Apple downgraded by UBS as analysts say growth will 'remain under pressure'

Apple (AAPL) stock closed at all-time high on Monday, but not all of Wall Street is buying in as the tech giant approaches a $3 trillion market cap.

In a new note on Tuesday, UBS analyst David Vogt downgraded the stock from Buy to Neutral while raising his price target to $190 from $180. Vogt downgraded Apple "given persistent softness in developed markets and data that indicates growth is likely to remain under pressure."

The call comes as Apple's stock has ticked higher throughout 2023, rising more than 40% year-to-date. Part of UBS' stance centers around Apple's valuation. Apple, and a select few tech stocks, have added billions to their market caps this year while carrying the S&P 500 higher. The tech giant's gains put it at a historically high price, UBS argues.

At current levels Apple trades at 29x near-term earnings per share estimates, which is higher than its average over the last five years. Apple is also trading at a roughly 50% premium to the S&P 500, a 10-year high, per UBS.

"While a premium is justified, expansion is unlikely given growth headwinds," Vogt wrote.

While excitement around a new headset helped drive Apple stock higher in May, the new Vision Pro isn't set to hit the market until 2024. So Wall Street has shifted focus to Apple's most savored product: the iPhone.

After falling from the year prior in the first quarter, Apple's iPhone sales barely returned to positive growth in the most recent quarter, rising just 1.51% compared to the year prior. Analysts are projecting iPhone sales for the current quarter to decline roughly 2%, per Bloomberg consensus.

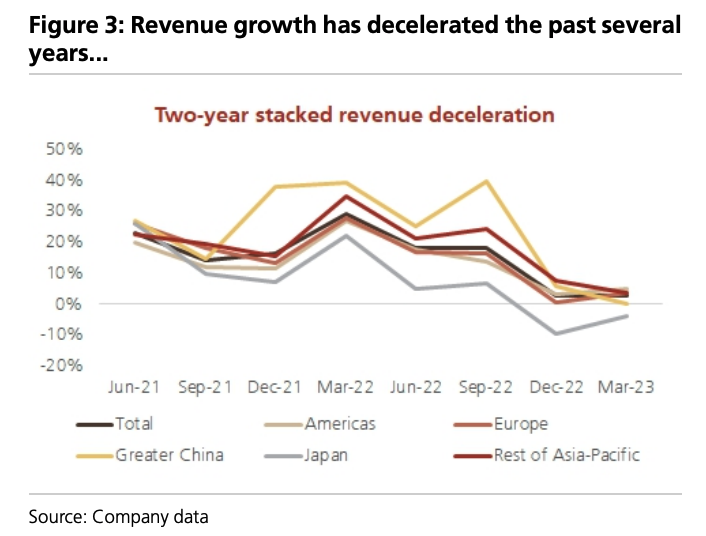

UBS is concerned about long-term growth for Apple's most popular product, too. Vogt points out iPhone sell throughs in the US, China and Europe declined a combined 7.5% year-over-year in the most recent quarter. On top of that, overall revenue growth is declining too, particularly in Greater China and Japan.

But not all analysts are in agreement in what comes next for Apple iPhone sales. Wedbush Securities Dan Ives recently upped his price target from $205 to $220, specifically citing expected demand for the yet to be released iPhone 15.

"We estimate roughly 250 million iPhones have not been upgraded in over 4 years and [that] sets Apple up for a major installed base upgrade cycle heading into this anniversary 15 year release," Ives wrote in a note on June 7. "With more Apple customers heading down the Pro path, especially in China we believe ASPs (average sales price) could start to approach the ~$925 level for the iPhone 15 cycle and would be up roughly $100 in the last 18 months from an ASP perspective for Cupertino as another key tailwind for Cook & Co."

Josh is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance