Dreading hurricane season? At least you can save on supplies in Florida. Here’s how

Predictions for the 2023 hurricane season began with the storm forecast.

Two things we know for certain:. The season begins June 1. And there are two tax holidays to buy hurricane supplies.

“As we saw last year with Hurricane Ian, a disaster can bring a host of needs to people in its path. Advanced preparation can help keep people, homes, and pets safe when disaster strikes,” Jim Zingale, executive director of the Florida Department of Revenue, said in a statement. “The 2023 Disaster Preparedness Sales Tax Holiday helps Floridians save money while gathering essential supplies.”

Here’s what to know:

When are hurricane tax-free days in Florida?

▪ The first sales tax holiday begins Saturday, May 27, and runs through Friday, June 9.

▪ The second tax holiday period begins in the thick of the season, Aug. 26-Sept. 8.

During these tax break periods Floridians can build their hurricane kits of emergency supplies with qualifying household goods including pet food and supplies, batteries, flashlights, detergent, and other necessary items while avoiding the sales tax.

Note: Florida’s general sales tax is usually 6%. If you buy $10 in pet supplies, for instance, you save 60 cents.

KNOW MORE: What’s likely in store for hurricane season.

What supplies are tax free?

The Disaster Preparedness Sales Tax Holiday begins THIS Saturday, May 27 and runs through Friday, June 9. Build your #hurricane kit with qualifying household supplies, pet supplies, batteries, flashlights and more - tax free! More info: https://t.co/xonZyv8Xsz pic.twitter.com/PdGWLluok5

— Florida Department of Revenue (@FloridaRevenue) May 25, 2023

Some of the no-tax qualifying hurricane supplies include:

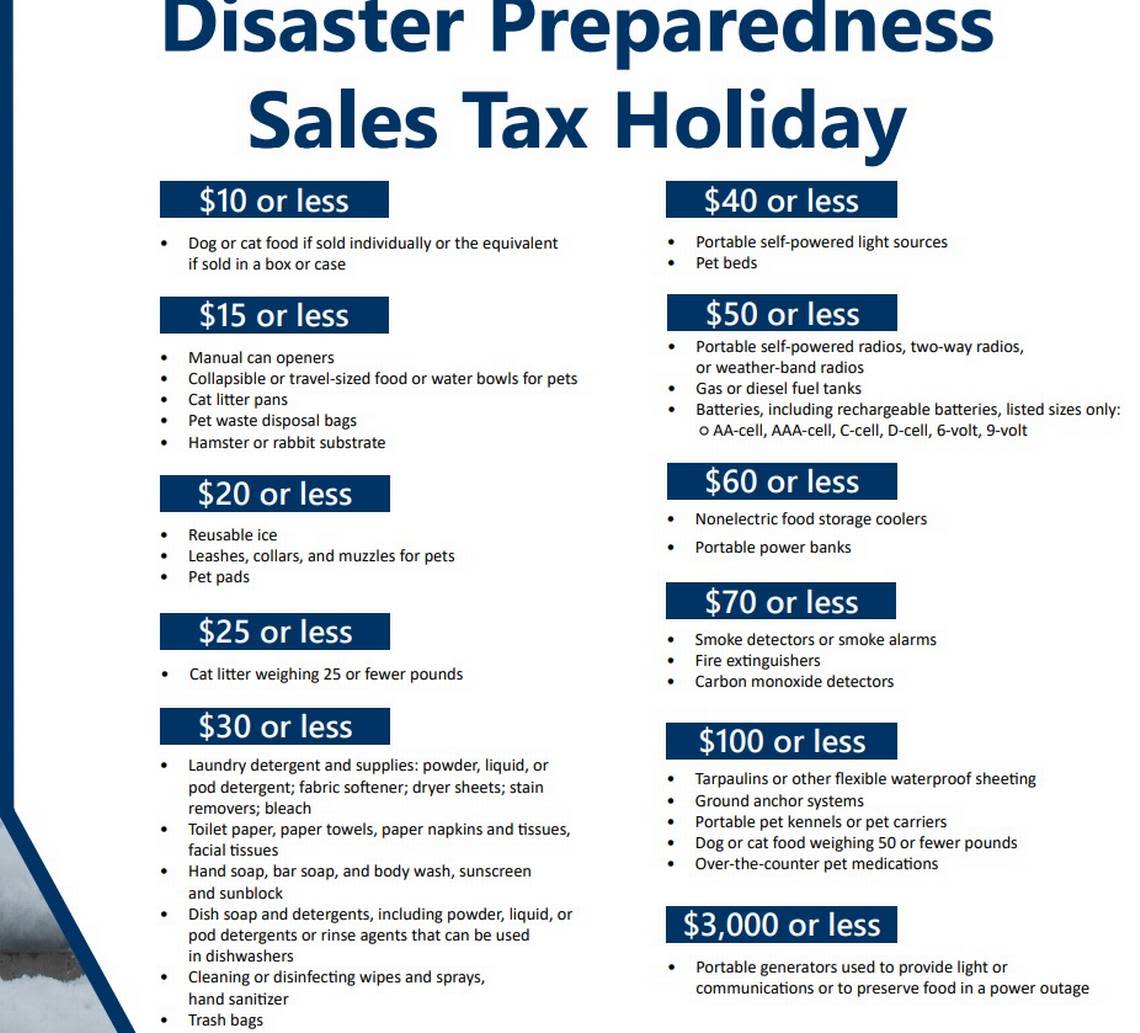

Selling for $10 or less

▪ Dog or cat food if sold individually or the equivalent if sold in a box or case.

Selling for $15 or less

▪ Manual can openers

▪ More pet supplies like collapsible or travel-sized food or water bowls, cat litter pans and pet waste disposal bags, and hamster or rabbit substrate. Leashes, collars and muzzles for pets and pads, as well as cat litter that cost more are also included in the tax break. Also pet kennels or carriers and pet food of 50 pounds or less and over-the-counter pet medications that can cost $100 or less are included.

Selling for $20 or less

▪ Reusable ice.

Selling for $30 or less

▪ Laundry detergent and supplies: powder, liquid, or pod detergent; fabric softener; dryer sheets; stain removers; bleach. Also dish soap and detergents used in dishwashers.

▪ Toilet paper, paper towels, paper napkins and tissues, facial tissues.

▪ Hand soap, bar soap, and body wash, sunscreen and sunblock.

▪ Cleaning or disinfecting wipes and sprays, hand sanitizer.

▪ Trash bags.

Selling for $40 or less

▪ Portable self-powered light sources.

Selling for $50 or less

▪ Portable self-powered radios, two-way radios, or weather-band radios.

▪ Gas or diesel fuel tanks.

▪ Batteries, including rechargeable batteries, listed sizes only: AA-cell, AAA-cell, C-cell, D-cell, 6-volt, 9-volt.

Selling for $60 or less

▪ Nonelectric food storage coolers.

▪ Portable power banks.

Selling for $70 or less

▪ Smoke detectors or smoke alarms and carbon monoxide detectors.

▪ Fire extinguishers.

Selling for $100 or less

▪ Tarpaulins or other flexible waterproof sheeting.

▪ Ground anchor systems.

Selling for $3,000 or less

▪ Portable generators used to provide light or communications or to preserve food in a power outage.