AMD beats earnings estimates, misses Q4 guidance

AMD (AMD) reported its third quarter earnings Tuesday after the bell, but not all the chips fell its way.

While it beat estimates on the top and bottom line, the company missed on its Q4 guidance. AMD's shares fell about 4% in after-hours trading, but gained back the loss after optimism about its latest data center chips grew. The stock is up 8% on Wednesday.

In Q3, AMD reeled in $5.8 billion in revenue and $0.70 in EPS, but forecasted $6.1 billion in revenue for the next quarter, missing analysts' expectations of $6.4 billion.

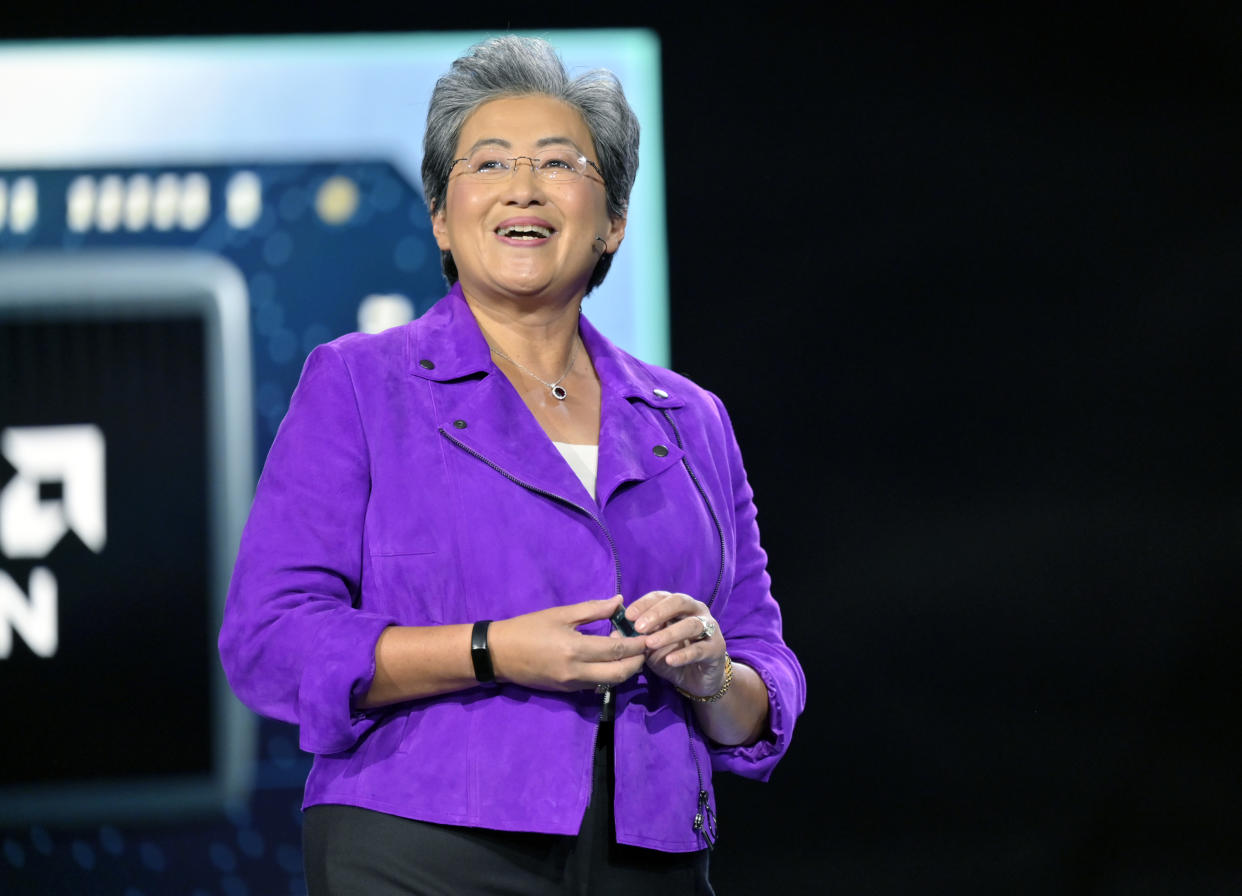

Amid the AI boom, AMD is playing catch-up with Nvidia (NVDA), which currently rules the roost when it comes to AI chips. But the underdog has been making headway — AMD CEO Lisa Su recently made the case that the AI field is more wide open than it might appear right now.

"I'm not a believer in moats when the market is moving as fast as this," Su told the audience at the 2023 Code Conference. "When you think about moats, ... [they are in] markets where people are not really wanting to change things a lot."

Looking ahead, AMD's newest data center chip, the MI300, could be the push it needs to narrow the gap on the competition.

The company is betting that a ramp-up of its MI300 chips will give it a piece of the lucrative data center business, as tech firms race to secure power to train their AI models. "This growth would make MI300 the fastest product to ramp to $1 billion in sales in AMD history," Su said in a call with analysts.

TD Cowen's Matthew Ramsay, writing on Oct. 16, noted that while this might be a "choppy" earnings season for AMD and competitors like Broadcom (AVGO) and Marvell (MRVL), these companies are set up for strong growth by the end of 2024 and into 2025.

"We continue to emphasize that the vast majority of these semis franchises ... are high-quality, high-margin businesses and long-term secular trends remain quite positive," he wrote.

Last Friday, Cathie Wood's Ark Invest bought more than 50,000 shares of AMD, a purchase valued at more than $5 million.

The chipmaker's shares are up about 50% year to date.

The earnings rundown

Here are the key numbers that AMD reported as compared to analysts' expectations compiled by Bloomberg:

Revenue: $5.8 billion actual versus $5.7 billion expected

Adjusted EPS: $0.70 actual versus $0.68 expected

Adjusted operating margin: 22% actual versus 21.6% expected

Q4 revenue outlook: ~$6.1 billion actual versus $6.4 billion expected

Currently, Wall Street analyst recommendations for AMD shake out to 39 Buys, 12 Holds, and one Sell.

AMD's gaming revenue came in at $1.5 billion, down 8% year over year and missing analysts' expectations of $1.53 billion. AMD's gaming chips are used in video game consoles like Sony’s PlayStation 5.

The company's embedded segment revenue for Q3 was $1.2 billion, amid a still-sluggish PC market. The number marks a decline of 5% year over year and falls short of estimates of $1.31 billion.

AMD will keep AI and data centers as its focus in 2024. "We will definitely increase both R&D investment and the go-to-market investment to address those opportunities," Su told analysts. "The way to think about it is that our objective is to drive top-line growth, much faster than OpEx growth, so our investment can drive long-term growth."

Allie Garfinkle is a Senior Tech Reporter at Yahoo Finance. Follow her on X, formerly Twitter, at @agarfinks and on LinkedIn.

Click here for the latest technology news that will impact the stock market.

Read the latest financial and business news from Yahoo Finance