Everyone Is Talking About the Fidelity Nasdaq Composite Index ETF. Is It a Good Long-Term Option?

The Nasdaq Composite has climbed in the past year and a half, roaring out of a bear market and into bull territory as investors piled into the types of stocks the index is best known for: technology players. This has been -- and is still -- the case for two reasons.

First, investors are eager to get in early on the high-growth opportunity of artificial intelligence (AI). Many tech companies today are either developing and selling AI tools and platforms or using AI to improve their own businesses. This already is starting to pay off, and it could send earnings soaring over time. Second, investors are looking ahead to a better economic environment down the road, and to prepare, they're betting on growth stocks.

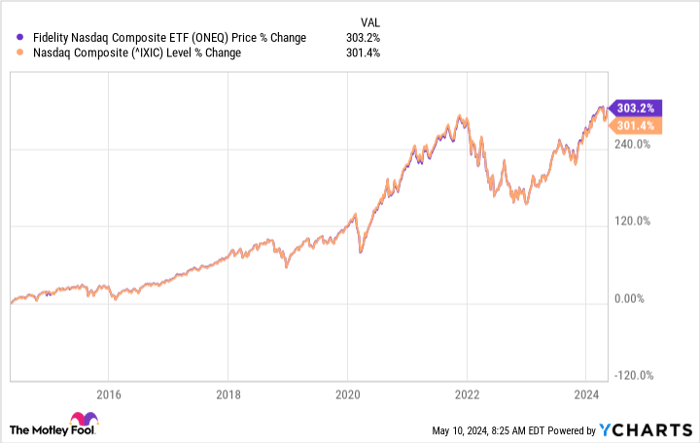

All of this has driven the Nasdaq higher -- and that has translated into double-digit percentage gains for the Fidelity Nasdaq Composite Index ETF (NASDAQ: ONEQ), an exchange-traded fund that tracks that benchmark. So, everyone is talking about this top-notch ETF as it has recently been an easy tool for generating fantastic returns. But is it a good long-term option?

Image source: Getty Images.

An easy investment

You may wonder why I call this investment "easy." That's because it doesn't require you as an investor to research individual stocks or closely watch any particular company's every move. Instead, this ETF offers you immediate exposure to all the Nasdaq companies, giving you the opportunity to benefit from the growth of many instead of betting everything on just a few stocks.

Now, let's consider the pros and cons of investing in the Fidelity Nasdaq ETF. The point I just mentioned is definitely a pro, and this brings me to the idea of diversification. An investment in this fund offers you instant diversification across many tech players -- and growth companies in other sectors such as communication services and consumer discretionary. So forget about the pressure of choosing just the right stocks -- it doesn't exist when you buy shares of the Fidelity Nasdaq ETF.

Another advantage, also linked to this diversification, is that owning shares of this fund lowers your risk compared to investing in a small handful of individual tech stocks. If certain Nasdaq companies suffer, others that are thriving can compensate to a certain degree, and this limits the downside for investors.

Of course, the flip side of that is the one disadvantage of investing in this or any other index ETF. You're unlikely to enjoy the types of explosive gains that can be had from the market's big winners, due to the fact that your investment is spread out across so many stocks. Even if, as part of your investment in this ETF, you have stakes in some tech stocks that skyrocket, your stakes in them will be relatively small. The same element of diversification that limits your risk also limits the extent of potential gains.

Take a close look at fees

Another element that some may see as a negative of ETFs is their fees, which eat into investors' returns over time. But this doesn't mean you should avoid all of these funds. Instead, look for ETFs with expense ratios of less than 1% -- below that level, the purchase will be worth your while. The expense ratio of the Fidelity Nasdaq ETF -- at 0.2% -- clearly fits the bill.

This ETF has performed particularly well, as mentioned above, due to investor interest in technology stocks these days -- companies with the information technology classification make up 48.5% of the fund, and the communication services sector -- which features big tech names like Alphabet and Meta -- makes up another 14.5%. And the most heavily weighted positions in the fund include Microsoft, Apple, Nvidia, and Amazon, some of the market's top performers in recent months and years. So now is a great moment to be invested in this fund.

What history suggests

But investing isn't about short periods of time -- it's about growing your money over the long term. Can the Fidelity Nasdaq ETF do the trick? Yes. And here's why. Today, the index and this index ETF that tracks it are going through a period of growth. Historically, these periods of growth have eventually been followed by phases of stagnation or decline -- but so far, the Nasdaq Composite index has always gone on to recover from such corrections and climb to new record levels.

If you hold onto the Fidelity Nasdaq ETF just for the short term during good times like right now, sure, you'll score a win -- but you're likely to score an even bigger victory if you hold onto the investment over the long term.

Of course, it's always important to consider your investment strategy and comfort with risk before making a move. If you're a cautious investor who favors dividend-paying stocks, for example, you may want to buy a few shares of this fund, but invest more heavily in industries such as healthcare or in an ETF that tracks the broader S&P 500 index. But, if you're an investor who prioritizes growth, you may want to scoop up shares of the Fidelity Nasdaq ETF hand over fist.

Should you invest $1,000 in Fidelity Commonwealth Trust - Fidelity Nasdaq Composite Index ETF right now?

Before you buy stock in Fidelity Commonwealth Trust - Fidelity Nasdaq Composite Index ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fidelity Commonwealth Trust - Fidelity Nasdaq Composite Index ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.