The Democrats’ dilemma on taxes

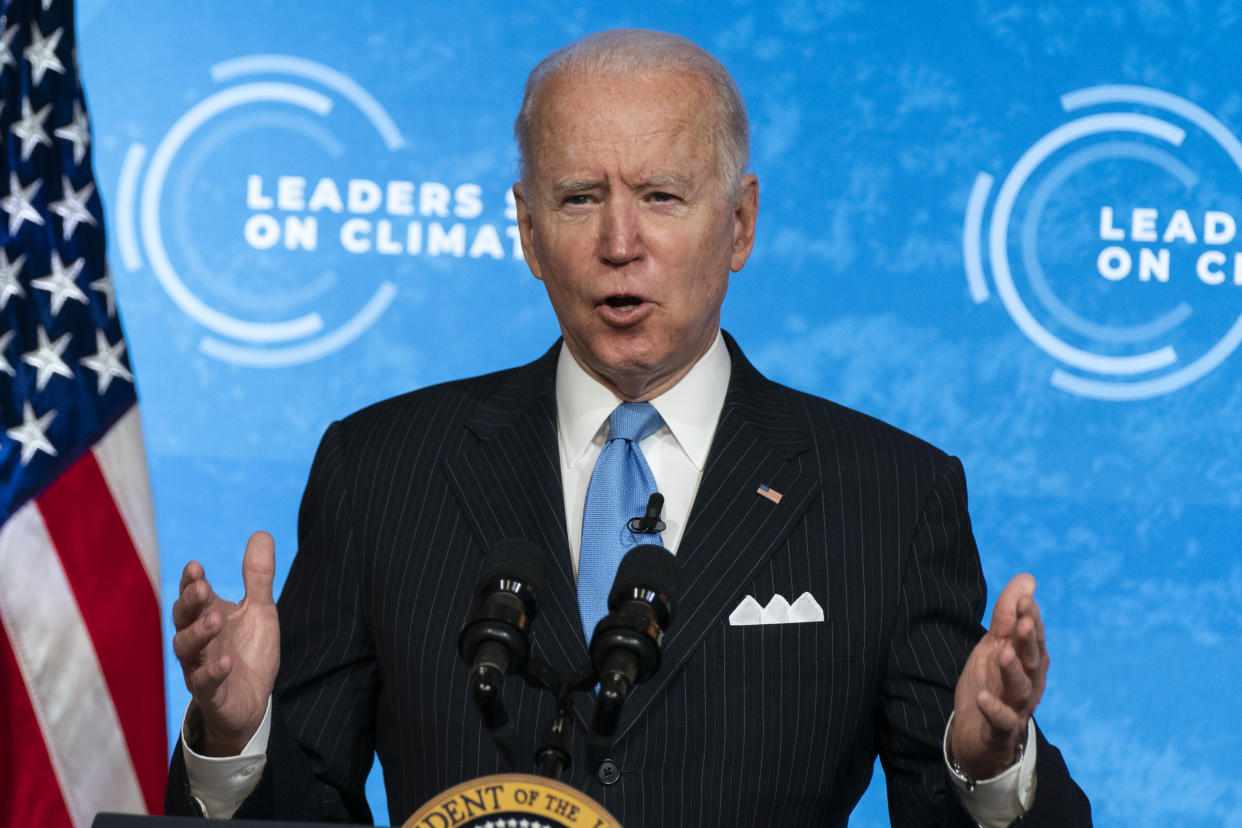

President Biden is pushing hard for higher taxes on the wealthy, to pay for his climate plans, infrastructure, child care benefits and a variety of social-welfare programs. Just one problem: Biden and his fellow Democrats would be raising taxes on their own constituents more than any other political group. That suggests Democrats in Congress will end up voting for considerably smaller tax hikes than Biden is calling for.

Biden wants to raise the top income tax rate from 37% to 39.6%, which would affect taxpayers with incomes starting at around $530,000. He’d nearly double the capital gains tax for people who earn more than $1 million and raise the inheritance tax above $3.5 million in holdings. That’s in addition to a planned increase in the corporate tax rate and other tax hikes Biden may yet announce as part of the “American Family Plan,” his package of social-welfare reforms that’s coming soon.

