Deutsche Bank now expects 'an earlier and somewhat more severe recession'

The first economist on Wall Street to predict a U.S. recession in 2023 is moving up his timeline for an economic contraction.

"More than two months ago we forecasted that the U.S. economy would tip into a recession by end-2023," Deutsche Bank Chief U.S. economist Matt Luzzetti wrote in a note to clients on Friday. "Since that time, the Fed has undertaken a more aggressive hiking path, financial conditions have tightened sharply and economic data are beginning to show clear signs of slowing. In response to these developments, we now expect an earlier and somewhat more severe recession."

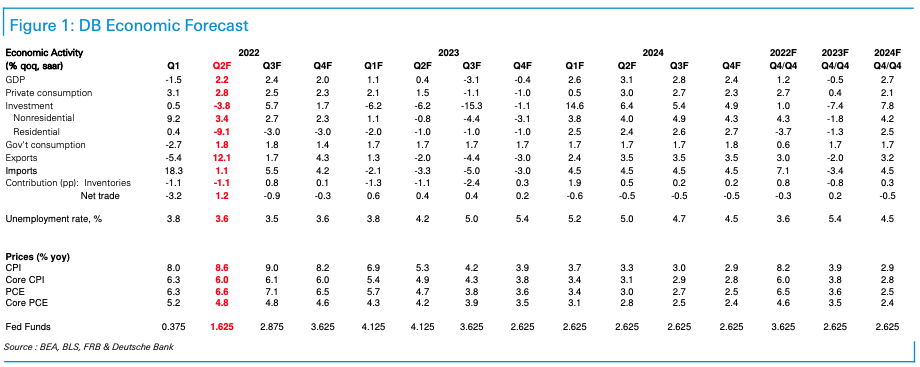

Luzzetti now sees U.S. gross domestic product (GDP) growth coming in at "sub-1%" in the first half of 2023, followed by a -3.1% contraction in the third quarter of 2023 — one quarter earlier than Luzzetti previously estimated. In the fourth quarter of 2023, Luzzetti expects growth to contract by another -0.4%.

"The upshot is that the economy is likely to contract next year by about 0.5%," the note stated. "A more severe downturn leads to a higher unemployment rate, which peaks near 5.5%. The weaker labor market helps to guide inflation closer to target by 2024, though we still anticipate a nearly half percent overshoot at that point."

Luzzetti and team also see the Consumer Price Index (CPI) peaking at 9% in the third quarter of 2022. CPI, a closely watched measure of what Americans pay for goods and services, was up 8.6% year-over-year as of May — the most since 1981.

Recession fears are picking up across Wall Street and the C-Suite as the Federal Reserve embarks on an aggressive pace of rate hiking. On Wednesday, the Fed lifted rates by 75 basis points as the central bank took a harder tone on stomping out inflation.

On Friday, the Fed reiterated his hawkish stance on policy by noting in a report to Congress that the monetary body is "acutely" focused on bringing down inflation. The commentary weighed on stocks yet again despite the S&P 500 and Nasdaq Composite already being in bear market.

"A more severe tightening of financial conditions could easily pull forward recession risks to around the turn of the year, which could short-circuit the Fed’s tightening cycle," added Luzzetti. "That said, higher inflation during that period would likely constrain the Fed's ability to cut rates to counteract the downturn. On the other side, a more resilient economy in the near-term with more persistent inflation pressures would spell upside risk to our Fed view."

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube