directly attest to this.

“Bear down,” Mike Drak tells younger generations going through a similar financial landscape. “Try to work as hard as [you] can and make as much money as [you] can, and be as frugal as [you] can. That's the key. And there's no way around it. You have to be prudent. You have to pull back and you have to watch your pennies.”

Here are some tried and true ways to ride out a recession and maintain your financial wellness.

Don't Miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Only 20% of Americans are confident they'll have a comfortable retirement — use this 1 magic move to get back on track ASAP (It will only take seconds but most people don't do it.)

Take control of your finances in 2024: 5 money moves to start the new year off strong

Pay off your debts

This probably seems like an obvious piece of advice, but it’s important to conquer this often intimidating feat. If you have credit card debt, the compounding interest likely feels insurmountable.

Consolidating your debt will allow you to save money on interest, lower your monthly payments, improve your credit and pay your debt off faster — so you can be ready for a recession without the nagging feeling of unpaid debts following you around.

With Credible* — an online marketplace of vetted lenders — you can shop around for debt consolidation loans to make the task of cutting down your debt manageable.

After answering a few simple questions about yourself and your finances, Credible will provide you with a list of loan rates from top lenders within minutes. You can decide which works best for you and compare loans all in one place.

Read more: This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Stay invested in your future

Even though the future might not look so bright, don’t give up on preparing your finances for it. You’ll want to stick to your savings plan and invest what you have leftover — even if it’s just nickels and dimes.

Acorns* is an investing platform that rounds up your purchases to the nearest dollar and automatically puts that spare change in a smart investment portfolio. Basically, the platform provides you with an easy way to cushion your finances in case of a recession, without having to think too hard about it.

It costs just $3 a month, and signing up takes less than five minutes — all you need to do is provide a bit of information about yourself, link your bank account and spend as you normally would and Acorns will take it from there.

Stop overpaying for insurance

It’s more important than ever to take a closer look at your budget and make sure you’re not spending more than you need to be. Many people overlook their insurance policy as a cost cutting measure, but you can actually save hundreds of dollars a year if you shop around for a better rate.

SmartFinancial* is a platform that scans the web to find you the best home insurance rates in your area. Within minutes of answering a few questions about yourself and home, SmartFinancial will provide you with a list of quotes for high-quality insurance and even check for discounts so you can ensure you’re getting the best price possible and not blowing up your budget.

BestMoney.com also makes it easy to save on your car insurance*. Give BestMoney.com a try and pay less for your peace of mind.

What to read next

Robert Kiyosaki warns: ‘Cash is trash’ — Discover the power of diversifying with gold now

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Millions of Americans are in massive debt in the face of rising rates. Here's how to take a break from debt this month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.