Feds in Florida and two other states to lead crackdown on COVID-19 relief fraud

After losing billions of dollars in COVID-19 relief funds due to phony claims, the U.S. government has started deploying investigative teams in South Florida, California and Maryland to zero in on criminal organizations that are suspected of stealing from public programs offering small business loans and unemployment insurance.

The federal strike-force teams were picked in these states not only because they have experienced significant relief fraud during the pandemic, but they also boast the resources to help combat the escalating problem across the country, federal authorities said in an announcement Wednesday.

“In some ways, this is a novel approach dictated by the type of fraud we’re dealing with,” Kevin Chambers, the Justice Department’s associate deputy attorney general, said in an interview with the Miami Herald. “But it’s not uncommon to go to districts where the prosecutors have developed a particular expertise in specific financial crimes.”

In effect, the three teams working with the U.S. Attorney’s Office in South Florida, California and Maryland will have the authority to investigate and prosecute COVID-19 economic relief cases anywhere in the country — without the Justice Department in Washington calling the shots, as it has done with Medicare fraud strike forces deployed in major cities nationwide since 2007.

Chambers, who is the national director of COVID-19 fraud enforcement, said the three regional teams will focus on international organizations that are suspected of stealing people’s identities in the United States and filing false claims for relief benefits that were adopted under the nearly $650 billion CARES Act by Congress after the coronavirus struck in 2020. The teams will also focus on domestic criminal gangs suspected of exploiting the same federal and state benefits.

Most of the COVID-19 relief schemes revolved around the Small Business Administration’s Paycheck Protection Program (PPP), which was meant to help businesses decimated by shutdowns caused by the rapid spread of the coronavirus.

The program allowed for the loans to be forgiven, if borrowers followed criteria laid out by the SBA to use the funds for payroll and other overhead. Determined to inject money quickly in the faltering economy, the U.S. government waived many traditional requirements that lenders normally check before issuing business loans.

Asked why the Justice Department is ramping up its crackdown on COVID-19 relief schemes, Chambers said: “We’re taking a breath and saying, we’ve been at this for two years now so let’s amplify our efforts and focus on large-scale fraud.”

Chambers said that the Justice Department has collected vital data, especially from states hit hard by bogus unemployment insurance claims, that will bolster the three regional teams’ investigative efforts.

“We’re going to be able to use analytics today that we haven’t been able to do before,” Chambers said. “The tools we have are far more advanced than 15 to 20 years ago.”

U.S. Attorney Tony Gonzalez, based in Miami, said the Feds have compiled dozens of data sources from around the country that will be used by the regional investigative teams to fight COVID-19 relief rackets.

“It’s like putting together a puzzle and now we have all the pieces on the same table,” Gonzalez told the Herald.

Federal authorities said that while the three investigative teams in South Florida, California and Maryland will target complex criminal rackets, they will also continue to go after individual and small-scale scofflaws.

The number of prosecutions and losses have been staggering over the past two years.

To date, Justice Department officials say prosecutors have brought criminal charges against more than 1,500 defendants nationwide, with relief fund losses exceeding $1.1 billion and seizures surpassing $1.2 billion. Additionally, prosecutors have launched civil probes of more than 1,800 individuals and entities that applied for pandemic relief loans totaling more than $6 billion.

As the nation’s No. 1 fraud capital, South Florida has led the financial crime wave that followed the passage of the CARES Act, according to federal prosecutors.

The U.S. Attorney’s Office in South Florida has charged more than 80 COVID-19 relief cases, mostly involving the PPP program, making it the nation’s leader in such prosecutions. Those schemes account for loan requests totaling more than $230 million, with the applicants receiving tens of millions of dollars in ill-gotten funds. Nationally, one study estimated that up to 15 percent of PPP loans may have been fraudulent.

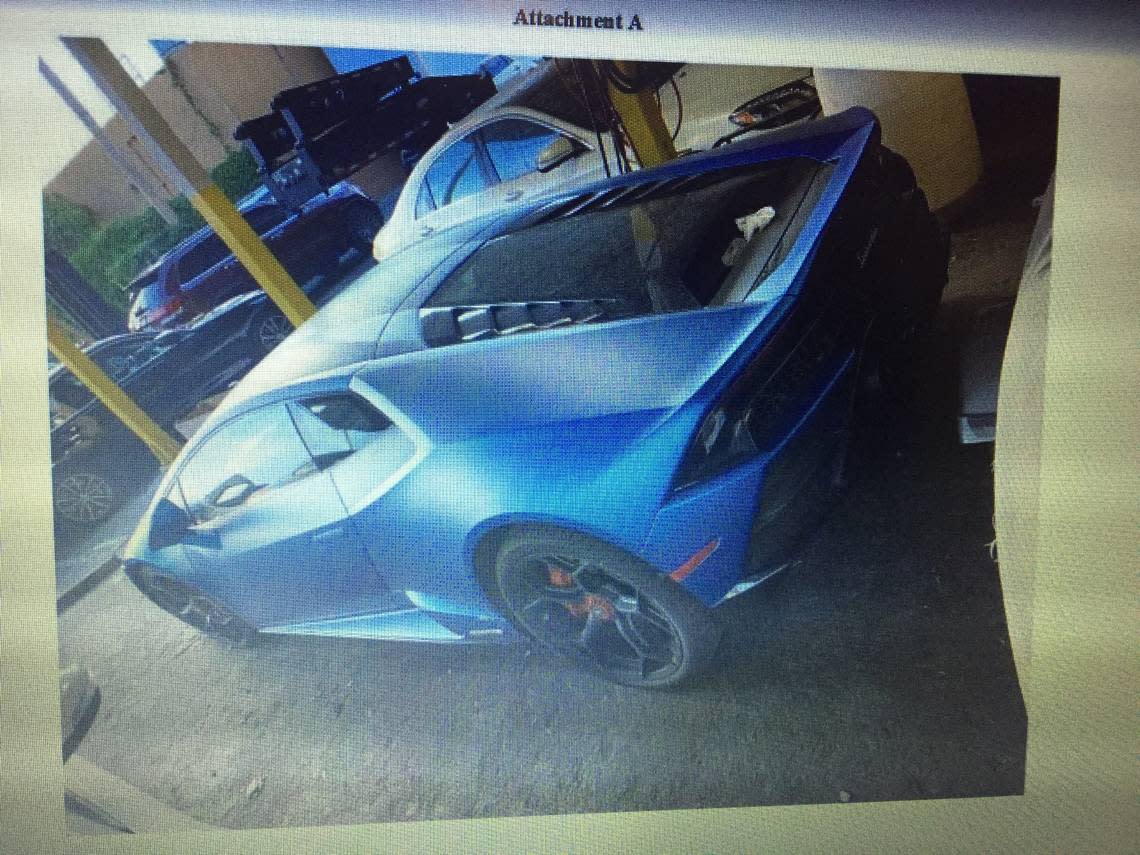

In South Florida, criminal cases have included a businessman using PPP money to buy a $318,000 Lamborghini, a nurse who lied about his business to get $474,000 that was used in part to pay a Mercedes-Benz lease and child support, and a North Miami suburban couple who claimed to be farmers to qualify for $1 million in relief benefits.