The Fed’s decision on rates isn’t getting any easier

Investors are increasingly concerned hot economic data and mixed commentary from some Federal Reserve officials could cause the central bank to scale back the number of interest rate cuts this year.

One or two rate cuts in 2024 now seem to be more possible to traders than the median of three estimated by Fed officials at their last meeting in March. And traders have been reducing their odds of a first cut in June, which now stand at roughly 58%.

The concerns come as a strong labor report Friday showed the US economy generated more jobs than expected in March while the unemployment rate ticked lower and wage growth remained steady, putting the labor market on firmer footing than many economists had predicted.

Just hours later, Dallas Fed president Lorie Logan poured more cold water on near-term hopes for an easing of monetary policy.

"I believe it’s much too soon to think about cutting interest rates," she said in a speech Friday. "I will need to see more of the uncertainty resolved about which economic path we’re on."

Fed Governor Michelle Bowman also voiced concerns Friday, even saying the Fed may need to raise rates at a future meeting if progress on inflation stalls or reverses. Her baseline outlook, however, is that the Fed will still lower rates this year.

The Fed has "got a tough few months ahead of them in terms of feeling confident about beginning interest rate cuts," Conference Board chief economist Dana Peterson said on Yahoo Finance Live.

Some Fed officials did offer new assurances this week that the outlook had not changed, including Jay Powell.

The Fed chair repeated his assertion in a speech Wednesday that central bank officials expect to lower rates at "some point" this year.

For the second time in one week, he also emphasized that the economic picture was largely the same despite some hotter-than-expected inflation readings at the start of the year.

Additional certainty came from comments made by Cleveland Fed president Loretta Mester and San Francisco Fed president Mary Daly, who stuck with a prediction for three cuts in 2024 — echoing another recent estimate from Chicago Fed president Austan Goolsbee.

But not all Fed officials spoke from that same script.

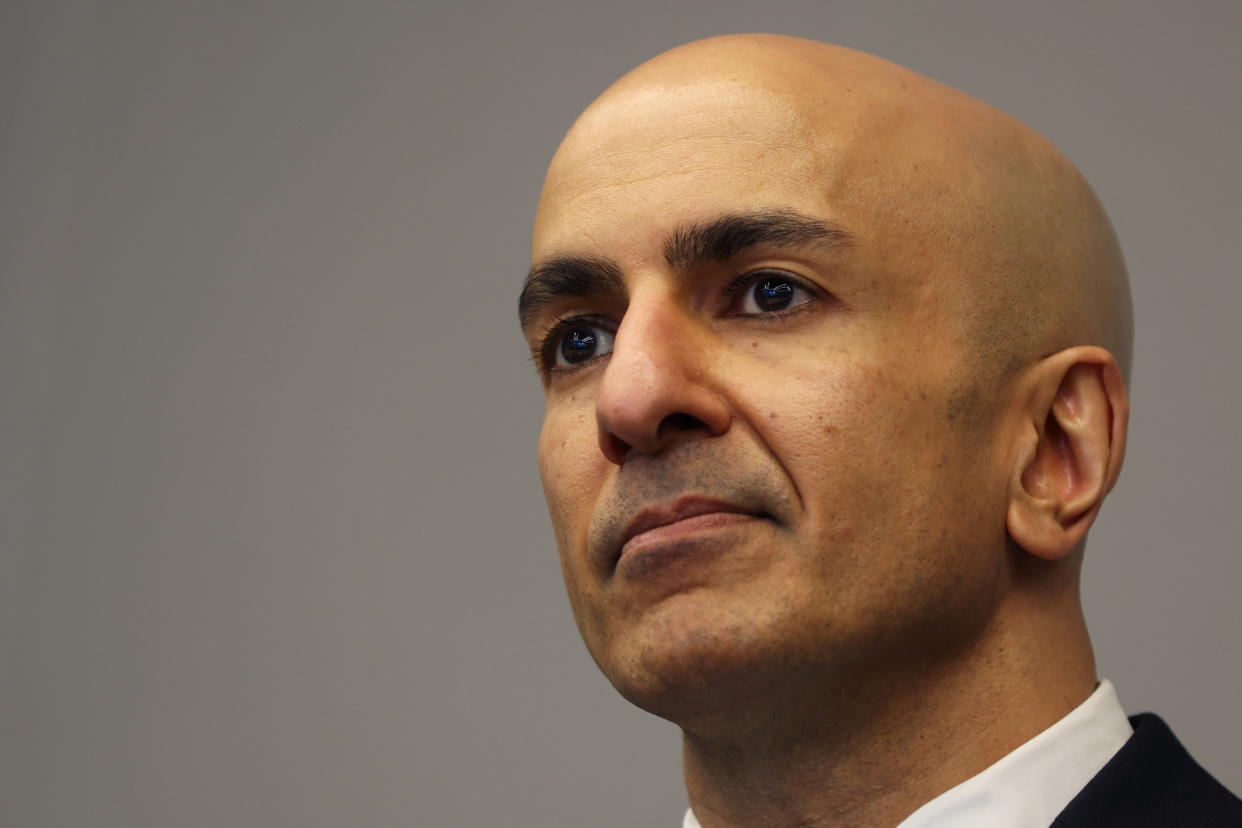

Atlanta Fed president Raphael Bostic predicted just one cut in the fourth quarter and Minneapolis Fed president Neel Kashkari suggested that the Fed may not even cut rates "if we continue to see inflation moving sideways."

Logan, the Dallas Fed president, offered more reasons for investor uncertainty Friday by saying she sees "meaningful risks to continued progress" on inflation after some hotter-than-expected reports in January and February and is "increasingly concerned about upside risk to the inflation outlook."

The key risk, she said, is that "inflation will stall out and fail to follow the forecast path all the way back to 2% in a timely way."

Bowman, the Fed governor, pointed to upside risks to housing services inflation, given low inventory of housing as well as the prospect that a strong job market could lead to higher demand for services.

"Should the incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive," Bowman said in a speech in New York.

"However, we are still not yet at the point where it is appropriate to lower the policy rate, and I continue to see a number of upside risks to inflation."

Bowman also said she believes there may be structural changes in the economy, like higher investment demand, that could lead to the need for higher rates. That could mean fewer rate cuts would be needed to get the policy rate to neutral — the interest rate that officials believe neither boosts nor slows growth.

The variance in commentary among Fed officials reflects the "split" in their estimates of 2024 rate cuts penciled in during a March meeting, State Street senior global macro strategist Marvin Loh said on Yahoo Finance Live.

Nine officials at that March meeting saw three rate cuts this year, while five officials believed two cuts would be needed. Two officials predicted one cut and two officials estimated no cuts.

"Everyone is going to be in a camp where they are going to be able to point to something that continues to make them believe that," Loh said.

But Loh noted the prospect of zero cuts "isn't a widespread view" at the Fed, calling Kashkari "a little bit of an outlier."

As for pushing off a first cut beyond June, Loh said "I don’t think they are there yet."

There is no doubt, however, that most Fed officials are urging caution as they continue to assess the data.

Richmond Fed president Thomas Barkin said Thursday it’s "smart" for the central bank to move slowly and look for more certainty about the path of inflation.

"No one wants inflation to reemerge," Barkin said in a speech to the Home Building Association of Richmond.

"Given a strong labor market, we have time for the clouds to clear before beginning the process of toggling rates down."

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance