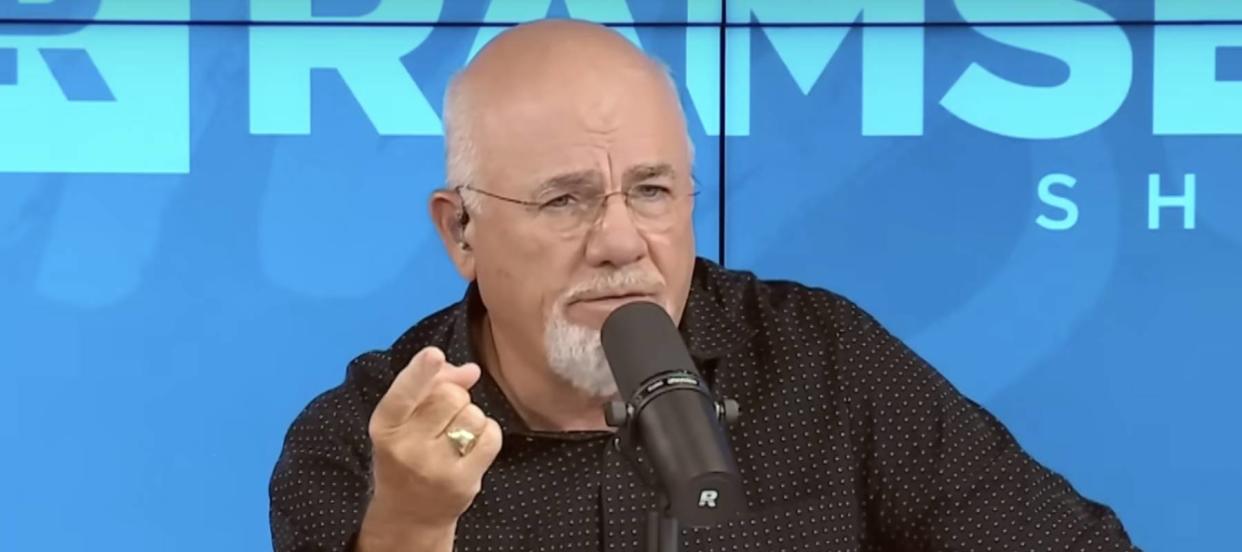

'Don't tell me you have a tractor': This Oklahoma man and his wife are 'upside down' on 4 vehicles that cost them $2,500 a month — and now he has no job. Dave Ramsey gave him 3 choices

When you’re “upside down” or “underwater” on an auto loan, it means you owe more than the vehicle is worth. This situation is almost inevitable, per Debt.org, considering how vehicles lose value.

But David from Oklahoma recently told Dave Ramsey that he and his wife are upside down on four vehicles simultaneously — a truck, an SUV and two motorcycles — and they want to downsize and get debt free.

The couple’s payments on these loans are so high, Ramsey said it made him “want to puke” on a recent episode of “The Ramsey Show." He said, “Don’t tell me you have a tractor. I’ll kill ya.”

Don’t miss

This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Find out how to save up to $820 annually on car insurance and get the best rates possible

Take control of your finances in 2024: 5 money moves to start the new year off strong

While David didn’t offer specifics on how far upside down these loans are, it appears selling isn't going to be enough. Car owners could still owe thousands of dollars in a lump sum if they sell their vehicles privately or surrender them to the bank. Voluntary repossession should be avoided as far as possible, said Ramsey.

Making matters worse for the couple is the decline in used-car prices. "... since a peak in early 2022, used-car values have fallen more than 20%, according to the Manheim Used Vehicle Value Index," Bloomberg reported in December.

The financial expert listed three ways they could take action.

Stack cash, cover the difference

One of the ways to deal with an underwater asset, according to Ramsey, is to “stack cash and cover the difference.” Essentially, cutting back on expenses and boosting income should help David and his wife accumulate enough capital to close the gap between their auto loans and the market value of their vehicles.

Unfortunately, David recently lost his job, making it difficult to implement this strategy right away. Meanwhile, the debt burden is immense. David and his wife must pay $852 a month for his truck, $677 for her SUV, and $555 and $408 respectively for two motorcycles. Altogether, the couple needs roughly $2,500 a month to cover these payments but currently live on a single salary and unemployment benefits.

“I know you lost your job but right now is not the time to wait for your dream job to come along,” said co-host Jade Warshaw. “Right now get any jobs you can.” Ramsey wanted him to consider ride sharing or food delivery. “You can drive because you've got a lot of things to drive,” he said dryly.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

Borrow the difference

David could also borrow funds to cover the difference between market value and purchase price. Ramsey encouraged him to seek out a loan from a credit union or other lenders. He can then use the money in conjunction with the proceeds of selling the vehicles privately to pay off the auto loans in full.

Debt consolidation like this is a common strategy, according to TD Bank. Borrowers usually tap into their home equity or apply for personal loans to pay off debt that’s either too expensive or due imminently (though using home equity carries its own risks).

This strategy also hinges on the borrower’s creditworthiness and income, thus David’s current unemployment could complicate this strategy.

Negotiate with the lender in person

Ramsey’s final suggestion is to negotiate with the auto lender directly. David’s auto loan might be held at a local bank or credit union where the manager is willing to consider an alternative: an unsecured note for the difference between the loan amount and the resale value of these vehicles.

It is essential, Ramsey told David, that this be done “in person, not on the phone and for God sakes not by email! Go sit down and look ‘em in the eye.” Restructuring or refinancing debt is difficult but certainly possible.

Large corporations – including car sales outlets, ironically – restructure debt frequently. Used-car company Carvana (CVNA) successfully restructured $1.3 billion in debt earlier this year to avoid bankruptcy. Individual borrowers should consider such negotiations too.

Another alternative: yard sale

Based on the assumption that a family with four vehicles probably has more assets, Warshaw encouraged David to sell other possessions to raise cash. “Something tells me with these trucks and vehicles, you’ve got more stuff laying around to get rid of,” she said.

Exercise equipment, lawnmowers, furniture or anything with scrap value could be sold off to help rescue the family from this urgent situation and give them some breathing room.

What to read next

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.