Disney had a win this week — but its future in traditional TV is still in question

Disney (DIS) resolved its high-profile dispute with cable giant Charter (CHTR) earlier this week — but the company's future in traditional TV remains unclear as multiple news outlets reported that Disney has engaged in early stage talks with both Nexstar Media Group (NXST) and businessman Byron Allen to sell its broadcast and cable channels.

The talks, first reported by Bloomberg, are said to still be in exploratory stages; however, Allen did reportedly offer $10 billion for the purchase of ABC, National Geographic, FX, and other Disney-owned local broadcast channels.

Nexstar declined to comment. Allen Media Group did not immediately respond to Yahoo Finance's request.

In a statement, Disney said, "While we are open to considering a variety of strategic options for our linear businesses, at this time The Walt Disney Company has made no decision with respect to the divestiture of ABC or any other property and any report to that effect is unfounded."

The reports come after Disney and Charter reached a precedent-setting agreement on Monday following a contract dispute that led Disney to pull its owned and operated channels, including ESPN and ABC, off Charter Spectrum cable systems in late August.

As part of the deal, Charter will offer some Disney streaming services — the ad-supported version of Disney+, ESPN+, and ESPN's yet-to-be-launched direct-to-consumer offering — for select cable packages at no additional cost to the consumer.

Linear TV 'past the point of no return'

The Charter dispute had raised questions about the future of the traditional cable TV bundle, especially as more consumers drop their cable packages in a trend known as cord-cutting and instead opt for streaming services that are less profitable for media companies.

According to recent data from Nielsen, linear TV viewership fell below 50% in July for the first time. Broadcast and cable each hit a new low of 20% and 29.6% of total TV usage, respectively, to combine for a linear television total of 49.6%.

Time spent streaming (via a television) increased 2.9% in July compared with June, according to the data, to reach a record of 38.7% of total TV usage.

"Linear TV [is] past the point of no return," Macquarie analyst Tim Nollen wrote in a note just ahead of the data's release. He added the revenue line for cable and satellite operators is "probably permanently negative" as pricing fails to drive upside and TV advertising growth stalls.

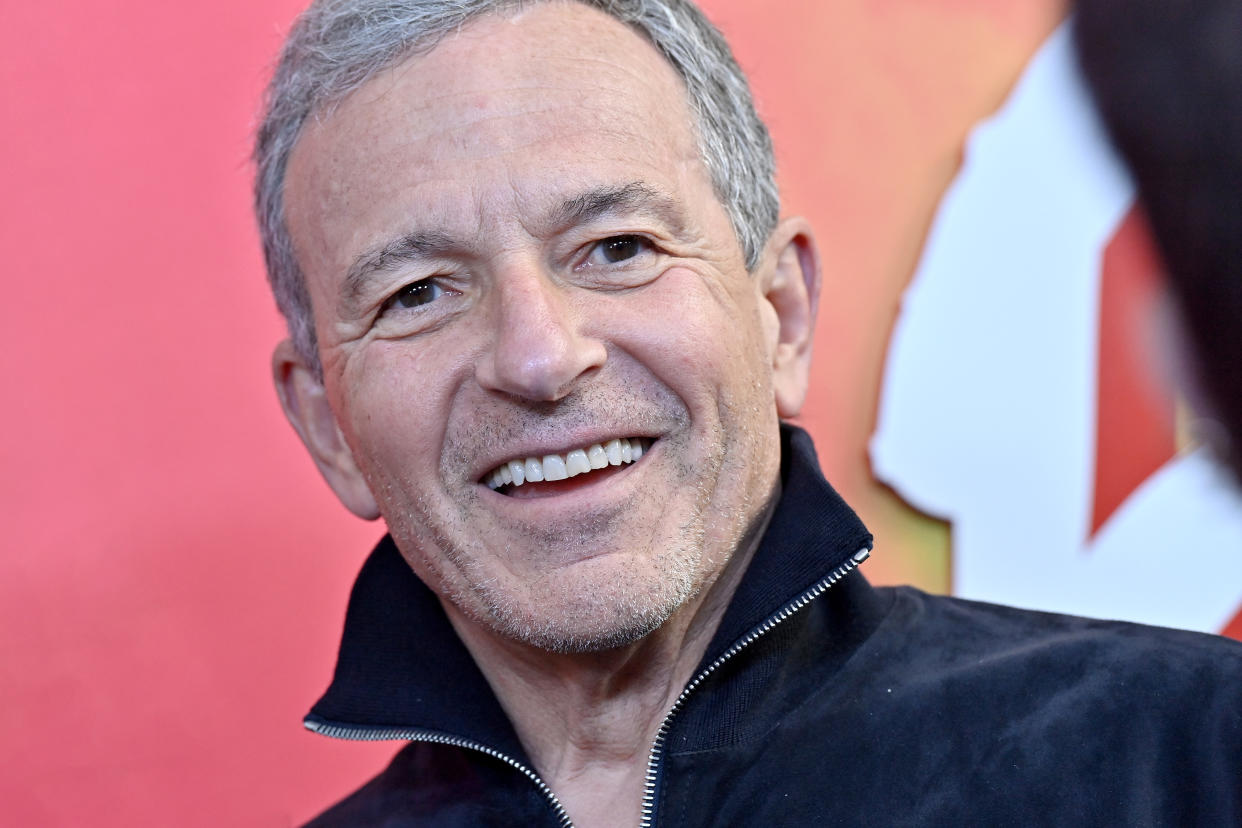

Amid those declines, Disney CEO Bob Iger said he would take an "expansive" look at the entertainment giant's traditional TV assets, which includes broadcast network ABC and cable channels FX, Freeform, and National Geographic — signaling the potential for a sale.

"We are expansive in our thinking about [the linear business], and we're going to look expansively ... [for] opportunities there because, clearly, it's a business that's going to continue to struggle," the executive said in an interview with CNBC in July.

The executive added the current distribution model is "definitely broken," saying the linear TV assets "may not be core" to Disney's strategy any longer.

It's a challenge that fellow legacy media companies have also faced with Comcast's NBC (CMCSA), Paramount's CBS (PARA), and Fox Corporation's Fox network (FOXA) all feeling the pressure as TV advertising woes mount.

"The television advertising sector is experiencing what might feel like an existential crisis at the moment," Brian Wieser, principal at insights provider Madison and Wall, said in a new note released earlier this month.

"At the start of this year, we had a situation where cord-cutting was accelerating into high-single-digit levels of decline, enabled (if not outright encouraged) by traditional TV network owners’ shift of resources and programming budgets into streaming platforms, which have been and are likely to always be ad-free or ad-light at best," he continued, adding the Hollywood strikes have also added an extra layer of impact.

Investors have also seemed to put their weight behind streaming services as the market cap of Netflix (NFLX), currently hovering above $175 billion, roughly equals the market caps of Disney, Fox, and Paramount combined.

'Who wants to buy a linear TV business?'

Still, networks continue to earn double-digit margins as sports viewership remains a big driver behind cable bundle subscriptions.

Tom Carter, Nexstar’s former COO who became a senior adviser at the company in August, said at Bank of America's Media, Communications, and Entertainment Conference on Wednesday that the company would be interested in "opportunities" to acquire linear assets from legacy media giants, including Disney.

Still, he warned a sale would likely be complicated, especially if ESPN is not included in a potential spin-off.

"A lot of those assets, the linear and the [direct-to-consumer] assets are intertwined," he said. "From a programming perspective and from a content perspective, you're seeing ESPN simulcast the majority of their large sporting events on ABC. If you were to buy the ABC complex, how would that work going forward? So there's a lot of questions that need to be answered there."

Analysts have questioned the strength of a potential buyer for Disney's TV channels given the intense secular declines in linear television networks.

"Every media company is facing cord-cutting, shifts of television advertising to connected TVs and other platforms," Rich Greenfield, media and technology analyst at LightShed Partners, previously told Yahoo Finance Live. "The linear TV business is just under a lot of pressure, and investors are already asking me, 'Well, who are they selling it to? Who wants to buy a linear TV business?'"

Other industry watchers said a possible asset sale is likely necessary to protect the business's future — but only with the right buyer.

"We agree that asset sales are a good idea, but our best advice would be to sell all (or all the content assets) of DIS to AAPL, AMZN, or another company that never needs to make money from creating content," Needham analyst Laura Martin previously wrote. "If they don't sell, DIS will be competing against those companies in an industry with deteriorating economics (because they never need to make money from content), we believe."

Some have even said Disney should consider splitting up the business. MoffettNathanson analyst Michael Nathanson suggested the company should be broken up into two entities: one focused on parks, Disney+, and studio IP and another focused on Disney’s linear networks, ESPN+, Hulu SVOD, Hulu Live TV, and Disney+ Hotstar.

"I'm not in the camp that says that Disney really needs to split up," Bank of America analyst Jessica Reif Ehrlich previously told Yahoo Finance, maintaining the solution likely won't be enough to solve Disney's myriad problems.

"Having said that, I think all options, and Bob Iger has made this very clear, all options are on the table," she said.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on Twitter @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance