What if the Fed hadn't made a 'mistake'? A hypothetical to consider.

A version of this post was originally published on TKer.co

Stocks rallied last week, with the S&P 500 rising 3.5%. The index is now up 7% year to date, up 14.9% from its October 12 closing low of 3,577.03, and down 14.3% from its January 3, 2022 closing high of 4,796.56.

Much of the market volatility over the past year can be explained by the Federal Reserve’s ongoing fight to bring down inflation with increasingly tight monetary policy.

I’m not one to dwell on the past, but it’s become pretty commonplace for people to blast the Fed for getting monetary policy wrong from the perspective of inflation. Specifically, many point out that inflation has been stubbornly high because the central bank made a “mistake” by being too slow to remove stimulative monetary policy.

These critics aren’t necessarily wrong. But assuming the Fed did hit the brakes on the economy when inflation started heating up in 2021, where would we be today?

If such a move worked and inflation eased quickly, then it’s also unlikely the economy would be as strong as it is today. After all, tightening monetary policy is about cooling demand — and that means the labor market probably wouldn’t be as robust as it is today.

Would everyone be OK with that?

Remember, the number of people who’ve gotten jobs during this period of high inflation is massive. And the money earned by these newly employed people is helping to keep inflation high as they bring more demand into the economy.

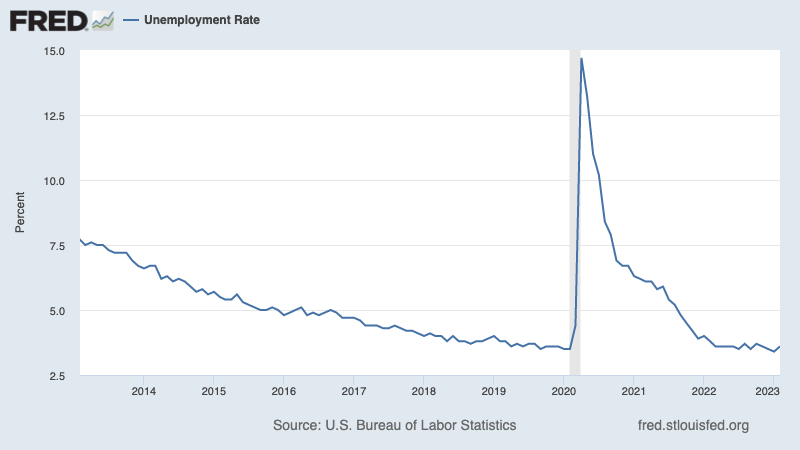

As of February of this year, total payroll employment was at a record 155 million. This metric didn’t return to its pre-pandemic level of 152 billion until June of 2022.

Meanwhile, inflation became particularly alarming back in June 2021, when the consumer price index surged above 5% for the first time since 2008. At that time, total payroll employment was much lower at 147 million.

Similarly, as of February, the unemployment rate was a very low 3.6%. It didn’t initially fall back to the pre-pandemic level of 3.5% until July 2022. In June 2021 when inflation was setting off alarms, it was elevated at 5.9%.

To be clear: This is a discussion about counterfactuals, which means there’s no way to know exactly how things would’ve unfolded under alternative scenarios.

But it’s not unreasonable to imagine a world where inflation was closer to the Fed’s target 2% rate today because the central bank acted quickly to rein in demand. This is what the Fed’s critics would argue could’ve happened.

However, it’s very hard to imagine achieving this without lower employment. Perhaps payroll employment would be above 147 million and the unemployment rate would be below 5.9%. But it’s hard to see the figures being very close to the 155 million and 3.6% levels we enjoy today.

So what’s worse: High inflation or high unemployment? 🤔

This is the type of trade-off that’s worthy of philosophical inquiry: Is it better to have moderate inflation with 147 million people employed as 8 million struggle with joblessness? Or is it better to have 155 million employed people share in the struggle with high inflation?

I don’t know how to answer these questions. (Though I’m eager to read your thoughts in the comments section!)

One of the reasons why I raise these questions now is because I was struck by Sen. Elizabeth Warren’s comments on March 7 to Fed Chair Jerome Powell during his appearance before the Senate Banking Committee.

Warren pointed out that the Fed’s own projections at the time assumed the unemployment rate would climb to 4.6% by the end of the year, which she said could mean two million people would have to lose their jobs. It was a jarring yet fair observation.

But again, I can’t help but think of how this scenario would compare to alternative scenarios. Would it have been better if employment levels just never got as strong as they are today? Two million jobs were created over the past six months alone. Is it better to have never hired those two million people? Or is it better to hire two million people and then layoff two million over a matter of months?

To be clear, the economy isn’t so simple such that we should only consider the binary outcomes offered above.

All I’m suggesting is that if you want to argue that the Fed was wrong in how it implemented monetary policy, then you are also implying that it was a mistake to foster an environment that led to the creation of millions of jobs over the past two years.

All that said, all eyes are once again on the monthly jobs report, which will be released on Friday at 8:30 a.m. ET.

Related from TKer:

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

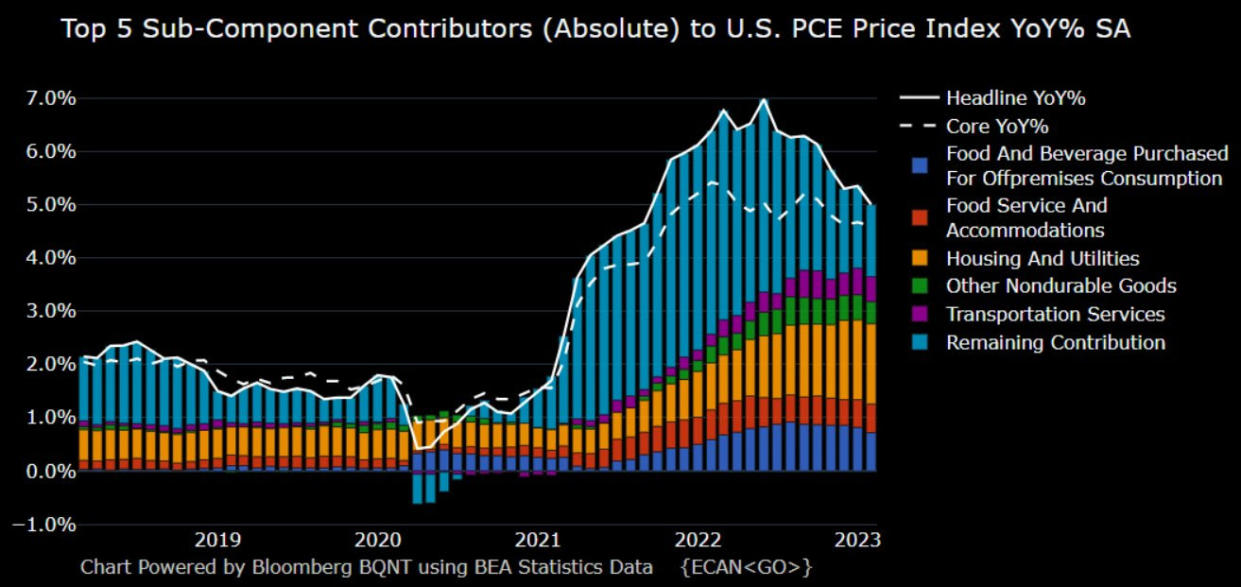

🎈 Inflation cools

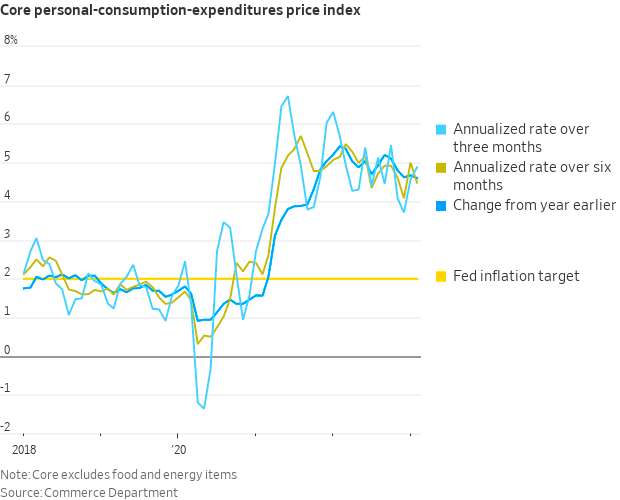

The personal consumption expenditures (PCE) price index in February was up 5.0% from a year ago, down from the 5.3% increase in January. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 4.6% during the month after coming in at 4.7% higher in the prior month.

On a month-over-month basis, core PCE was up 0.3% in February. This was down from the 0.5% rate in January. If you annualized the three-month trend in the monthly figures, core PCE is rising at a 4.9% rate.

The bottom line is that while inflation rates have been trending lower, they continue to be above the Federal Reserve’s target rate of 2%. For more on the implications of cooling inflation, read:The bullish 'goldilocks' soft landing scenario that everyone wants 😀.

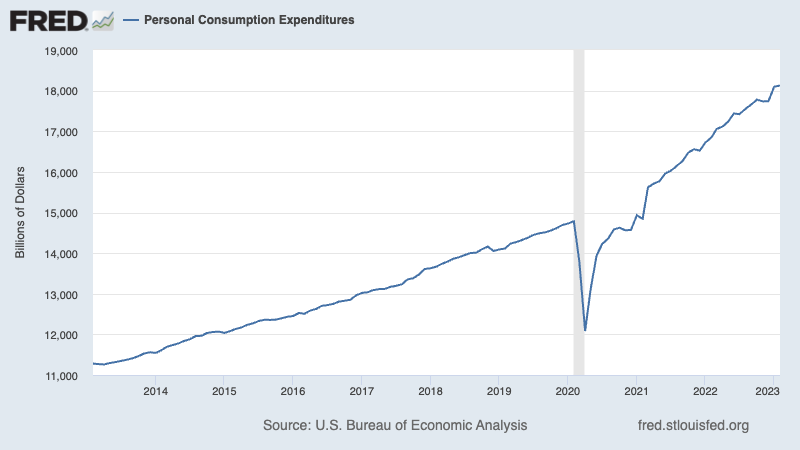

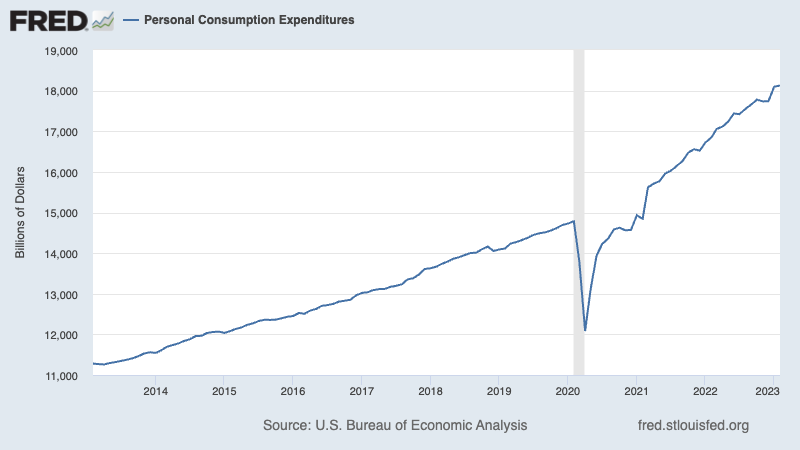

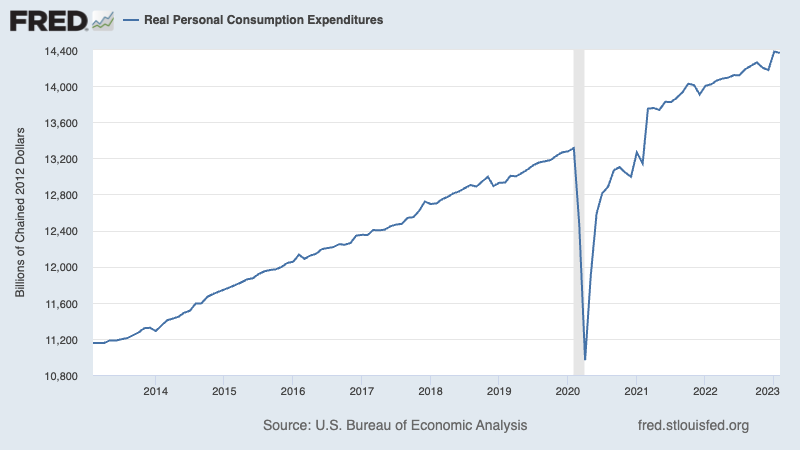

🛍️ Consumer spending is up

Personal consumption expenditures rose 0.2% in February.

Adjusted for inflation, real spending was down 0.1% during the period.

The bottom line: Consumer continue to spend at record levels. For more on consumer strength, read: 9 reasons to be optimistic about the economy and markets 💪.

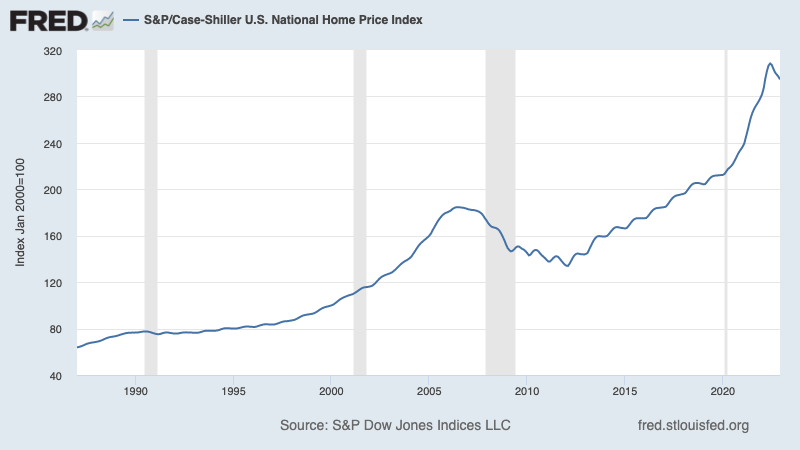

🏠 Home prices cool

According to the S&P CoreLogic Case-Shiller index, home prices fell 0.5% month-over-month in January, the seventh consecutive month of declines. From SPDJI’s Craig Lazzara: “Financial news this month has been dominated by ructions in the commercial banking industry, as some institutions’ risk management functions proved unequal to the rising level of interest rates. Despite this, the Federal Reserve remains focused on its inflation-reduction targets, which suggest that rates may remain elevated in the near-term. Mortgage financing and the prospect of economic weakness are therefore likely to remain a headwind for housing prices for at least the next several months.”

For more on the cooling housing market, read:The U.S. housing market has gone cold 🥶

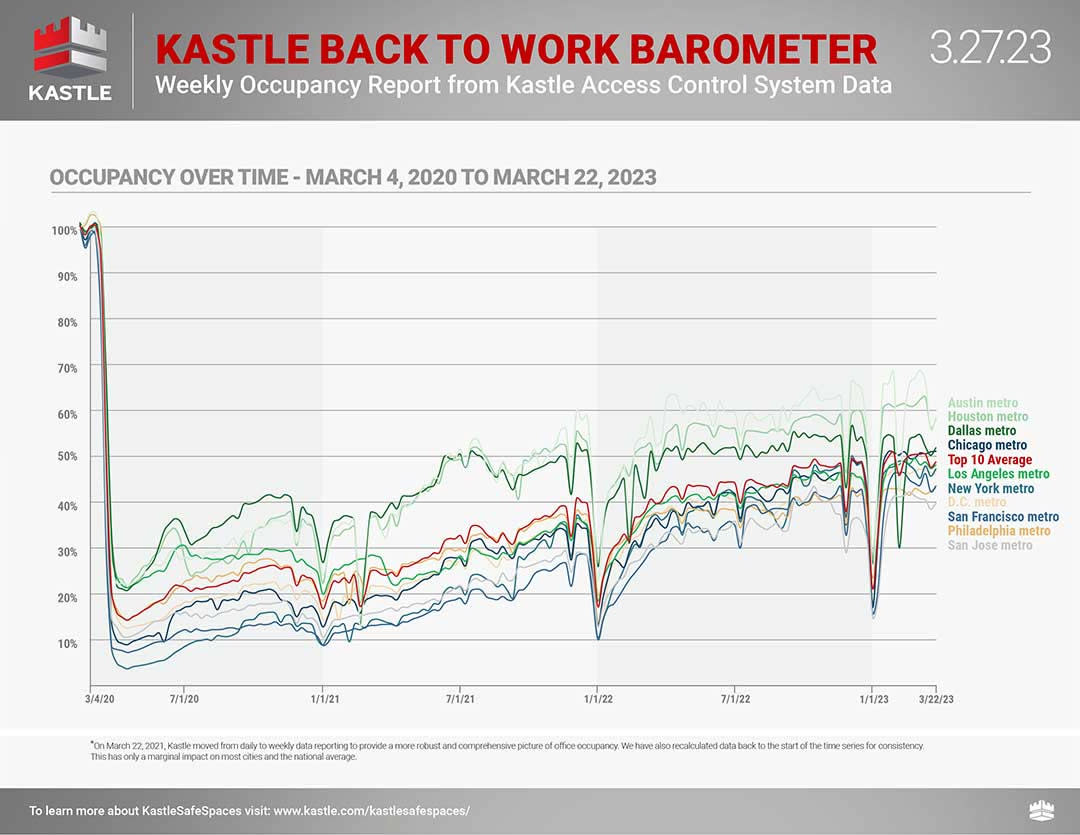

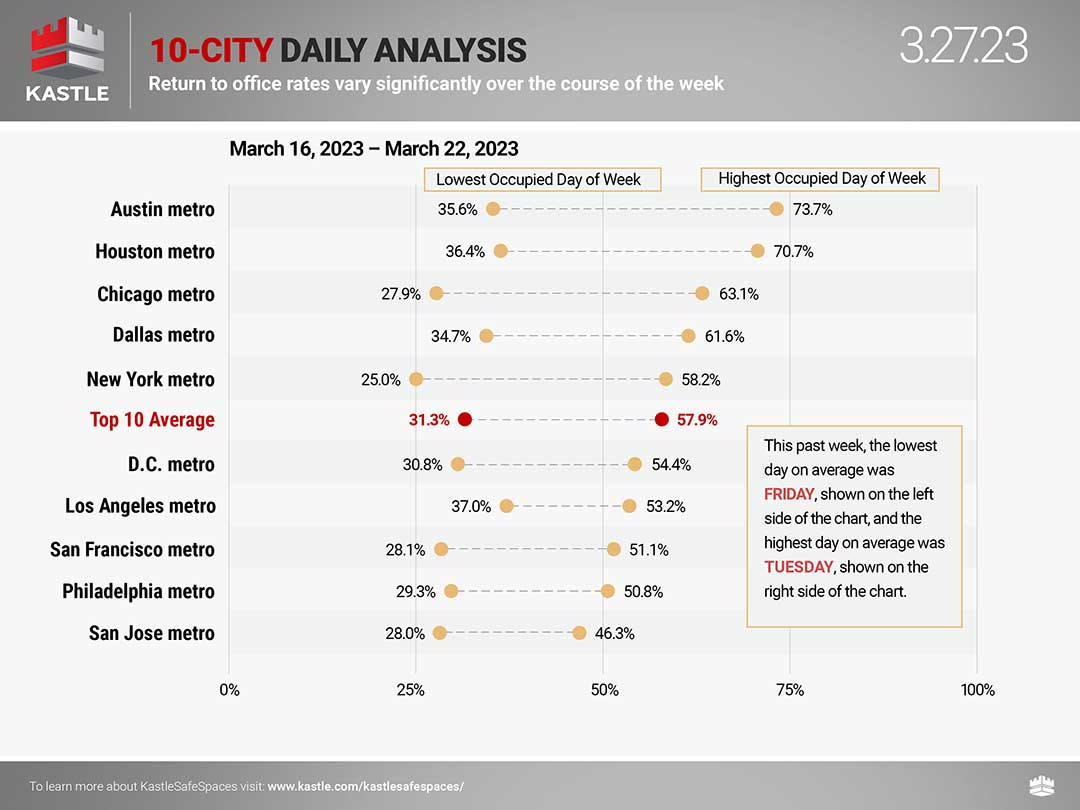

🏢 Offices are half empty

From Kastle Systems: “Office occupancy rose more than a point last week to 48.4%, according to the 10-city Back to Work Barometer.”

Fridays are the emptiest: “The daily high was Tuesday at 57.9% and the low was Friday at 31.3% occupancy.”

For more on empty offices, read: This stat about offices reminds us things are far from normal 🏢

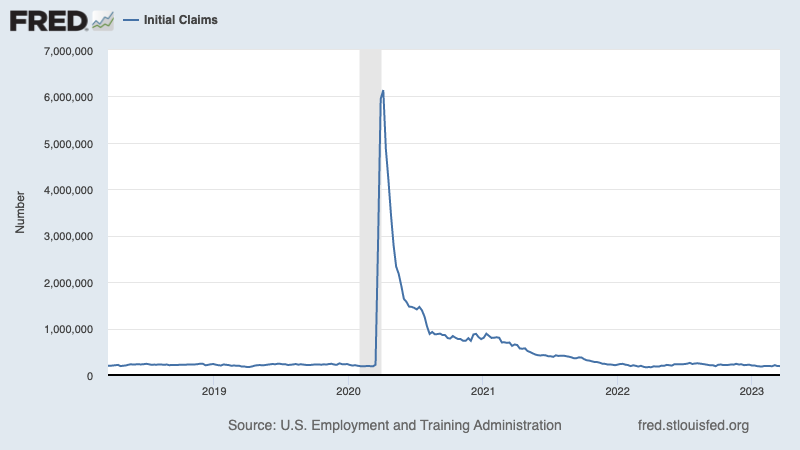

💼 Unemployment claims remain low

Initial claims for unemployment benefits — the most up-to-date of the major labor market stats — climbed to 198,000 during the week ending March 25, up from 191,000 the week prior. While the number is up from its six-decade low of 166,000 in March 2022, it remains near levels seen during periods of economic expansion.

For more on low unemployment, read: The labor market is simultaneously hot 🔥, cooling 🧊, and kinda problematic 😵💫.

👍 Consumer confidence improves

From The Conference Board: “Driven by an uptick in expectations, consumer confidence improved somewhat in March, but remains below the average level seen in 2022 (104.5). The gain reflects an improved outlook for consumers under 55 years of age and for households earning $50,000 and over… While consumers feel a bit more confident about what’s ahead, they are slightly less optimistic about the current landscape. he share of consumers saying jobs are ‘plentiful’ fell, while the share of those saying jobs are ‘not so plentiful’ rose. The latest results also reveal that their expectations of inflation over the next 12 months remains elevated—at 6.3%…”

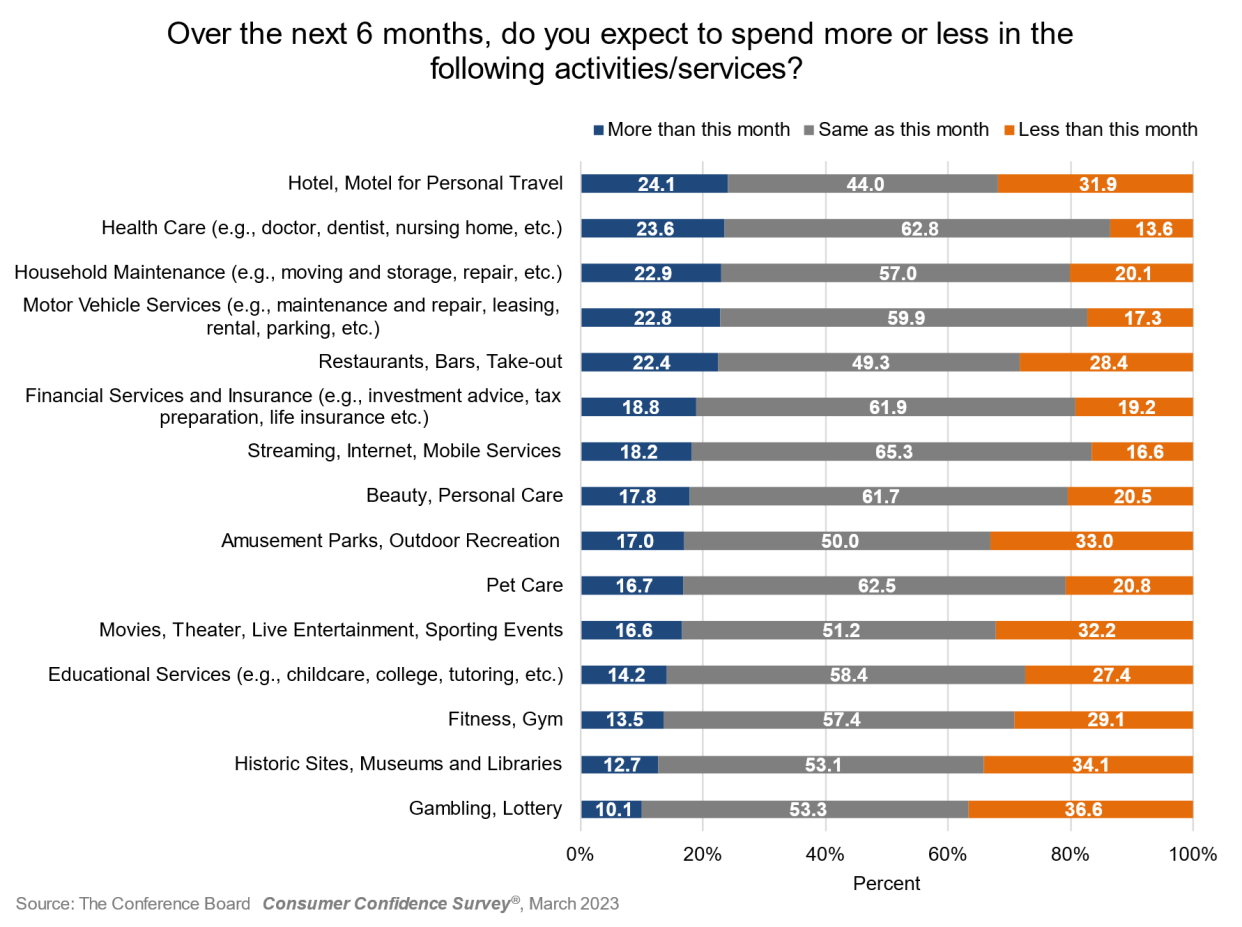

💸 Consumers plan to less on stuff they don’t need

From The Conference Board: “…consumers plan to spend less on highly discretionary categories such as playing the lottery, visiting amusement parks, going to the movies, personal lodging, and dining. However, they say they will spend more on less discretionary categories such as health care, home or auto maintenance and repair, and economical entertainment options such as streaming. Spending on personal care, pet care, and financial services such as tax preparation is also likely to be maintained.”

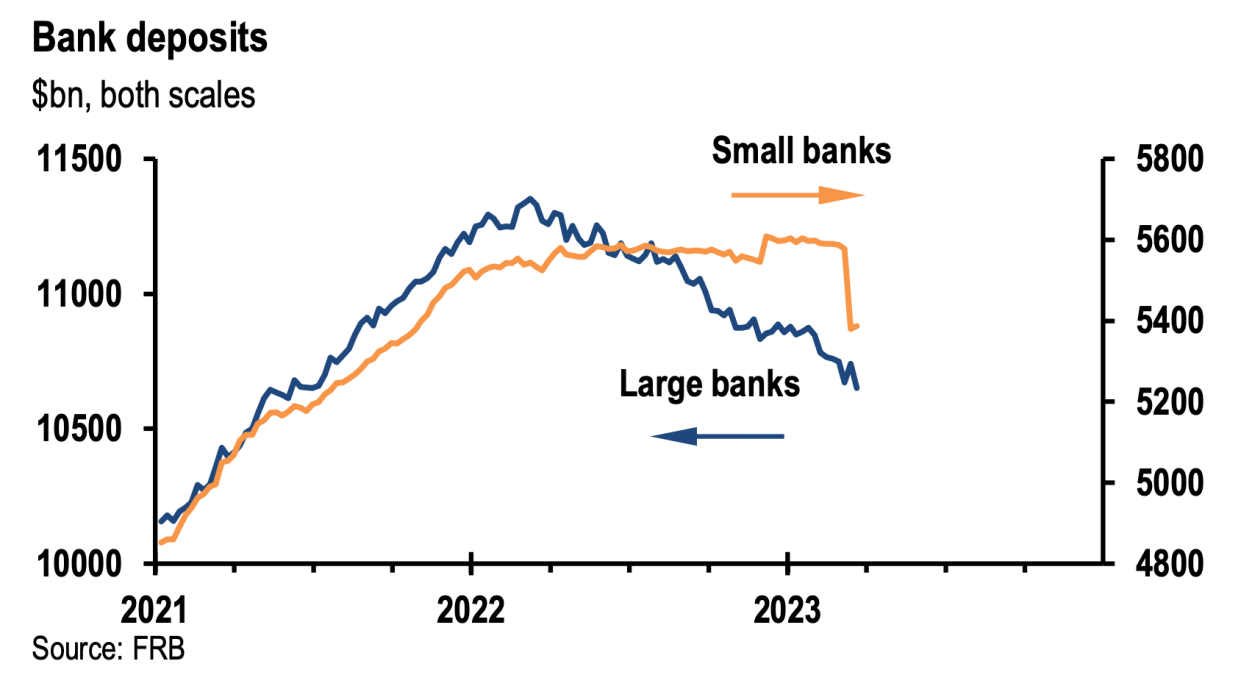

💸 Small bank deposit outflows stabilize

Here’s JPMorgan on the Fed’s recent H.8 report: “Deposits at small banks (all those except the 25 largest) edged up $6 billion in the week ending March 22. This is a huge improvement over the $196 billion deposit flight in the prior week. Large banks (which includes a bank assisted by an industry consortium) saw deposits decline $90 billion in the latest week, more than reversing the $67 billion of deposit inflows the prior week.”

For more on what’s going on at the banks, read:As if the economic outlook weren't already hard to predict... 🤦🏻♂️; Same destination, but now a more treacherous path 🚧; andA few thoughts on the Silicon Valley Bank failure... 🏦

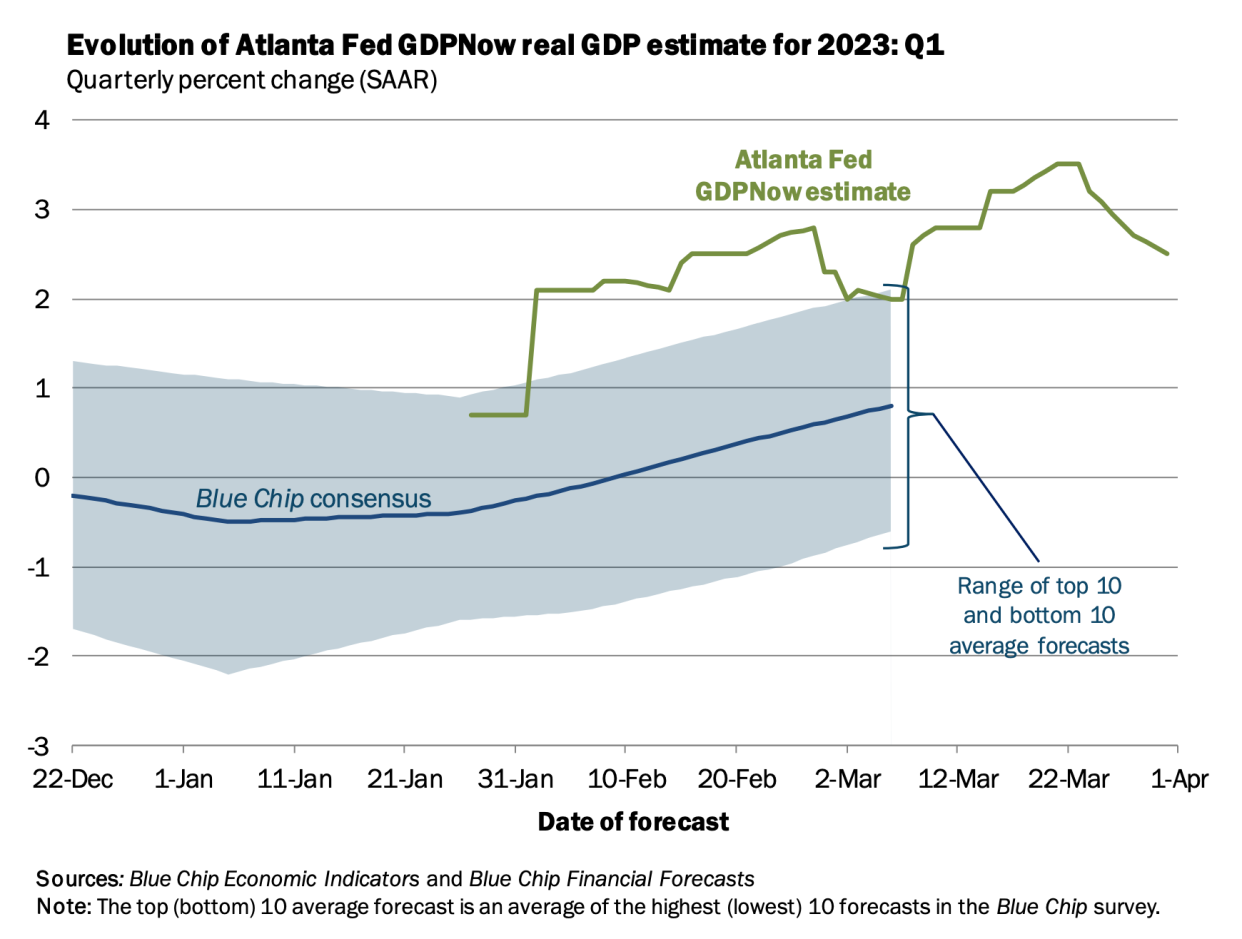

📈 Near-term GDP growth estimates remain rosy

The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.5% rate in Q1. While the model’s estimate is off its high, it’s nevertheless up considerably from its initial estimate of 0.7% growth as of January 27.

Putting it all together 🤔

Despite recent banking tumult, we continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.” And on March 22, the Fed signaled that the end of interest rate hikes is near.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tighter financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations).

All of this means the market beatings may continue for the time being, and the risk the economy sinks into a recession will be relatively elevated.

However, it’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

A version of this post was originally published on TKer.co

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance