Bank of America sees more upside for stocks despite 'fresh wave of bear narratives'

With fears of another Fed rate hike and a consumer slowdown looming, there's plenty for stock market bears to point to when making the case for equities to decline as 2023 comes to a close.

But Bank of America's head of US equity & quantitative strategy Savita Subramanian has a simple message for investors courtesy of a jazz legend: "Don't worry, be happy," Subramanian wrote in a new note to clients on Wednesday.

Bank of America boosted its year-end target for the S&P 500 to 4,600 from 4,300 in the note. That would reflect about 3% upside from the S&P 500's current levels.

"'Recession averted' says the consensus economist, but a fresh wave of bear narratives around equities have emerged," Subramanian wrote. "The net message of our five target indicators is bullish, yielding a new 2023 year-end target of 4600, up from 4300."

Bank of America Research's economics team no longer sees a recession for the US economy, leading Subramanian to conclude markets are already in the "recovery phase." The equity strategy team believes the profit declines seen in second quarter earnings were the bottom, meaning a potential boost for stocks as corporate profits often drive stock performance.

According to Subramanian's note, BofA's "highest conviction call" remains that the equal-weighted S&P 500, which doesn't adjust the index for the size of companies, will outperform the standard S&P 500 index. The past nine recovery cycles have seen the weighted average index outperform the normal index, per BofA. On top of that, Subramanian's team believes any threats of deglobalization, like China cutting back on its Apple consumption, would weigh more heavily on megacap tech stocks than midcap stocks.

With five companies accounting for 25% of the S&P 500 index, Subramanian notes the S&P 500 is "more top heavy than ever."

This, she argues, means opportunity lies in the other companies that haven't been run up amid the artificial intelligence boom.

"Old economy, inefficient [companies] (more prevalent in the equal weighted S&P 500) could benefit as much as Tech and growth, but have not priced this theme in as richly," Subramanian wrote.

Everyone hating stocks is a good thing

Bank of America's year-end 4,600 call for the S&P 500 is one of the highest among Wall Street strategists tracked by Yahoo Finance. That's a good sign, according to BofA's research.

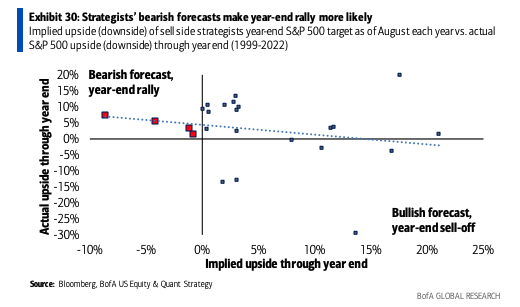

Based on data since 1999, BofA found the average S&P 500 year-end target at the end of August typically projects 5% gains through the end of the year. In the rare years when strategists see the benchmark index declining from its August close, the S&P 500 actually performs better than normal.

When the consensus forecast is for the index to fall during the last four months of the year, the S&P 500 has risen every time and boasts better average returns than when strategists had predicted gains for the S&P 500.

So if this year's consensus forecast for a 2% drop in the S&P 500 through the end of 2023 is any indicator, stocks could have more room to run higher.

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance