After federal regulator scrutiny, Cook Group inks smaller deal with CooperCompanies

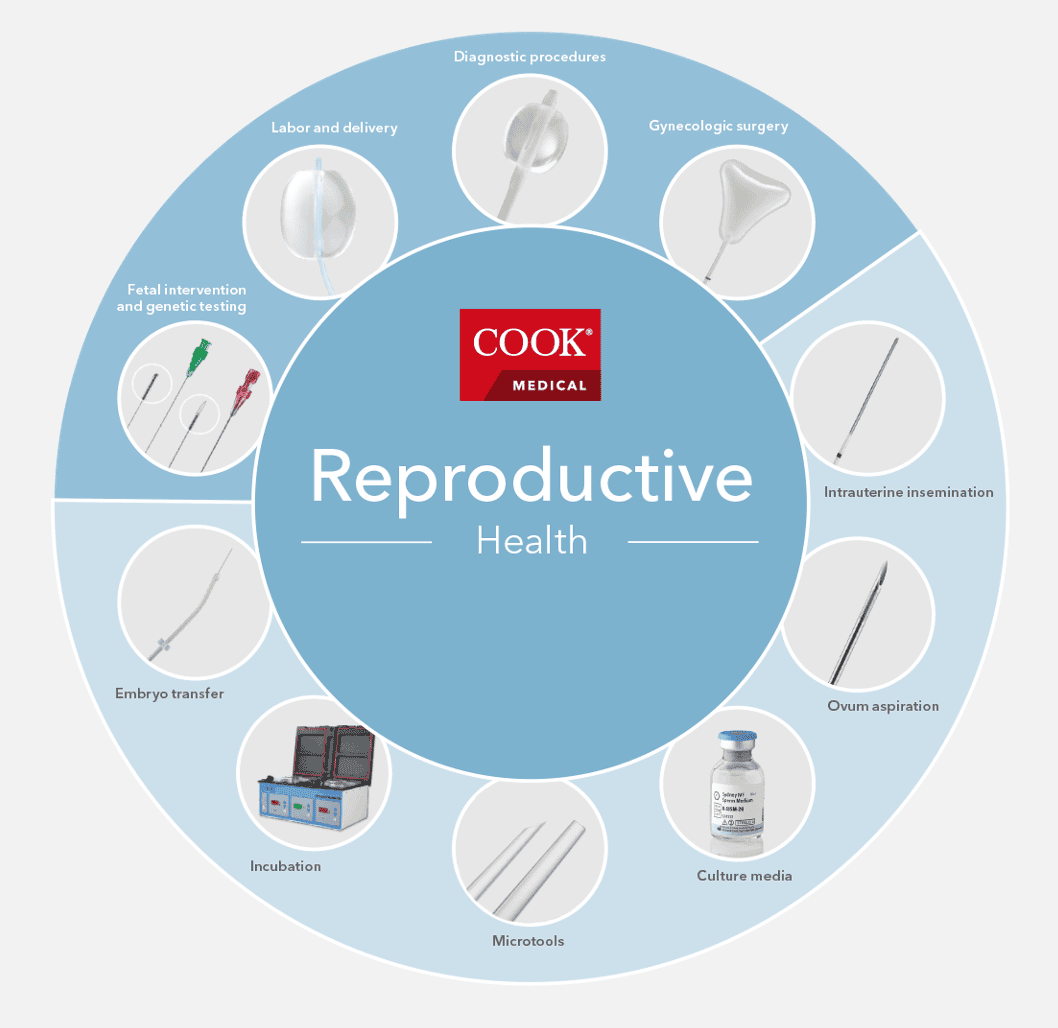

Cook Medical has sold parts of its reproductive health and ear, nose and throat businesses to a California rival in a much smaller deal than the companies originally envisioned.

The companies abandoned an earlier deal after scrutiny from federal antitrust regulators who said the deal would have lowered competition too much.

Terminated: A competitor planned to buy part of Cook Group. Feds investigated. Now the deal is off.

Publicly traded CooperCompanies said last month that it had bought part of Cook’s business for $300 million to strengthen the company’s position “as a leading global fertility and women’s health company.”

Pete Yonkman, president of Cook Medical and Cook Group, which are privately held, said in a news release the sale would allow the Bloomington company “to invest in future growth and new technologies while also allowing the new Cooper product lines to thrive and meet patients’ needs.”

Cook, a medical device maker, said in the release, “No manufacturing jobs are at risk.”

“Our vision is to get back to what we were founded on, delivering a continuous stream of innovative new products and services to address unmet customer needs," Yonkman said. "Reaching this vision requires careful planning, a lot of hard work, and deliberate choices including a full review of our product portfolio to ensure strategic fit for the future,”

On the day that Cooper announced the acquisition, the company’s shares jumped $5.17, or 1.7%, closing at $316.92. Shares on Nov. 30 were trading near $335.

Cook said the product lines it sold represent about 2.5% of the company’s annual sales, which last year were about $2.2 billion.

The two companies had been working on a much larger deal, valued at $875 million, but abandoned it after scrutiny from the Federal Trade Commission, one of the federal agencies that intervenes when regulators believe a proposed merger or acquisition would reduce competition too much and harm consumers.

CooperCompanies had announced early last year that it planned to buy Cook’s reproductive health business to improve CooperCompanies’ international reach, especially in the Asia-Pacific region.

The FTC said this summer the parties had terminated their agreement.

At the time, Holly Vedova, director of the FTC Bureau of Competition, said in a news release, “Following a full-phase investigation by FTC staff, CooperCompanies’ decision to abandon this proposed acquisition ensures that critical reproductive health markets remain competitive.”

The companies’ new deal includes some of the same products — such as the Bakri Postpartum Balloon and Cook’s Cervical Ripening Balloon — and a similar payment structure, with an initial partial cash payment followed by $50 million installments.

Cook said it will continue to make the products for at least two years, during which it would transfer manufacturing to CooperSurgical.

Boris Ladwig can be reached at bladwig@heraldt.com.

This article originally appeared on The Herald-Times: Cook Medical sells reproductive health business to California rival