Those tax hikes would hammer Democrats in blue states more than the Republicans in red ones. Of the 50 wealthiest Congressional districts, Democrats represent 42 of them, according to Census Bureau data. Republicans hold just 8. For the last 25 years, shifts in party affiliation have brought more wealthy urbanites to the Democratic party, and more working-class whites to the GOP. Republicans used to be the party of business, but even that seems to be changing as the GOP radicalizes and some businesses keep their distance.

Will Democrats really raise taxes on their own? Probably, but watch for some sleight of hand. While drafting tax hikes on businesses and the wealthy, Democrats in Congress also want to repeal the $10,000 cap on state and local tax deductions that Republicans imposed in their own 2017 tax bill. The new cap on so-called SALT deductions hit hardest in coastal blue states such as New York and California, which tend to have high taxes residents used to be able to deduct against their federal taxes. Biden hasn’t taken a stand on repealing the SALT cap, but some key Democrats in Congress have said that’s a condition of them signing on to any other tax bill Biden wants.

Polls show a majority of voters favor higher taxes on the wealthy to pay for programs such as infrastructure, so the rhetoric and the political equation works for Biden and his fellow Democrats. But for every Elizabeth Warren or Alexandria Ocasio-Cortez who wants to soak the rich, there are moderate Democrats who quietly oppose sharp tax hikes.

[Read more: Biden’s capital gains tax hike would only affect the top 0.3%, White House says]

Middle ground for an 'acceptable increase'

Chuck Schumer, the Senate Majority Leader, has in the past opposed raising the capital-gains tax for wealthy investors to the top income-tax rate, which is exactly what Biden is proposing. That’s a sop to the hometown financial industry in Schumer’s New York. Schumer has also defended the “carried interest” provision that lowers taxes for hedge funds and private equity firms. Rep. Richard Neal of Massachusetts, who chairs the House Ways and Means Committee – which writes tax legislation—is another defender of the carried-interest provision. Neal said recently that Congress “will accept some of what [Biden] is proposing,” not exactly a ringing endorsement of the president’s tax plans.

Whatever tax hikes are coming might end up sounding meatier than they are. “There will have to be some paring back of the tax proposals in order to gain unified Democratic support,” Beacon Policy Advisors explained in an April 26 client note. “The real negotiations will be between people like Neal, who is probably the biggest Democratic ally for investors, and Democratic leadership in finding a middle ground for an acceptable increase in rates for investors.”

Many analysts think tax hikes that ultimately pass will be roughly half of what Biden wants. So instead of rising from 20% to nearly 40%, the capital gains rate for high earners might end up between 28% and 30%. Biden wants to raise the corporate tax rate from 21% to 28%, but 25% might be more realistic.

At the same time, Biden is trying to revive his party’s appeal among the working class, which used to be primarily Democratic but no longer is. On April 26, the Biden White House announced the formation of a task force on workers’ rights, with the mission to improve workers’ ability to join unions and bargain with their employers for better pay and benefits. There aren’t too many Washington, D.C., task forces that do memorable work, and this one could be window dressing that doesn’t change much of anything. But Biden is trying to expand the Democratic coalition beyond the college-educated urban elites who have given the party a bit of an egghead reputation, perhaps contributing to Donald Trump’s surprise win in 2016.

Trump won the presidency with an unforeseen coalition of working-class whites, nativists, evangelicals and business-minded voters. That coalition didn’t quite hold in 2020, but it proved that voters have shifting loyalties and politicians can woo them from one party to another. Biden is now trying to win back some of the blue-collar voters who ditched the Democratic Party during the last two decades, at the expense of the urban elites in another corner of the tent. If that’s okay with everybody, Biden might out-Trump Trump.

Rick Newman is the author of four books, including "Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. You can also send confidential tips, and click here to get Rick’s stories by email.

Read more:

Get the latest financial and business news from Yahoo Finance