4 retail predictions for 2022

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Monday, December 27, 2021

As yours truly and Julie Hyman bantered about on Yahoo Finance Live last week, the sharp drop in the U.S. savings rate during the holidays was a tell-all on how the crucial shopping season likely panned out.

Being right always makes one feel warm and fuzzy inside, which is where I am emotionally after digesting an impressive batch of holiday retail sales data.

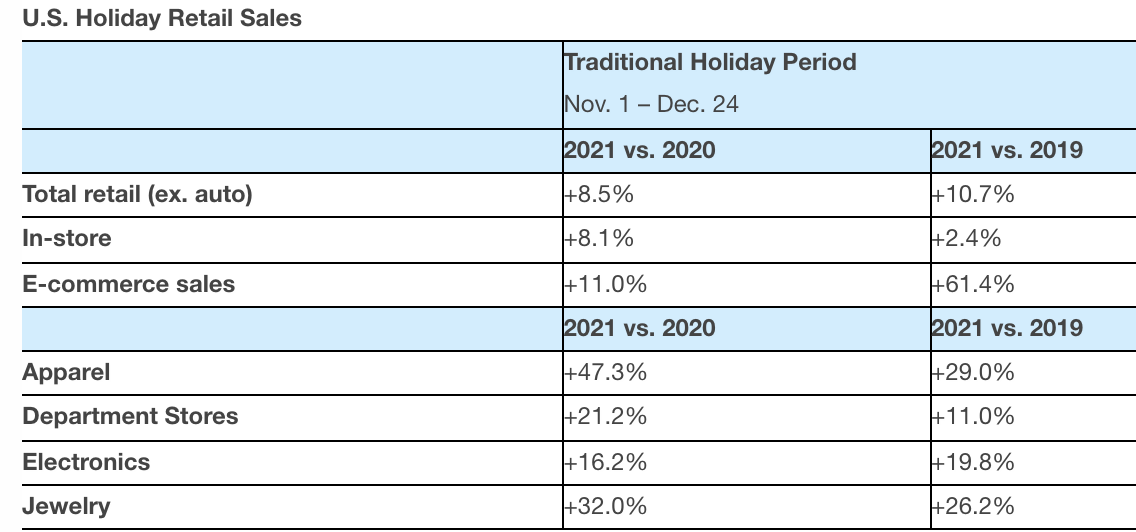

Holiday retail sales excluding autos rose a solid 8.5% year-over-year, according to Mastercard SpendingPulse. Online sales rose 11% from a year ago, on tough peak pandemic comparisons no less. “Consumers splurged throughout the season, with apparel and department stores experiencing strong growth as shoppers sought to put their best dressed foot forward," said Steve Sadove, senior advisor for Mastercard and former CEO of Saks.

Splurge they did, as the the below graph shows.

It's now reasonable to expect a few retailers to issue positive sales and profit pre-announcements within the coming weeks.

The upbeat holiday season data inspired me to cook up a few retail predictions for 2022. On days like this, I wish I was still a stock analyst because I see a few retail stocks that are set up to plunge (and a few that could pop). Alas, those days are long gone for me... so enjoy these four predictions and do with them what you want.

Prediction No. 1: Kohl's gets new management.

I have been surprised at how Kohl's (KSS) management — led by CEO Michelle Gass — has fended off activist investor attacks in 2021. In April, it secured a settlement with activist investors led by Macellum. Now Engine Capital is pushing for big changes. I have read every single memo written by these activists (among other aspects in the reporting process) and they are all 100% on point. Kohl's has generally done terribly these past five years in terms of stock and margin performance versus peers. The stock alone is barely up, compared to a 108% gain for the S&P 500. Kohl's has a track record of over-promising and under-delivering. How is this acceptable for a public company led by nicely compensated executives? How does the Kohl's board not shake things up after seeing the company's name dragged through the mud twice by high-profile activist campaigns in one year? None of this stuff is acceptable, and the winds of change could be blowing through the C-suite at Kohl's next year.

Prediction No. 2: Gap sees activists knock on its doors.

As you can watch here, I was super passionate on the major earnings warning from Gap (GPS) that absolutely hammered the stock. I hate when investors lose money... and I especially hate when that happens because executives make blatant errors. The warning was disturbing, and embarrassing for the well-regarded executive team. But I digress. If Gap has another stinker of a quarter (which would be its important holiday results), it's reasonable to expect activist investors to swoop in and agitate for a breakup of the company. The executives leading Gap went through all the detailed work back in 2020 to spin off Old Navy (the spinoff was scrapped) so the process has been done. In this market, retailers with a singular focus (see nice valuations on recent IPOs Allbirds, ON Holdings and Warby Parker) are being rewarded rather than conglomerates of old (Gap). To see Gap trading on a P/E ratio of 7.9x forward earnings borders on ridiculous given the portfolio of brands it owns. The company's market cap is a mere $6.45 billion.

Predictions Nos. 3 and 4: The spinoffs that will... and won't happen.

Macy's (M) CEO Jeff Gennette tossed fuel on the fire last month when yielding to activist pressure, he said the company was looking at spinning off its e-commerce operations. The stock has generally been on fire ever since. That said, I don't think the spinoff happens and the commentary from Gennette was simply designed to jack up the stock further heading into 2022. Having covered Macy's for a while, there is nothing the company hates more than sweeping change and bowing to external pressure. I think it detests the notion of going into the future of retailing not having full control of its online operations. Look for the company to say early on in 2022 it won't be spinning the business off, noting it's crucial to have in house during a post-pandemic clothing buying cycle.

As for one department store that may execute a spinoff, that would be Nordstrom (JWN). Recent reports have the company looking to spin-off Nordstrom Rack, reports that I believe are on the mark. Unlike Macy's, Nordstrom's executive team has never been afraid to make bold moves to better the company. I think Rack's uneven performance in recent years frustrates Nordstrom, who would benefit from focusing on its core brand. Expect Nordstrom Rack to spin off sometime in 2022.

Have a great day. Happy trading!

Odds and ends

Goldman notes for your trading desk: I must say Jan Hatzius, Goldman Sachs' chief U.S. economist, is on a headline hot streak in December. First, Hatzius slashed his 2022 GDP forecast for next year because President Joe Biden's Build Back Better plan went up in smoke (for the time being). Now, Hatzius is out with two predictions for 2022 that are worth your time. "With labor demand red hot and enhanced unemployment benefits now expired, we expect the unemployment rate to return to the pre-pandemic 50-year low of 3.5% by the end of 2022. Labor force participation is likely to remain below the pre-pandemic trend, though this looks largely voluntary or structural," penned Hatzius in a new note to clients. In the same breath, Hatzius said inflationary pressures aren't going anywhere just yet. "The current inflation surge is likely to get worse before it gets better, but by the end of next year we expect core PCE inflation to fall to 2.5%. Admittedly, the key driver of our forecast — the partial resolution of supply-demand imbalances in the durable goods sector — is hard to time. But we do not see underlying wage growth or inflation expectations as inconsistent with the Fed’s 2% inflation goal, and therefore expect inflation to begin to come down meaningfully."

Dow leaders: It has been a remarkable year for shares of Home Depot, as pointed out by research outfit Bespoke below. What makes the year-to-date stock gains more impressive is that sales growth has slowed at the home improvement chain in 2021 after major pandemic gains in 2020. Profit margin expansion has cooled, too. The message: brisk sales of new and existing homes these past two years has created a pipeline of remodeling projects that may extend well beyond 2022. Meanwhile, Microsoft's 51% year-to-date ascent is only a small reason why the company won Yahoo Finance's coveted Company of the Year award for 2021.

Home Depot $HD and Microsoft $MSFT head into the final trading week of the year in 1st and 2nd place in the Dow for 2021. Both up 50%+. https://t.co/kRGHmprFhNpic.twitter.com/BdOz91v1qT

— Bespoke (@bespokeinvest) December 26, 2021

Can't help but to look at Bezos:Leave it to the Daily Mail to snap a new picture (see below, full story here) of a very buff 57-year-old Amazon founder Jeff Bezos vacationing in St. Barts during Christmas break. Jeff, if you read this newsletter please drop me a line on what protein powder I should be ordering from Amazon because you look amazing. Vin Diesel, take notes.

I mean...wow? H/T @JeffBezoshttps://t.co/sicpkCcNEJ

— Brian Sozzi (@BrianSozzi) December 26, 2021

Other business news: Subpar execs at public companies (and boy are their tons of them) beware, activist investors are entering 2022 with a lot of momentum (again). Barron's Carleton English reports $18.3 billion in capital was deployed across 90 activist campaigns this year, up 16% from a year ago. The headline activist campaign of the year: Engine No. 1's successful campaign against the massively over-compensated and rather underwhelming executives at Exxon. Patrick Temple-West and Kiran Stacey at the Financial Times dive into UK asset manager Legal and General Investment Management demanding disclosure changes at Moderna, in particular around COVID-19 vaccine prices. Keep an eye on this one. Another win for Barron's, with their team highlighting sizable stock purchases at Harley-Davidson. H Partners now owns 8% of Harley's outstanding shares. I can't say I am surprised in light of what Harley CEO Jochen Zeitz recently told me about its spinoff of their electric vehicle operations. Meanwhile, NBC News' Vicky Collins followed the money and ended up in Colorado, where the ski community stands to potentially lose billions of dollars in revenue as a result of global warming. If you are curious on the long-term impact of the pandemic on the economy and society (and you should be... I assume you invest in some form), The New York Times' Erica L. Green takes a look at what's happening right now inside Liberty High School in Bethlehem, Pennsylvania.

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Yahoo Finance Highlights

Boston Starbucks workers 'inspired' by Buffalo union, seek votes as movement spreads

Why Black Americans are leading the NFT, crypto revolution

A chocolate company's key ingredient for warding off supply chain, inflation pressures

—

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn