Bank of America forecasts S&P 500 to reach record 5,000 in 2024

The stock market has had a stellar run in 2023, and the equity strategy team at Bank of America expects another strong year in 2024 will send the S&P 500 (^GSPC) to a record high of 5,000.

In a note to clients published Tuesday, Savita Subramanian and her team at Bank of America argued the coming year will be a "stock picker's paradise" as markets move past the "maximum macro uncertainty" investors faced this year.

"The market has absorbed significant geopolitical shocks already and the good news is we're talking about the bad news," the firm wrote.

"Macro signals are muddled, but idiosyncratic alpha increased this year. We're bullish not because we expect the Fed to cut, but because of what the Fed has accomplished. Companies have adapted (as they are wont to do) to higher rates and inflation."

The firm's forecasted year-end target for the S&P 500 implies the benchmark index will rise about 10% from current levels. The firm had a year-end price target for 2023 of 4,600 on the S&P 500.

Read more: High-yield savings account vs. investing: Which is right for you?

Despite mounting headwinds such as a weakening consumer and fears the lagging impacts from the Fed's interest rate hikes could be larger than anticipated, Bank of America sees earnings growing 6% in 2024 to $235 per share.

Subramanian's team told Yahoo Finance earlier this month that not only was the recent earnings recession coming to an end but that companies were prepared to excel even if the economy takes a downturn.

"Companies have cut costs and adapted to the weaker demand environment, and saw earnings growing again in 3Q (+3% YoY)," Subramanian wrote. "History suggests earnings typically recover stronger than they fall, as downturns usually remove excess capacity, resulting in leaner cost structure and improved margin profiles."

Still, Subramanian's team writes the best path forward for stocks is for earnings to rise with positive GDP, matching BofA's economists' call for no recession in 2024.

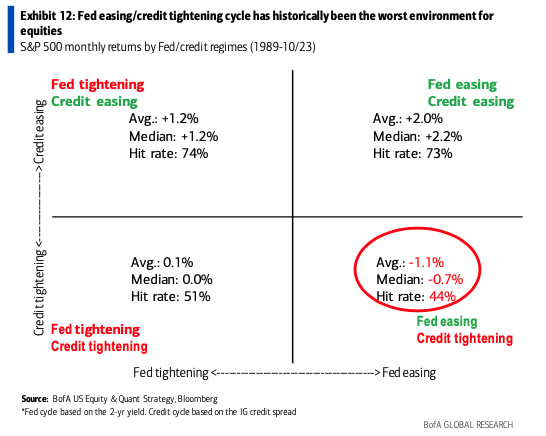

Bank of America's call for stocks to rise as the economy skirts recession is in line with what Goldman Sachs detailed in its own 2024 outlook. Both research teams made clear that the worst-case scenario for stocks would be if the Fed's interest rate-cutting cycle begins as it becomes clear the economy is headed for recession.

"The bulls should hope for an improving economy, resulting in an easing credit cycle, rather than a dovish Fed driven by a weaker economy," Subramanian wrote.

The firm also noted that outside of the recent interest in tech and artificial intelligence trades, there remain plenty of investors who are bearish on equity markets, a contrarian indicator supporting the bull case.

Bank of America also notes that pension fund allocations to stocks are at 25-year lows, active funds are hugging benchmarks, and Wall Street strategists are coming off multiyear lows in their recommended equity exposure.

"Bull markets typically end with high conviction and euphoria," Subramanian wrote. "We are far from that."

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest technology news that will impact the stock market.

Read the latest financial and business news from Yahoo Finance