Disney's feud with activist Nelson Peltz is heating up — why it matters for Bob Iger

Disney stock (DIS) is bouncing back from the multiyear lows it hit in 2023. But investors are still grappling with an ongoing question heading into the company's earnings on Wednesday: Will activist investor Nelson Peltz of hedge fund Trian Management succeed in shaking up the entertainment giant's board?

Stockholders are unlikely to get an answer anytime soon. If the proxy battle continues to a vote, a shareholder meeting set to take place on April 3 will ultimately determine the board's fate.

Wall Street watchers have viewed the battle as a noisy distraction for CEO Bob Iger, who's currently in the midst of resetting the company's strategy. Nevertheless, the proxy fight continues to serve as a lingering overhang, clouding that goal.

Trian Fund Management, which beneficially owns $3 billion of common stock, filed a definitive proxy statement last week after announcing plans to nominate Peltz and former Disney CFO Jay Rasulo to the media giant's board.

Rasulo is the second former Disney exec to publicly join Peltz in his push for a board shake-up. Former Marvel executive Ike Perlmutter has entrusted his stake in the company to Peltz, making up the bulk of Trian's 30 million-plus shares in the entertainment giant.

Peltz ended a previous proxy battle against Disney one year ago after the company committed to various cost-cutting initiatives. He revived the fight last fall as Disney's stock plunged.

How we got here

Trian has cited the loss of tens of billions in shareholder value, a drop in consensus earnings estimates for the next two years, and disappointing studio content as some of the reasons it's pushing for a board shake-up.

"It is unfortunate that a company as iconic as Disney and with so many challenges and opportunities has refused to seriously engage with us, its largest active shareowner, about board representation," Peltz said in his initial proxy statement last month.

He added the current board lacks an "ownership mentality" and mainly consists of legacy directors and hand-picked replacements who have failed to address some of the biggest issues at the company, including plans for a CEO successor, the path to streaming profitability, and a revamp of its box office.

In a new letter to shareholders on Feb. 1, titled Restore the Magic, the activist hedge fund said it would initiate a board-led review of the company's creative processes, in addition to pushing management to implement "executable" plans as it relates to its streaming and theme park businesses, along with executive pay and succession.

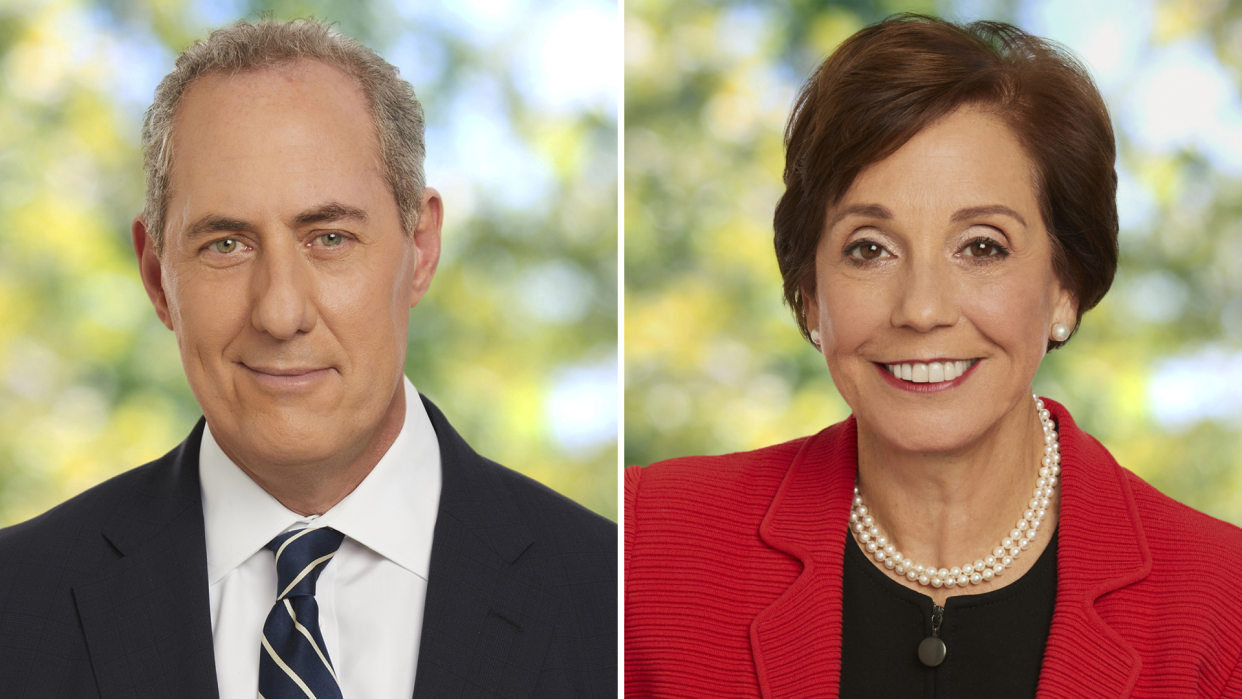

As part of Trian's proxy statement, Peltz named the two existing board members he's seeking to replace: former Mastercard executive Michael Froman and Maria Elena Lagomasino, CEO of wealth management firm WE Family Offices.

A Disney spokesperson said in a statement to Yahoo Finance that Froman and Lagomasino are "highly valued and engaged members" of the board.

Disney has said it's made "significant progress" in strategically realigning the business in order to foster growth and create shareholder value.

Some changes have included the implementation of new revenue streams like the ad-supported tier for its streaming service Disney+, in addition to price increases and password-sharing crackdowns across its streaming services and parks businesses.

The company has also said it's "actively engaged in the high-priority work of succession planning," with Iger's contract set to expire at the end of 2026.

Other activists join the fight

Other shareholders are jumping into the fray as the proxy battle gains steam. Trian has received support from fellow activist investor Ancora.

Meanwhile, ValueAct Capital has come out against Peltz — giving Disney an extra boost in fighting off the billionaire investor. The activist entered into an information-sharing agreement with Disney, which ensures it will support the media giant's recommended slate of board nominees in exchange for information.

And Blackwells Capital, which boasts a $15 million stake in Disney, has nominated studio executive Jessica Schell, Tribeca Film Festival co-founder Craig Hatkoff, and TaskRabbit founder Leah Solivan for election to the board.

In a letter to shareholders on Tuesday, viewed by Yahoo Finance, the hedge fund said Disney should consider splitting up the conglomerate "into standalone public companies."

"Disney may simply be too complex for any one successor to Mr. Iger to manage holistically, and Blackwells believes that it is the responsibility of the Board to oversee these types of analyses in the ordinary course," the letter said.

Disney did not immediately respond to Yahoo Finance's request for comment on the letter or a potential company breakup. The company has maintained it will only endorse its current members and encouraged shareholders not to vote for Trian's or Blackwells' respective candidates.

'Distraction for Disney'

Wall Street analysts say Peltz's path to victory is challenging.

"Disney's a huge company, so it'd be very difficult for Peltz to amass enough shares to have a chance of really winning a vote," said Doug Creutz, managing director at TD Cowen. "If you own the stock, it's because you believe in Bob Iger, and Bob Iger has said he doesn't want Nelson Peltz on the board."

Creutz, who called the proxy fight a "distraction for Disney," said Iger has been focused on turning the business around amid a particularly challenging time in the industry.

Steve Schiffman, former media executive and adjunct professor at Georgetown University’s McDonough School of Business, stressed that point to Yahoo Finance: "These activists just don't fully understand how systemic and seminal the marketplace is changing in media."

Schiffman pointed to the industry's ever-changing economics, which have included a shift away from linear television on the heels of increased cord-cutting while TV advertising has fallen off a cliff.

Competition is also more intense than ever as legacy companies launch unprofitable streaming platforms amid surging content costs while post-pandemic audiences significantly alter their viewing habits.

"The smartest media executives in the world right now are really struggling to figure out what to do here and there are no easy answers," Schiffman said.

"At the end of the day, I actually think the Disney senior management team is quite good. I've seen some companies where that's not a reality. I don't think that's the case with Disney."

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on Twitter @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance