Despite Headwinds, Mood in Menswear Remains Upbeat for Fall

Neither flight delays and cancellations nor the concerning macroeconomic environment could dampen the spirits of retailers who braved the unfriendly skies to shop the Chicago Collective and Project/MAGIC in Las Vegas last week.

Although they were cognizant of a potential recession, rising inflation, the ongoing war in Ukraine, health concerns — monkeypox and polio in addition to COVID-19 — and other larger issues impacting consumer confidence, business continues to be strong for most stores.

More from WWD

Red Carpet Looks at the 'She-Hulk: Attorney at Law' L.A. Premiere

Red Carpet Looks at 'The Lord of the Rings: The Rings of Power' L.A. Premiere

Red Carpet Looks at the 'House of the Dragon' London Premiere

As a result, they were in an upbeat mood and shopping aggressively for spring and immediates to meet the ongoing demand from their customers.

Dress apparel continued to lead the way for most men’s stores as events and weddings are leading to heightened demand. And while sales of strict athleisure apparel may have slowed as customers eye a return to work — even on a hybrid basis — after Labor Day, updated sportswear made strides along with suits and patterned sport coats for guys.

While retailers are not hiding their heads in the sand about the issues they’re facing, they believe that the lessons learned during the pandemic that helped them survive will serve them well in the future.

Ken Giddon, president of Rothmans in New York, said, “We’re not seeing any slowdown yet. Business is really good and there might be a recession, but if business does turn down, we’re prepared.”

He said the pandemic helped him create strong bonds with his vendors and to develop ways to navigate shipping delays and the threat of canceled orders.

“We’re buying from people who have inventory,” he said, “not six months ahead. We learned there are no guarantees, so we better be prepared.”

For Rothmans, that meant buying fall as well as spring 2023 in Chicago. He singled out Emanuel Berg and Brats as tailored vendors that have created stock programs — thereby eliminating risk — and also pointed to Jack Victor, Seven Downie St. and Fair Harbor as brands he was buying at the show.

Rick Penn, president of Puritan Cape Cod, said 2021 “was a great year and 2022 is even better.” He pointed to the “dress part of the business” as a highlight, “driven by events and travel.” But it’s not just suits that are experiencing a boost in business, sportswear is also performing, he said.

At the show, he was buying both tailored clothing and sportswear, even though some vendors were still experiencing supply chain issues and may not be able to deliver for more than six months. “We’re going to have to figure that out together,” he said.

Penn said that while he may not be buying as aggressively for spring 2023 as he did for this past spring, he’s still optimistic.

“The world changes so quickly now and we have to adjust quickly, too. We learned some tough lessons in 2020,” but being a “high service, high touch” store has served him well. “This is a great time to be an independent because the customer is really enjoying the relationship we have with them.”

That sentiment was echoed by Keith Kinkade of Kinkade’s Fine Clothing in Ridgeland, Miss.

“Our business is still extremely strong — better than last year, which was our best ever,” he said. The surge is being driven by suits, sport coats, shirts and ties, wedding attire as well as sportswear.

He has been courting his customers by offering some little extras such as a free hoodie, umbrellas to guard against spring showers and seasonings. If these small investments can draw shoppers to the store more than their traditional twice a year visits, they’re well worth it, he said.

“We feel a little bit of caution, but we’re still buying with optimism. We don’t know what’s going to happen in November, but people are still going to need clothes.”

Among the brands he was banking on were Johnnie-O, 34 Heritage, Barbour, Faherty, Filson and local Mississippi brand GenTeal whose polos and sport shirts have sold well and with whom he has established a strong bond. “We’re sticking with the ones who brought us to the dance,” he said.

Ted Silver of Weiss & Goldring in Alexandria, La., also characterized his business as good, but he has expanded beyond suits and running shoes to other products including crystal, pots and pans, knives and even Swiss chocolate.

“I sell what my customer wants,” he said.

In apparel, top sellers include Tasc, Vuori and On Running in the active realm and he was planning to place an order for Johnnie-O sport coats in Chicago. “It’s a performance coat that sells for $795,” he said. “It’s a no-brainer and something cool for the store.” Denim was also on his shopping list.

Patty Leto, senior vice president of The Doneger Group, who attended both the Chicago Collective and Project, was buoyed by the heightened energy she saw in Vegas and the number of major retailers who attended the show, including Nordstrom, Macy’s and Walmart.

For retailers with a younger customer or those in the street side of the business, “Project remains the show to go to,” she said.

For Doneger’s retail clients, she said they experienced a strong 2021 in spite of supply chain issues and were shopping with an upbeat attitude. “The consumer was ravenous and spending money,” she said of last year.

Although spring 2022 was more challenging, retailers remain optimistic and are working to manage inventories. Back-to-school results will provide a good peek into the future, she said, and until they get more clarity, they’re being cautious about the future.

Even so, top opportunities for spring 2023 include cleaned-up streetwear, wovens with performance properties, hybrid pieces to wear to the new workplace, polos and golf wear, Leto said.

Vendors were also upbeat at the shows.

Dan Orwig, president of Peerless Clothing, acknowledged the “headwinds” around the world, from inflationary pressures to wars and bloated inventories in slowing categories such as activewear. “A lot of people thought that business would go on forever,” he said. “But now there’s a lot of inventory in the pipeline.”

But for Peerless, the country’s largest tailored clothing manufacturer, business continues to be good. “From better and mid-tier department stores to specialty stores, the velocity is still very strong.”

Although lower-income customers are feeling the pinch of rising prices, “there’s still demand for dress wear.”

Orwig sees a bit of a slowdown in the occasion business in the third quarter, but expects it to be offset by a pickup in return-to-work clothes — not necessarily suits, but dressier hybrid options. “For the fourth quarter, we feel good about the return on celebrations and for the first quarter, we expect a reassessment,” but the number of weddings in the hopper for 2023 should help the numbers stay healthy.

Peter Leff, executive vice president of wholesale for Tommy Bahama, said the brand’s upbeat, colorful spring offering — and the rising popularity of its womenswear — will lead to double-digit increases for spring. Among the most popular items are technical pants, shorts and shirts for men including the Chip Shot bottom and the Nova Wave seersucker shirt.

Once again, the Chicago Collective and Project/MAGIC overlapped, forcing many retailers to choose. The more upscale independent stores opted for the Windy City while those with more of a streetwear or young men’s bent were better served in Vegas.

Bruce Schedler, vice president of the Chicago show, once again pushed the venue to its limit and there was still a large waiting list of brands hoping to get a booth. The Italian Trade Agency, which brought some 60 vendors to the show, had a large presence, wining and dining retailers and also hosting a dinner and architectural cruise on the Chicago River.

Schedler deemed the show a success and revealed that starting in March, a women’s version with a similar aesthetic will be launched. It will replace the current Stylemax show, which will hold its last event in October.

The Chicago Collective women’s edition will serve as a “platform for higher-end brands” and present a more elevated experience for retailers, he said. There will be distinct areas for denim and contemporary, upscale missy labels, skin care and beauty, and even home and gifts.

The plan is to hold three shows a year, he said: March, June and October, to serve stores in the Midwest and elsewhere who would prefer to shop at a smaller, more-curated, higher-end show in the Midwest. “We want to seize the opportunity post-COVID-19,” he said.

Kelly Helfman, president of Informa Markets Fashion, owner of Project and MAGIC, was also pleased with how her Vegas shows have bounced back after COVID-19. Going forward, she doesn’t expect another overlap with Chicago.

”We’ve definitely grown since the last show,” she said, pointing to the return to Vegas of anchor brands such as Hudson, Joe’s Jeans and Levi’s that have historically been “crucial to our business.”

Although final numbers are not yet in, Helfman said the sourcing portion of the show more than doubled in size, international brands increased 15 percent and on the first day of the show, 33 percent of the buyers were new.

To help retailers discover new brands, she personally hosted what she described as a speed dating event at the show where brands were brought in front of potential customers.

“We understand the needs of buyers and brands,” she said, adding: “We’re a destination for present-day and future trends.”

Here are some standout brands from the shows:

Chicago Collective

Brand: Wythe

Designer: Peter Middleton

Backstory: Although the brand is based in New York, there’s no mistaking Middleton’s Texas roots. But Wythe’s distinct Western flavor is not traditional. In fact, the founder and designer — who worked for Faherty as well as at Ralph Lauren in textile research — has managed to blend the best of both worlds. “I’m from Texas but when I think of Americana, it’s less New England and more Southwest,” he said. Middleton takes those references and blends them with workwear, surfwear and just plain old menswear classics to offer a new take on some traditional ideas. “I don’t have to dress like a cowboy. I can mix it with other things I want to wear like an oxford or tank top.”

Key styles: Middleton recreated his grandfather’s oxford shirt in a cotton dobby, and offers a Tuscan-style hunting jacket in a linen-cotton blend with deep front pockets — a signature of the brand — in both an indigo dye, with matching pants, as well as an unbleached version. There are shiny western shirts in Tencel as well as solid and color-blocked options based on original rodeo shirts. Wythe also has a line of leather bags and belts, handcrafted by artisans in Mexico, featuring one-of-a-kind floral motifs.

Retail prices: T-shirts sell for $50 to $60, button-down shirts are $160 to $220, pants are $200 to $220 and jackets are $298.

Kimberly Sharp

Brand: Fourlaps

Backstory: Daniel Shapiro, a former merchant at American Eagle Outfitters and Old Navy, saw a void for preppy-inspired activewear when he created Fourlaps, which stands for the number of laps around a quarter-mile track that make up a mile, in 2016. The first products included hoodies, matching sweatpants and sweat shorts, tank tops, workout tops, running shorts, graphic T-shirts and hats — all with the brand’s signature red, white and blue stripe. Since then Shapiro has extended his reach into womenswear, as well as sweaters, hiking and commuter pants and even down jackets.

Key styles: At the show, Shapiro offered both fall pieces and spring staples. New for the fall season is an assortment of sustainable, traceable down jackets in a variety of silhouettes including long-sleeved models — one of which includes hand warmers — vests and a version that reverses to a biodegradable Sherpa. There are also windbreakers, recycled performance fleece in color-blocked models and a camo pattern, a heavier-weight shacket and lightweight sweaters featuring Coolmax. For spring, Fourlaps is offering a four-inch running short, a lined mesh basketball short, a commuter pant in slim or straight fits and a hiking cargo pant with a cinched bottom.

Retail prices: The down jacket is $298, the vest is $198, the color-blocked jacket is $138 to $158, the commuter pant is $118 and the sweaters are $98.

BALDOMERO FERNANDEZ

Brand: Grey/Ven

Designer: Gregory Abbou

Backstory: The brand was founded by Abbou in 2021 as a women’s luxury knitwear label centered around classic pieces that draw inspiration from contemporary femininity and modern lifestyles. Abbou, who served most recently as men’s design director of Frame Denim, had one goal in mind for his newly launched men’s range: To create a versatile wardrobe that can be worn throughout the year, with silhouettes that run the age gamut and can be translated into either a casual or a more refined tone, all based off of pieces from his personal closet.

Key styles: A loose-fit pleated trouser available in multiple colors, a modern take on travel sweatpants in organic cotton with front cargo pockets, zipped cropped jackets, cotton and linen blend T-shirts, and a pair of double-faced canvas denim five-pocket jeans.

Retail prices: The sweats retail for $320, cashmere knits and zipped cropped jackets come in just under $500 and the double-breasted blazers are $600.

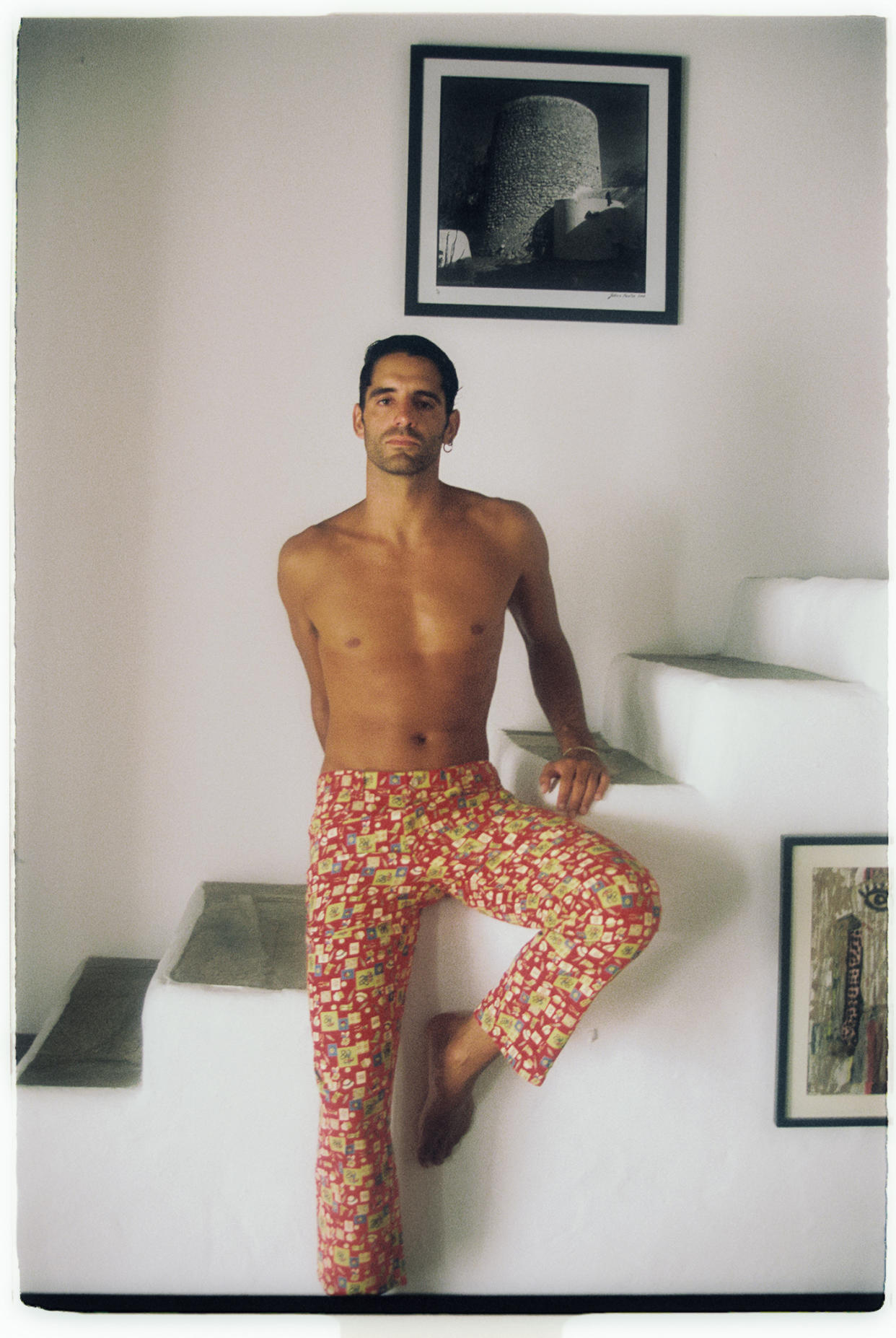

Brand: OAS

Backstory: It all began as a simple side hustle in 2010 when brand founder Oliver Adam Sebastian would travel to his family’s house in Barcelona each summer and his friends back in Sweden would put in orders for pairs of rare espadrilles and highly coveted Spanish swimwear. After years of supplying his close contacts, Sebastian decided to start his own resort brand, OAS. The label, which bears his initials, is known for its deluxe beachwear and accessories spanning from caftans to beach towels, swimsuits, linen shirts, hats and shoes. The brand’s flagship product is undoubtedly the terrycloth short-sleeved shirts, made in Portugal of 100 percent cotton and available in myriad retro-inspired motifs.

Key styles: With a penchant for vibrant graphics, this season’s “African Maximalist”-inspired patterns are found on linen camp shirts, velour half-zip sweatshirts and trippy Cuban terrycloth shirts.

Retail prices: Shirts range from $87 to $130 for the graphic camp styles, $138 for the terry cloth options and $87 for the swim trunks.

Brand: Gallia Knit Project

Designer: Mario Roberti

Backstory: What started as a small passion project for Roberti has grown into a visually impactful capsule collection filled with retro and nostalgic references. “Knitwear collections tend to look very similar nowadays,” said Roberti, who has been working with the Italian brand for more than 20 years. The result is a lineup that uses funky colors in classic menswear pieces with oversize volumes; bold colors mixed into intarsias and jacquards, and with key pieces infused with soft boucle yarns with a colorful spin.

Key styles: A ribbed white V-neck tennis sweater with colored striped detailing on the cuffs, a light varsity jacket with a soft boucle yarn, striped boucle T-shirts and geometric intarsia retro polos (some with flat ribs details inspired by cycling elements).

Retail prices: Price points begin just under $190 and go upward for the polos, with some of the basic pieces coming in just under $200; overshirts are $400.

Project

Brand: Cross Eyed Moose

Backstory: For decades, One Jeanswear Group has been a major player in the women’s denim world with its Gloria Vanderbilt label and other brands. Now the company is setting its sights on menswear, introducing a new collection, Cross Eyed Moose, that is intended to straddle the streetwear and outdoor markets. One Jeanswear’s chief executive officer Jack Gross called it a blend of “Lululemon-meets-Carhartt-meets-Stone Island” with its assortment of technical products that are comfortable and stylish. The collection is targeted at a customer who is looking for something “whimsical and fun,” he said, and is seeking something with “pizazz and attitude.” Although grounded in denim, the brand offers a full lineup of pants, shirts and jackets in eye-catching patterns and colors. “The days of being mundane are over,” Gross said. “People want personality and to stand for something.”

Key styles: A ripstop jacket with zip-off sleeves converts into a utility vest and is offered in bright solids as well as a colorful amoeba print. The same pattern was used in shorts that could be worn from beach to bar, woven shirts and ringer Ts. An updated fishing shirt offered multiple pockets and a vented mesh back, a long-sleeve sun T-shirt had both a hoodie and a built-in gaiter, and there were screen and acid-wash Ts with the brand’s moose logo. Classic twill pants with a water-resistant coating sported a camo print, ripstop cargo joggers, stretch denim joggers and a rain jacket with a hidden hood were also offered.

Retail prices: Bottoms retail for $69 to $89, tops for $29 to $49 and outerwear for $179.50 to $199.50.

Brand: Mustique

Designer: Vera Caldeira

Backstory: Mustique is a Lisbon-based brand founded by Caldeira and her childhood friend Pedro Ferraz. During a trip to India in 2017, they were enamored with the ancient art of block printing and the artisans who used the technique to create complex patterns applied to a variety of textiles. That prompted them to create a collection of block-printed shirts in the summer of 2018 that they sold direct to consumers. Mustique operates its own stores in Portugal and this marked its first first time showing at Project as it seeks to establish a foothold in the U.S. “We have a lot of American tourists who shop in our stores so we took a leap of faith,” Caldeira said.

Key styles: The colorful, funky and cool offering included a matching set of pants and an overshirt created from deadstock fabric they discovered in a warehouse in Portugal featuring a childlike print with strawberries, umbrellas, salt shakers and other images. Cotton sweaters with daisies on the sleeves; a folklore camp shirt with embroidered detailing was created from old Portuguese tablecloths, and an array of tie-dyed rayon shirts hand dyed in India were also offered.

Retail prices: The matching set sells for $156 for the pants and $168 for the overshirt, the tie-dyed shirts were $118, the folklore embroidered shirt was $160 and the daisy sweater was $148.

Brand: La Paz

Designers: Jose Miguel de Abreu and Andre Bastos Teixeira

Backstory: Created in 2011, the Portuguese brand is inspired by the staples in a gentleman’s wardrobe. While “Paz” may be the Spanish word for “peace,” for the Portuguese label it almost seems to translate to harmony — a melding of traditional menswear shapes with regionally specific manufacturers and styles, all sourced and manufactured in Portugal. De Abreu and Teixeira infuse each piece with a heavy dose of seaside influence, from boat print button-downs, beach-ready shorts (made from recycled fabrics), lightweight cotton sweatshirts to easily cuffed trousers. The result is a collection of staples that could be styled for beach bonfires, office meetings, and any adventure in between, echoing the seafaring heritage of Portugal’s coast.

Key styles: Baby corduroy shorts (a bestseller style for the brand), terrycloth sweatshirts and sustainable swim shorts are all produced in the season’s color palette of soft pastel pinks, vibrant greens, navy and coral reds.

Retail prices: The corduroy shorts sit at $130, the swimwear is $100 to $110, shirts range from $130 to $160, jackets start at $250 and the T-shirts sell for $50 to $70.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.