Don't Sweat the Latest PENN Pullback, Bull Signal Says

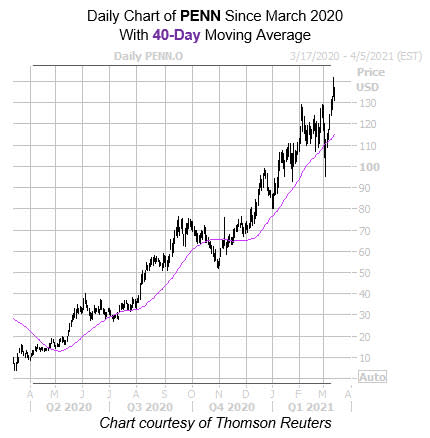

The shares of gambling name Penn National Gaming, Inc (NASDAQ:PENN) are down 3.5% at $131.65 at last check. The security is pulling back from yesterday's all-time high of $142, though it still sports a jaw-dropping 1,443% year-over-year lead, with regained support from the 40-day moving average. Another reason why traders should not sweat this pullback is that a historically bullish signal now flashing, could have PENN positioned for even more records highs in the near future.

Specifically, Penn National Gaming stock's recent peak comes amid historically low implied volatility (IV), which has been a bullish combination for the equity in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been three other times in the past five years when the security was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower. This is now the case with the equity's SVI of 73%, which sits at the sixth percentile of its 12-month range.

White's data shows that a month after these signals, PENN was higher in 67% of those circumstances, averaging a 9.4% return for that time period. From its current perch, a similar move would put the security just over the $144 mark, at a fresh all-time high.

Analysts are evenly split towards Penn National Gaming stock, leaving the door open for price-target hikes and/or upgrades moving forward. Of the 14 analysts in question, seven call it a tepid "hold" or worse. Plus, the 12-month consensus target price of $109.36 is a 17.1% discount to current levels.

Shorts have already started to hit the exits, though there is still plenty of pessimism left to be unwound, which could push shares higher. Short interest fell 16.6% in the last two reporting periods, yet the 9.47 million shares sold short still make up a hefty 8.3% of the stock's available float.

Lastly, the equity's Schaeffer's Volatility Scorecard (SVS) sits at an elevated 98 out of 100. In simpler terms, this suggests the security has exceeded volatility expectations during the past year.