As demand for Domino's, Papa John's slips, independent pizzerias aren't seeing 'softness in pizza': Slice CEO

Americans love their local pizza shops and aren't pulling back amid inflation, per the CEO of Slice, a company that aims to "modernize" independent pizzerias by providing tech and delivery services.

"It's fascinating to see Domino's and Papa John's reporting their numbers...we're not seeing softness in pizza overall," CEO Ilir Sela told Yahoo Finance.

Domino's Pizza (DPZ) and Papa John's (PZZA) both ended Thursday's trading session in the red — down 12% and more than down 6%, respectively — following fourth-quarterly earnings results that largely demonstrated consumer demand for both of the pizza chains slipped at the end of 2022.

[Read more: Domino's Pizza posts mixed Q4 earnings report, same-store sales miss estimates]

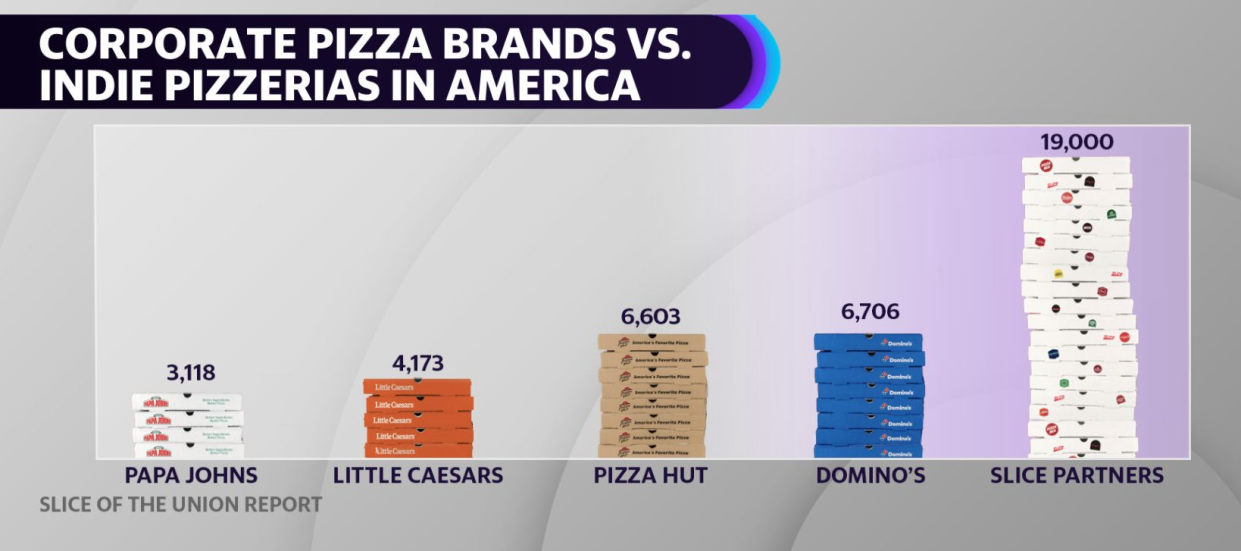

Sela, who started Slice in 2010 to support his family's New York City pizzerias (which have since closed) now has nearly 19,000 independent pizza shops in the company's portfolio.

"We're not seeing the independent slowdown [of local pizzerias] at all," Sela said.

He says mega chains don't offer the charm and quality that are keeping customers coming to locals shops amid high inflation.

"The authenticity, diversity, creativity, and ingredient quality found at local pizzerias can’t be matched by the major chains. Add in their unique personality and outstanding service, and it’s no wonder that many of these businesses have been neighborhood cornerstones for years," he said. "When families order local pizza, they’re not getting something filled with preservatives and filler," he added.

The average price for a large pie now costs $17.81, compared $16.74 in 2021, per Slice's annual Slice of the union report. Costs were driven higher by protein and packaging like pizza boxes and bags.

Prices do vary though. In Oregon, the average cost is $26.94 per pie, and in states like Washington and Alaska, customers can expect to pay upwards of $23.00. Pizza fans in Oklahoma, Minnesota, and Alabama fare better, with the average pie coming in around $14.00.

Despite rising prices, Sela said pizza remains a family staple in the U.S. for a few reasons. "It’s affordable for families, designed for gatherings, and it travels well."

Sela tells a different story than the mega fast food chains did on their recent earnings calls.

Domino's CEO Russell Weiner called the global brand a "work-in-progress" in unprecedented times. In a call with investors he noted that fewer consumers are ordering delivery overall as they return to pre-COVID habits like dining inside restaurants, impacting its delivery pizza here in the U.S., where delivery makes up roughly 60% of total sales.

"A relatively higher delivery cost during inflationary times leads some customers to prepare meals at home instead of getting them delivered," he said.

Meanwhile, Papa John's CEO Rob Lynch called 2022 "a very tough year" in a call with investors as sales volume normalized last year from a pandemic boost. Innovation helped the chain last year, with the introduction of its Epic Pepperoni Stuffed Crust and New York Style pizzas.

Lynch remains confident that innovation will remain a key driver in 2023, despite lower sales in North America in Q4.

“Investments in product and digital innovation, combined with strong operational excellence, will continue to enhance the customer experience and contribute to healthy North America comparable sales and unit economics," he said in the release.

Many pizza delivery giants were considered darlings of the pandemic as consumers ordered and ate at-home. Shares of Papa John's are now down nearly 4% compared to 2 years ago, whereas shares of Domino's are down nearly 11% on a 2-year stack.

—

Brooke DiPalma is a reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube