‘Your family is hungry!': This Ohio man with triplets and a sick wife overdraws his bank account on a 'weekly basis' — Dave Ramsey bluntly told him to feed the kids before paying MasterCard

About one-third of American households earning less than $65,000 a year were charged an overdraft or a non-sufficient funds fee in the previous year, according to a recent report by the Consumer Financial Protection Bureau.

Don’t miss

This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Millions of Americans are in massive debt in the face of rising rates. Here's how to take a break from debt this month

Take control of your finances in 2024: 5 money moves to start the new year off strong

Travis, from Toledo, Ohio, is part of that group. On a recent episode of The Ramsey Show, he talked about how his wife’s medical issues had left her unable to work and forced them to support their three kids on a single income. “I’m overdrawn almost on a weekly basis,” he told co-host Jade Warshaw.

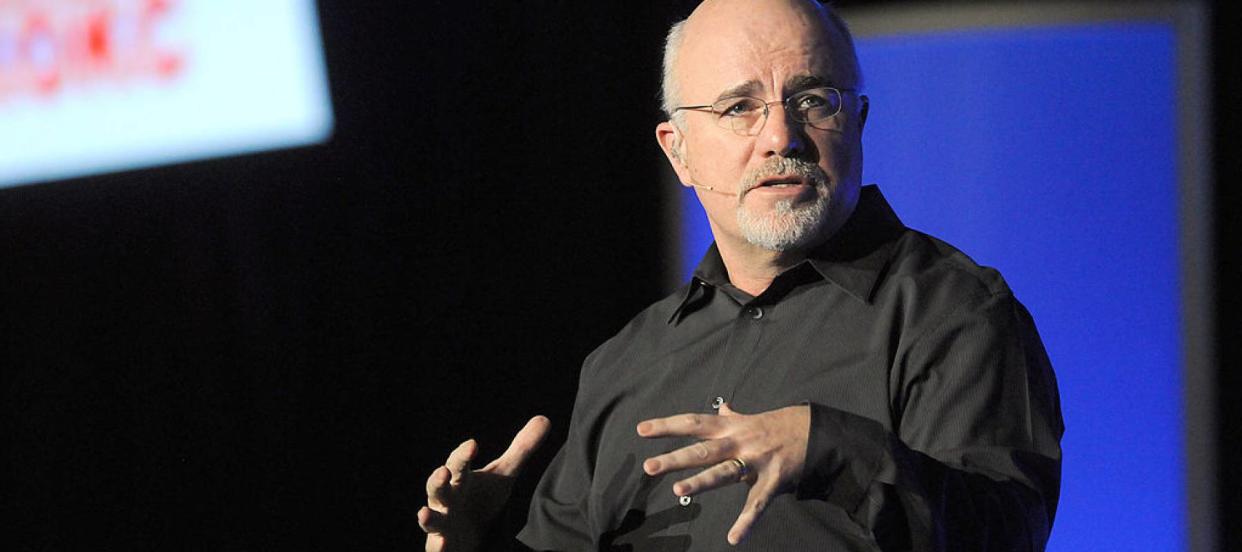

Dave Ramsey recommended tough measures to pull the family back from the brink of financial ruin. “You’re about to do some more work, dude,” he told Travis. “Your family is hungry.”

The survival mentality

Ramsey believes Travis isn’t prioritizing his spending appropriately. His monthly take-home pay is $3,600 a month. Travis has a monthly car payment of $441 and consumer debt of $26,000 besides the car. Monthly interest payments are leaving the family without much extra cash to buy groceries on a regular basis.

The situation is unsustainable. Ramsey recommends prioritizing food and shelter before managing debt. “I want to give you permission to feed your children before you pay MasterCard,” he said.

Food, shelter, transportation and utilities are the “four walls” that must be prioritized, according to Ramsey. “The rest of it is just a stupid game [you’re] behind on,” he said. Credit card companies are at the bottom of the list of priorities, and Ramsey believes they can’t do much if Travis misses payments temporarily.

“You know what they can do if you don’t pay them?” Ramsey asked. “Nothing, except destroy your credit and sue you eight years from now. But we’re going to take care of them before we get there.”

Credit card delinquency is rising, according to the Federal Reserve, and for younger Americans (ages 20-39) the rate of delinquency is near levels seen during the 2007-2009 global financial crisis. Defaulting on credit card debt can result in a hit to credit scores, account closures or even lawsuits.

However, Ramsey believes Travis can mitigate these outcomes if he raises his income.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

Boosting income

Travis said he’s going to a trade school three nights a week. This should help him boost his income. Some trades can pay as much as $80,306 a year, according to Indeed. That’s significantly higher than Travis’s current monthly income of $3,600.

However, his income is adjusted upward every six months as he progresses through the apprenticeship program, which means he needs to raise income quickly in the meantime to deal with current challenges. “You gotta get your income up, dude,” Ramsey told him. “You’ve got six months of hell ahead of you.”

Travis might need to spend extra hours and more nights working throughout the week to cover expenses. The spiraling cost of living and the consumer debt boom has left many in a similar position to Travis. As of December 2023, 5.3% of the American workforce had multiple jobs.

Nevertheless, Ramsey believes this situation is “fixable” because Travis has one big advantage: cheap housing. He pays only $560 a month for his mortgage, significantly lower than the national average.

The average monthly mortgage payment, excluding taxes and insurance, for borrowers taking out a conventional conforming 30-year fixed-rate mortgage was $2,045 in December 2022, according to the latest report by the Consumer Financial Protection Bureau.

“You’ve got a really nice, low house payment,” Ramsey told Travis. “It’s the best thing in this whole story right now.”

What to read next

The US dollar has lost 87% of its purchasing power since 1971: Learn how to diversify your portfolio by investing in the world’s most popular precious metal

Only 20% of Americans are confident they'll have a comfortable retirement — use this 1 magic move to get back on track ASAP (It will only take seconds but most people don't do it.)

Find out how to save up to $820 annually on car insurance and get the best rates possible

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.