25 Cities That Are Getting Too Expensive for Retirees

When selecting a retirement destination, year-round sunny weather and beautiful vistas often are priorities for retirees. And cities in states such as Arizona, California and Florida are popular choices for such a lifestyle.

Find Out: 27 Best Strategies To Get the Most Out of Your 401(k)

Learn More: 30 Greatest Threats to Your Retirement

You'll have to be selective about where you live if you want to adhere to a budget, however. Although you can still find cities in these states that can provide an affordable retirement, others are getting too expensive.

To help you avoid making the mistake of moving to a place that will take a much larger bite out of your hard-earned nest egg than necessary, GOBankingRates did the research.

Check Out: The Best Places To Retire If You Can’t Save $1 Million

By looking at factors such as the percentage of the population 65 and older, average home list price, annual cost-of-living expenses and whether there are taxes on Social Security or retirement income, GOBankingRates found 25 locales you might want to avoid if stretching your savings is a priority.

Last updated: July 29, 2021

25. Boca Raton, Florida

Those contemplating Boca Raton, Florida, for retirement won't have to worry about paying taxes on their Social Security benefits or retirement income. What they will have to worry about is how much a home is going to cost. The five-year median list price change for a home in this city is 28.92%.

Whoa: Jaw-Dropping Stats About the State of Retirement in America

24. Sun City, Arizona

Although Sun City, Arizona, ranks low among the cities that are getting too expensive for retirees, that doesn't mean the costs of living here aren't noticeably on the rise.

Median home prices have gone up by 73.85% over the past five years — the most on the list. Still, this city has the highest percentage of seniors 65 and older of the cities or towns studied at 75.8%.

Moving? 50 Best (and Worst) Cities for an Early Retirement

23. Pikesville, Maryland

Residents of Pikesville, Maryland, will pay taxes on their retirement income. At 22.97%, the five-year change in the median list price is the second-lowest in the study.

Check Out: 31 Surprising Facts About Retiring You Probably Didn't Know

22. Fort Lee, New Jersey

The George Washington Bridge takes drivers over the Hudson River from Fort Lee, New Jersey, to New York City. Its proximity to the city makes Fort Lee the third-highest place to live in the study in terms of cost of living at $77,451 and average home list prices at $762,761.

Surprising: The Cost To Retire in America’s Sunniest Cities

21. Tarpon Springs, Florida

Living in Tarpon Springs, Florida, is getting more expensive. Average home list prices have risen 46.19% in the past five years, and the annual cost of living is $50,944.

20. Oro Valley, Arizona

Living in Oro Valley, Arizona, isn't cheap. For example, the total annual cost-of-living expenses are $52,484, and the average home list price in the town is $370,874.

Read: Avoid These States in Retirement If You Want To Keep Your Money

19. Palm Harbor, Florida

Although taxes on retirement income and Social Security benefits aren't a concern for retirees in Palm Harbor, Florida, the rising cost of homes might be. The median home list price change over the past five years equals 48.51%. Plus, the total annual cost-of-living expenditures add up to $52,003.

18. Hilton Head Island, South Carolina

In Hilton Head, South Carolina, 37 out of every 100 residents are 65 or older, good for third-highest on the list. It's one of the priciest places to live, too, with an average home value of just over $575,000.

17. Palm Desert, California

In Palm Desert, California, the total annual cost-of-living expenses are the ninth-highest on the list at $58,689. In addition, retirees must pay taxes on their retirement income.

16. Bella Vista, Arkansas

In Bella Vista, Arkansas, seniors are required to pay taxes on retirement income. In addition, home prices are creeping up. The city has seen a 52.4% median home list price increase over the past five years, but they still are the lowest in the study at $211,668.

15. Lincoln, California

In Lincoln, California, the average home list price is the eighth-highest on the list at $531,387. The total annual cost-of-living expenses are in the top five most expensive at $65,424.

14. Catalina Foothills, Arizona

Near Tucson, Arizona, the Catalina Foothills area has housing prices and a cost of living that both are in the top 10 in the study. The average price of a home is $571,042, with the cost of living registering $62,875 a year.

13. Banning, California

In Banning, California, retirees have to pay taxes on their retirement income but not on their Social Security benefits. The total annual cost-of-living expenses could negate those savings, however. It's in the top half of the study at $53,446.

12. Bullhead City, Arizona

Even though the average home list price in Bullhead City, Arizona, is the third lowest on the list at $242,988, home prices have been increasing. Over the past five years, the median list price of a home has increased 60.02%. In fact, the city has the seventh-highest year-over-year home value change.

11. Dunedin, Florida

Among the cities on the list, Dunedin, Florida, ranks No. 6 for the highest median home list price increase over five years at 65.18%. Still, 32.6% of the population here is 65 and older.

10. Largo, Florida

Largo, Florida, had the fifth-highest median home list price increase in the previous five years at 67.83%. Thankfully, retirees might get a slight break because there are no taxes on retirement income or Social Security benefits here.

9. La Quinta, California

Home prices in La Quinta, California, haven't approached those of nearby Palm Springs yet. The average home value is $537,965 — about $200,000 less than in Palm Springs.

8. Prescott, Arizona

Prescott, Arizona, ranks 12th for total cost-of-living expenditures at $55,659. Plus, the average list price for a home isn't cheap at $449,262.

7. Georgetown, Texas

Texas doesn't tax retirement or Social Security earnings, giving residents of Georgetown a financial leg up. Home values went up 30.45% in the past year, which is the highest in the study.

6. Apache Junction, Arizona

Apache Junction, Arizona, ranks second for the median home list price increase. Over the past five years, list prices have jumped by 73.64%. Plus, senior residents in this city are subject to taxes on their retirement income.

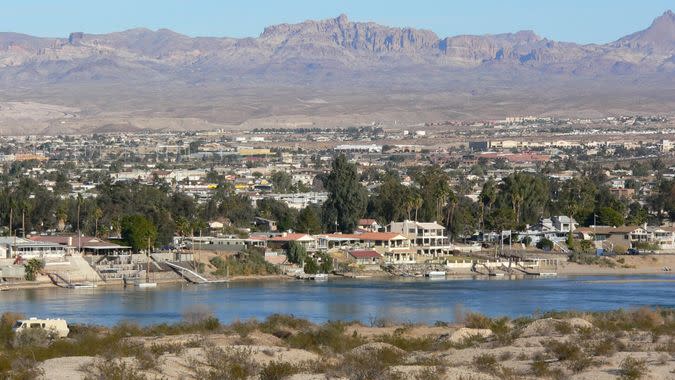

5. Lake Havasu City, Arizona

Seniors 65 and older who are thinking about Lake Havasu City, Arizona, as a retirement destination might want to think again. In the past five years, the median home list price has increased by 72.11% — the third-highest figure on the list. As food for thought, the most current average list price is $345,517.

Watch Out: Hidden Obstacles That Keep People From Retirement

4. Prescott Valley, Arizona

The price to buy a home in Prescott Valley, Arizona, is rising, with the median list price up 68.6% over the past five years. The average home value is now $333,883.

3. Palm Springs, California

The average home list prices in Palm Springs, California, are on the high side at $734,712. Plus, the total annual cost-of-living expenses are the sixth-most expensive on the list at $63,163.

Benefits: Chick-fil-A and 23 More Companies With Surprisingly Great 401(k) Plans

2. Walnut Creek, California

Costs must be high in Walnut Creek, California, for it to take second place on the list. To give you some perspective, total annual cost-of-living expenditures here are the second-highest on the list at $93,855. And the average home list price is $1,104,828 — also good for No. 2.

1. Rancho Palos Verdes, California

Rancho Palos Verdes, California, topped the list of cities that are getting too expensive for retirees — and for good reason. Total annual cost-of-living expenditures are $121,083, which are the highest on the list. Plus, retirement income is taxed, and the average list price for a home also is the highest on the list at a whopping $1,475,635.

More From GOBankingRates

Cynthia Measom contributed to the reporting for this article.

Methodology: GOBankingRates analyzed 50 cities with the greatest population of those 65 and older according to the 2019 American Community Survey conducted by the United States Census Bureau to find the 25 Cities that are Becoming Too Expensive for Retirees. GOBankingRates used the following: (1) percentage of population aged 65 or older as sourced from the 2019 American Community Survey conducted by the United States Census Bureau; (2) May 2020 – May 2021 average home value sourced from Zillow; (3) YoY change (%) in home value as sourced from Zillow; (4) 5-year change (%) in home value as sourced from Zillow; (5) annual total cost of living expenditures for a person aged 65 and older, based on the Bureau of Labor Statistics' 2019-20 Consumer Expenditure Survey and local cost of living indices sourced from Sperling's Best Places; (6) whether there are taxes imposed on Social Security Benefits as sourced from AARP; and (7) whether there is a tax imposed on retirement income as sourced from individual states. All these factors were then scored, with the lower score being best, and combined to give a final score. In the combining of factors, three and four were weighted 1.5 times. All data was collected and is up to date as of July 15, 2021.

This article originally appeared on GOBankingRates.com: 25 Cities That Are Getting Too Expensive for Retirees