How experts say Oklahoma will weather an upcoming recession

To put it in Oklahoma weather terms, the anticipated post-COVID-19 recession is in the forecast for next spring, but it's a thunderstorm warning with minimal damage to property expected, not a severe thunderstorm with high winds and extensive destruction.

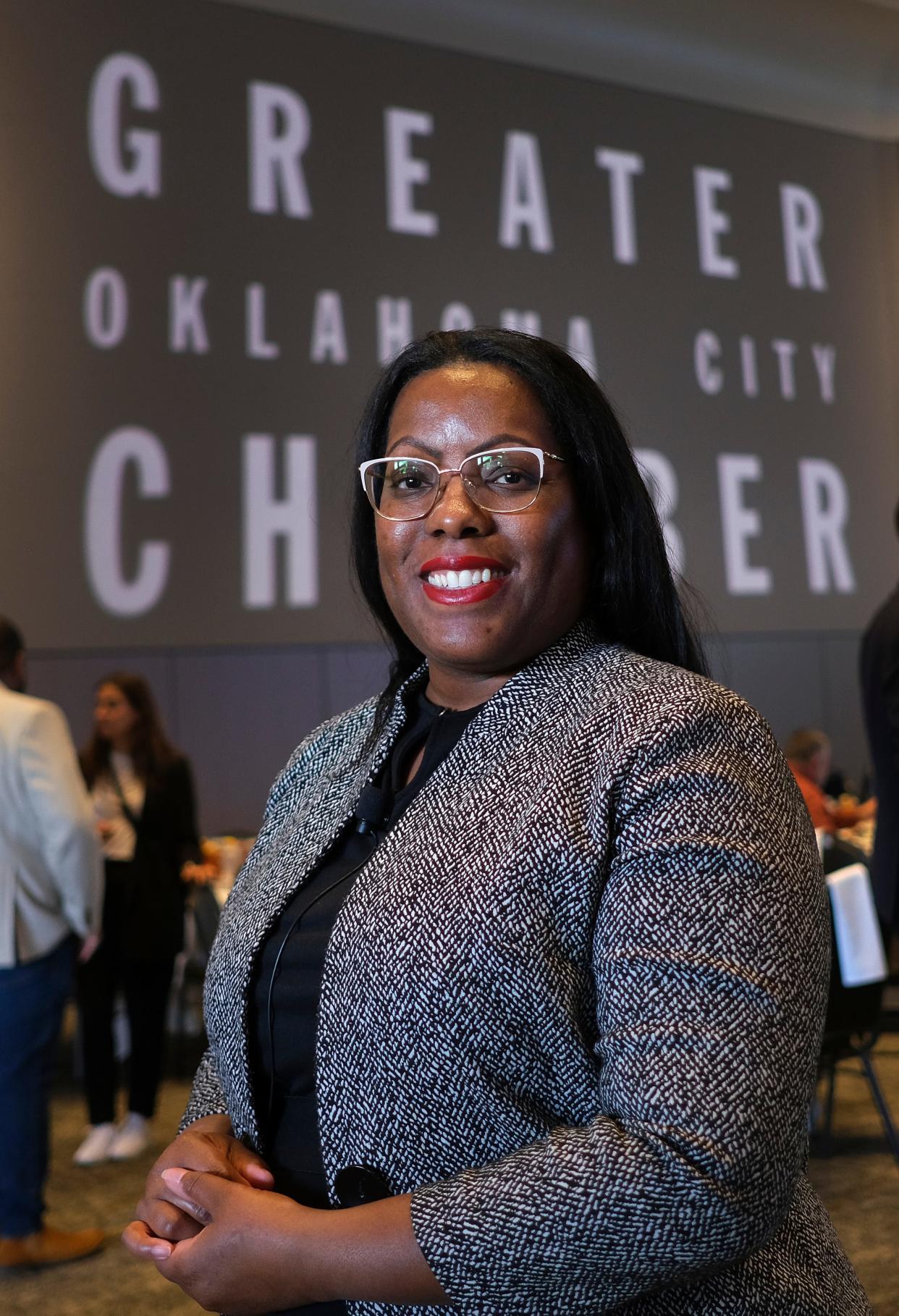

That's according to Dana M. Peterson, chief economist of The Conference Board, the New York economic think tank, keynote speaker for the annual State of the Economy event by the Greater Oklahoma City Chamber on Wednesday at the National Cowboy & Western Heritage Museum.

The Federal Reserve, after raising interest rates 11 times in the past 18 months to rein in inflation, is prepared for some "pain" in the economy, she said, but a minor, "short and shallow" recession with "minimal job losses" in the first half of 2024.

So many boomers retired during COVID, taking their skills with them, and others keep hitting retirement, that labor will remain tight, she said. Employers are working to keep workers, she said, noting that some 70% of corporations surveyed plan to offer raises next year between 3% and 5%.

HOUSING SHORTAGE: Affordable housing advocates and developers to get new Oklahoma Housing Needs Assessment

Peterson said it will be "nothing like the last two recessions," neither the sharp dive at the start of COVID nor the Great Recession of 2007-2009.

Then, consumer discretionary spending is expected to "come roaring back" since it has yet to attain pre-pandemic levels, said Peterson, who leads The Conference Board's U.S. Economy, Strategy and Finance Center.

Meanwhile, the Oklahoma City economy keeps "really clicking" despite "Fed overhang," the Federal Reserve's aim to keep interest rates "high longer," even if not "higher longer," to get inflation down to 2%, said Mark Snead, economist and president of RegionTrack, an OKC-based economic research firm. He was one of four experts on an earlier panel.

Positives and negatives in the OKC and Oklahoma economy

Here are some highlights from the panel, which also included Robert Dauffenbach, University of Oklahoma economist; Russell Evans, partner and chief economist of Thorberg Collectorate Inc., an OKC investment management firm; and Chad Wilkerson, Oklahoma City branch executive for the Federal Reserve Bank of Kansas City.

Kent Shortridge, vice chairman of economic development for the chamber, moderated the panel. He asked each of them for positives and negatives of the state and local economy.

Dauffenbach:Positive: The Metropolitan Area Projects Plan. MAPS, in its 30th year, "should be studied as an example of urban place making." Negative: He said was "concerned to the point of clinical depression" over the federal government's "'Thelma & Louise' plunge off the deficit cliff," comparing the 1991 road trip adventure film that ended with the protagonists plunging in a car to their death and sustainable U.S. taxing and spending; political divisiveness; and the potential for another federal government shutdown. Such division "can end us locally," he said.

Evans:Positive (partial): The state gross domestic product is "what it was five years ago," and not worse. Negative: He cautioned against complacency surrounding economic success and "how much we have going on." Quality of life demands aren't being met. "A young analyst in my office said just this week, 'I feel like there's a penalty for living in Oklahoma City'" instead of some other big cities, Evans said.

Wilkerson:Positive: Unemployment remains close to historic lows in OKC (3.2%) and the state (3%). Negative: Housing costs are "up dramatically," but not as much and still less costly than elsewhere, mainly because they were below the national average in the first place.

Snead:Positive: Retail sales are "hanging in there." Manufacturing and engineering are showing strength, and improvement are being made in quality of life. Negative: The Federal Reserve keeping interest rates high, and weakness in the energy sector, which Dauffenbach said was down to a workforce of 31,000 from a peak of 63,000 in 2014.

Sign Up: Weekly newsletter Real Estate with Richard Mize

Senior Business Writer Richard Mize has covered housing, construction, commercial real estate and related topics for the newspaper and Oklahoman.com since 1999. Contact him at rmize@oklahoman.com. Sign up for his weekly newsletter, Real Estate with Richard Mize. You can support Richard's work, and that of his colleagues, by purchasing a digital subscription to The Oklahoman. Right now, you can get 6 months of subscriber-only access for $1.

This article originally appeared on Oklahoman: Board: Recession is coming, but not a severe storm, in Oklahoma