Elite gathering of financial titans returns to Miami for annual event

Influential hedge-fund titans, investment bankers and private equity giants have moved to or opened up shop in Miami over the past two years.

Now a group born in the country’s hedge-fund capital of the world is recognizing the rapidly growing finance industry here and the city’s rising importance in global business.

The six-year-old Greenwich Economic Forum is set to hold an annual conference in Miami on Monday for the second straight year. Miami is the only city outside of Greenwich, Connecticut, where the organization hosts an event. The original one is held each October in Greenwich.

“It made sense” to bring the affair to Miami last year and now to double down, Bruce McGuire, co-founder of the economic forum, said in an interview. “We’ve been watching the migration of people working in our industry.”

McGuire, also founder and president of the Connecticut Hedge Fund Association, said he has been watching financial firms “set up significant operations down here and staffing up,” and so, “we thought, let’s lean into that.”

After opening remarks by him, longtime Miami businesswoman Lourdes Castillo and Jeremy Schwarz, a senior adviser to Miami Mayor Francis Suarez, will talk about what’s billed as the “Miami Phenomenon.” Castillo will provide a history of the city and its evolution in large part by incorporating waves of immigrants from Latin America who helped build it.

“We’re going to take people through Miami, from the lazy town it was in the 1960s to pre-COVID,” she said.

From there, Schwarz will explain why, during the pandemic, the city has become an attractive place for technology and finance professionals to do business.

Castillo, co-founder of the Economic Club of Miami, is helping with the event. Its other founders, businessman Jeb Bush Jr. and economist Jon Hartley are also slated to speak at the private gathering of about 130 people.

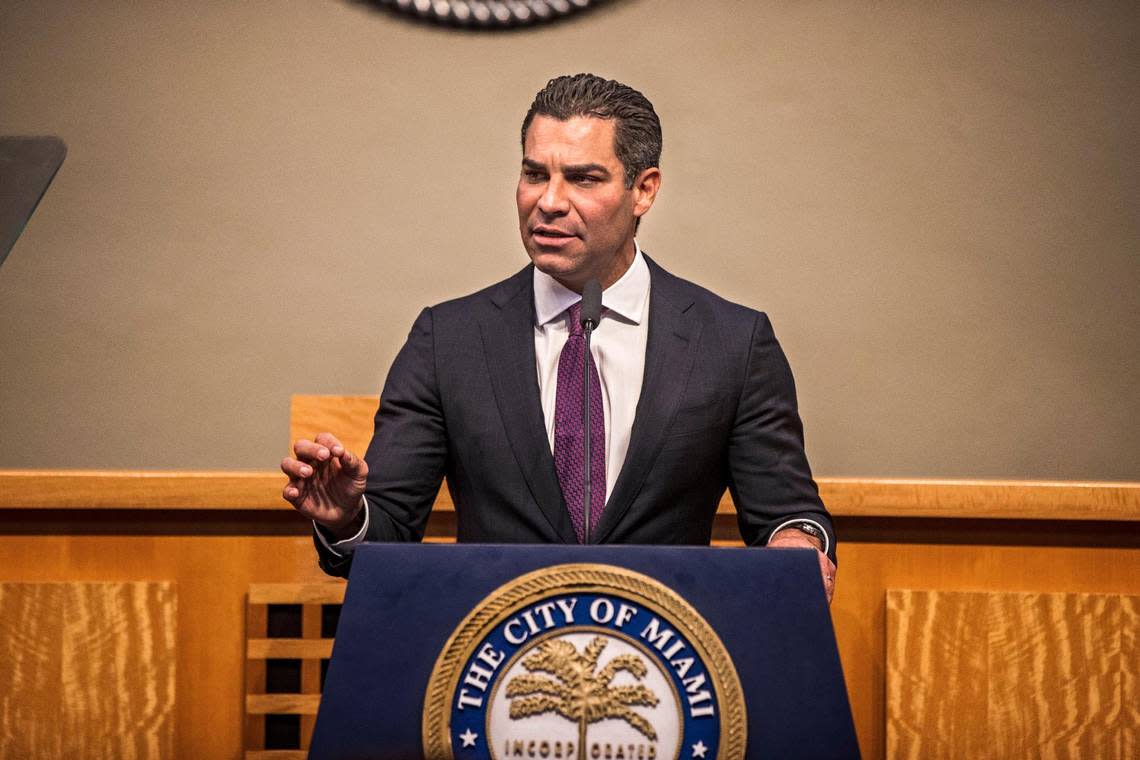

Suarez is listed as a speaker, too, on the event’s website but doesn’t appear on the daylong agenda of mostly panel discussions. At last year’s Greenwich forum here, Suarez talked about Miami’s tech and financial growth and why his administration deserves some credit for luring finance and tech workers to the city to live and work.

Monday’s forum will be held at the Mr. C. Miami Hotel in Coconut Grove. Heavyweight investment management speakers will include: Ken Kencel, president and chief operating officer of Churchill Asset Management; Robert Koenigsberger, founder, chief investment officer, and managing partner of Gramercy Funds Management; Pierre Caramazza, head of U.S. product and specialty sales at Franklin Templeton; and Kate Murtagh, managing director and chief compliance officer at Harvard Management Company, which runs Harvard University’s endowment.

“We are an investment conference for people working in private markets and private funds and the people who invest in those funds like most of the big institutional investors and more significant family offices,” McGuire said.

Participants will cover macroeconomic expectations for this year, such as inflation, recession concerns, how institutional investors are allocating assets, corporate climate and environmental policies and cryptocurrency. Fintech’s role in financial inclusion, healthcare, and whether now is the time to invest in emerging markets also will be discussed by panel participants.

“The old and the new are joining forces together,” Castillo told the Herald, contrasting Miami with the Northeast, long the capital of the financial industry.

Indeed, the Greenwich forum is bringing together decision-makers in hedge funds, private equity, private credit, digital asset, and venture capital with leaders of Miami’s fintech, wealth management and real estate sectors.

There are many more of them living in Miami today.

For instance, since the pandemic started in March 2020, Point72 Asset Management, the hedge fund started by Steven A. Cohen, has opened an office in Miami, while Apollo Global Management and Blackstone have expanded here.

In perhaps the most significant U.S. corporate relocation announced last year, billionaire founder and Citadel CEO Ken Griffin said he’s moving the home of the hedge-fund and securities trading firm to Miami’s Brickell neighborhood after 32 years in Chicago. And his company has acquired land on Brickell Bay Drive for $363 million to eventually build an office tower.

For himself, Griffin, a Florida native, bought the expansive Miami bayfront estate of banker and philanthropist Adrienne Arsht near the Vizcaya Museum for $106 million in September, a Miami-Dade County record price for a home.

McGuire said he hopes the Greenwich Economic Forum will become another respected yearly event in Miami like Art Basel. He also hopes it can help the city’s growing finance sector form a sense of community.

“Think of all these expats and refugees from the northeast who are now coming down for the first time” to live in Miami, he said referring to the migration of hedge-fund managers and other investors over the past few years. “A lot them don’t know anybody yet.”