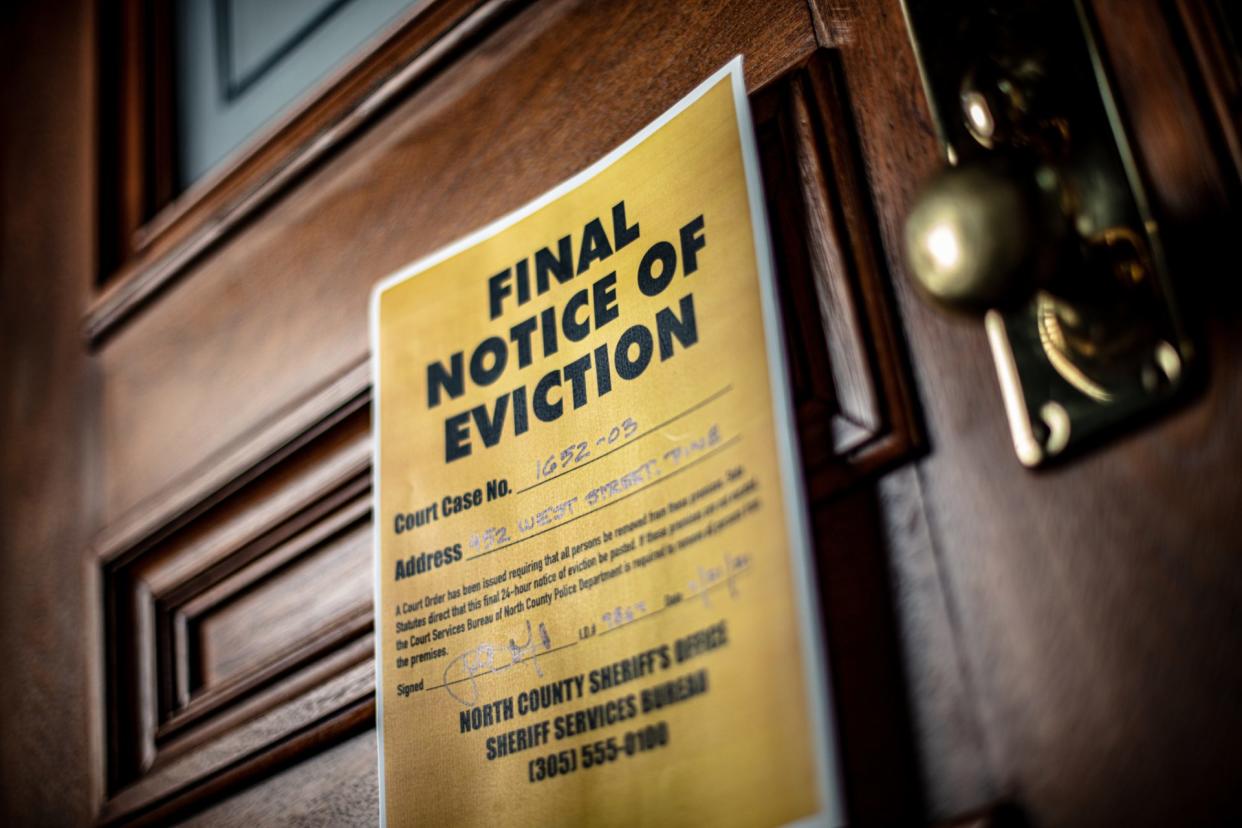

How To Avoid An Eviction If Your State Hasn’t Extended the Moratorium

The federal moratorium on evictions, which the Centers for Disease Control instated in September 2020 to help stop the spread of coronavirus, was blocked by the Supreme Court this August. The court said only Congress — not the CDC — had the right to institute such a policy. That means many families who are behind on rent payments could be looking at eviction before the fall.

See: These States Still Ban Evictions, Even After National Ban Is Struck Down

Find: Could the US Benefit From Another Stimulus Check?

More than 3.5 million people, or 6% of renters across the country, told the U.S. Census Bureau they are “likely” or “very likely” to face eviction with the moratorium lifted. In Southern and Midwestern states like Missouri, North Carolina and Louisiana, the survey showed, that number grew to 20% of renters who feared losing their homes.

If you’re facing eviction due to unpaid rent bills, take heart. There are places to turn for help.

Review State Laws to See What Protections Exist for Tenants

Depending on your state, you may still be protected from eviction for another year or more. For instance, the NYS COVID-19 Emergency Eviction and Foreclosure Prevention Act has been extended to protect renters in New York through January 15, 2022. You must submit a Hardship Declaration form to your landlord, a representative of your landlord (such as a property manager), or to the local Housing Court to qualify for the extension.

Apply for Federal Rent Assistance

If you don’t live in a state where the eviction moratorium has been extended, you may qualify for emergency rental assistance at the local, state, regional or federal level. The federal ERA program may also provide help with internet costs, electricity and other utilities. By having these costs covered through emergency assistance, you may be able to pay your rent.

Assistance might also cover rent payments and late fees. In some cases, if you are forced to move, you may be able to get help with security deposits, screening and application fees, according to ConsumerFinance.org.

Consider Alternate Options to Generate Income for Rent

With a tight labor market and many companies looking for help, you may be able to earn some extra cash to make ends meet. Consider picking up part-time gig work with a food delivery service, pet-sitting service or personal shopping service. You can also look into options with a flexible schedule you can do from home, such as working as a virtual assistant or transcriptionist. Many remote jobs have flexible hours so you can fit them in with your full-time job.

“It’s easier than ever in 2021 to make money on various apps, plus we are in a tight labor market,” Gary Grewal, certified financial planner and contributor at FinancialFives.com points out.

Negotiate with Your Landlord

Landlords don’t want to face the eviction process any more than their tenants do. But the fact is, not every landlord is flush with funds and if you aren’t paying rent, they might not be able to meet their mortgage payments to keep the building you’re living in or pay their utility bills to keep your lights on.

It pays to try to negotiate with your landlord to find an arrangement that can keep you in your home while giving your landlord the income they need, as well. Howard Dvorkin, CPA, advises, “Contact your landlord to discuss a deferred payment plan. This is worth a shot as most landlords do not want to pay a fee to file a lawsuit, go to court — especially with COVID still spreading — and go through the expense and hassle of finding a new tenant.”

See: A Staggering 75% of Unemployed Parents Are Struggling To Find the Right Job Opportunities

Find: Surging Meat Prices Could Cost You Hundreds This Year — Can You Afford It?

However, if your landlord decides to pursue the eviction with a court case, make sure you are protected.

“If you end up in court, you need a lawyer. Find one who specializes in evictions. If you’re worried about the cost, just know this: You’re likely to pay more and suffer more without one,” Dvorkin says.

More From GOBankingRates

What Money Topics Do You Want Covered: Ask the Financially Savvy Female

Nominate Your Favorite Small Business To Be Featured on GOBankingRates

This article originally appeared on GOBankingRates.com: How To Avoid An Eviction If Your State Hasn’t Extended the Moratorium