A delay of a key financial aid form could complicate college picking for seniors

The Free Application for Federal Student Aid (FAFSA) application will be delayed this year, which may worry some college applicants, especially if they applied for early decision.

FAFSA is how students apply for financial aid, like the Pell Grant and federal student loans. The FAFSA form is normally available in October, but due to major overhauls to the application process this year, it won’t be available until December.

For high school seniors applying for early decision to colleges, that means they will need to do a bit more work and communication with college financial aid offices.

"Students shouldn’t be deterred by the late FAFSA rollout to apply for early decision or early action," Gail Holt, dean of financial aid at Amherst College, told Yahoo Finance. "Schools offering either should have clearly posted information for those applicants, but many private schools have a way to offer those students financial aid based on the College Scholarship Service (CSS) profile application, merit, or other information."

What is FAFSA?

Financial aid for college comes from federal, state, and institutions of higher education, but most rely on the FAFSA form to determine eligibility.

"To qualify for financial aid — grants, scholarships, work study, and loans — financial aid offices need to know how much it's going to cost a family to go to college and how much financial need there is and it all starts with the FAFSA," Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators (NASFAA), told Yahoo Finance Live (video above).

Read more: Your complete guide to FAFSA for the 2023-2024 school year

For students applying for early decision, they’re making a commitment to the school that if accepted, they will attend. Those applying for early action don’t necessarily have to commit to attending. Typically, schools with these early application processes try to send accepted students their financial aid packages before the end of the year, according to Inside Higher Ed, so they have that information to plan ahead.

That could change now since the new FAFSA form won’t be available until December. Many schools may depend on the CSS profile to provide an estimate of aid.

What is the CSS application?

"Most private institutions that offer significant funding require applicants to complete the CSS profile application, whereas public universities rely on federal aid and FAFSA," Holt said. "The CSS application is available Oct. 1 and although students will still need to complete the FAFSA, families shouldn’t be concerned about changes in their financial aid offer unless there is different information between FAFSA and CSS applications."

For instance, New York University offered this guidance to applicants on its website:

"Early Decision 1 — Because the FAFSA will not open until after the Early Decision 1 deadline, students admitted in that process who have filed the CSS Profile on time will receive an estimate of federal financial aid eligibility in their financial aid package. NYU will update your financial aid package with your confirmed federal financial aid eligibility after your 24-25 FAFSA has been submitted."

There’s a fee for the CSS application, but a fee waiver is available for families with an adjusted gross income up to $100,000, if the student qualifies for a SAT waiver or the student is an orphan or ward of the state under 24 years old.

Students applying for early decision should talk to their school’s financial aid office to find out whether they use the CSS application.

If a school offering early decision isn’t using the CSS application, students should reach out to that school’s financial aid office to find out how they are determining financial aid for early decision applicants.

Completing the CSS application doesn’t mean applicants should forgo the FAFSA, because federal and state aid is determined by the FAFSA. Not applying for FAFSA would be leaving money on the table, missing out on the Pell Grant and state-based aid.

File FAFSA as soon as its available

"Even though the FAFSA won’t be available until December, students and parents should create their Federal Student Aid (FSA) ID now before completing the FAFSA. Both students and parents will need to have their own FSA IDs," Rick Castellano, vice president at Sallie Mae, told Yahoo Finance.

"Filing late could have real consequences as some scholarships, grants, and federal aid is offered on a first-come, first-served basis or from limited sources, so it’s critical families file as close to the open date as possible," he added.

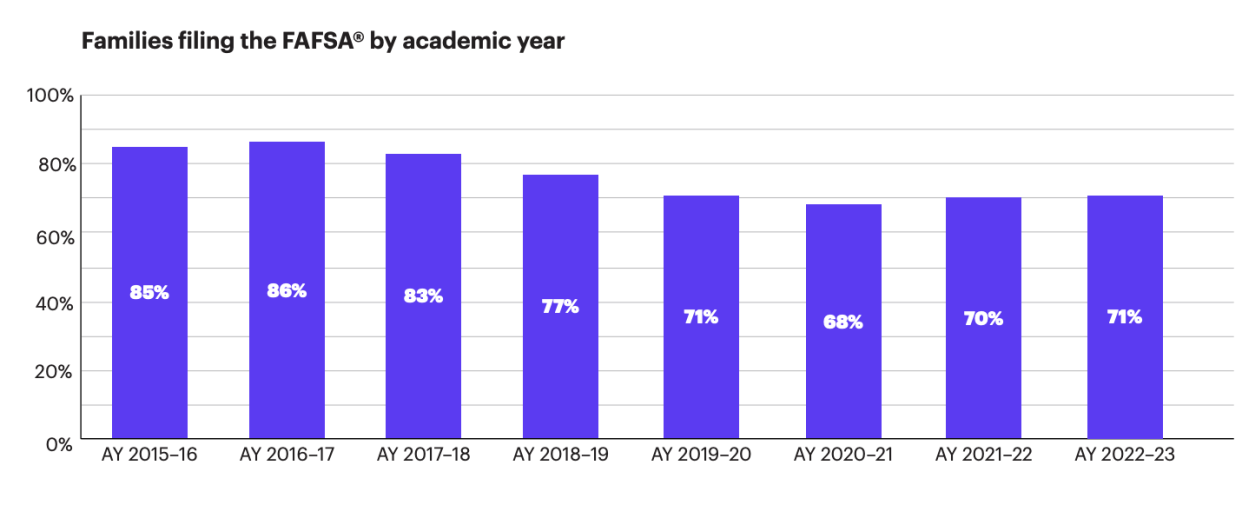

Around 7 in 10 families apply for FAFSA, but nearly 3 in 4 families weren't unable to identify when the FAFSA becomes available, according to a Sallie Mae report, and the late launch this year is likely to add to the confusion.

"This is a major financial decision that students and parents need to make with eyes wide open," Castellano said. "This is a complicated year due to the delayed application release, so setting expectations and talking about finances are key to making an informed choice."

Read more: Federal PLUS Loans: How do they work?

The reason for the delayed rollout is the FAFSA application is undergoing major changes to make the form a simple streamlined application for students and families.

The first noticeable change is that the application will go from 118 questions to 36 questions because instead of applicants answering questions about parents’ taxes, there will be automatic tax data-sharing from the IRS, which means tax data is imported to ensure accuracy," Castellano said.

One of the most significant changes is moving from the expected family contribution (EFC) need analysis formula to a student aid index (SAI) to determine eligibility for federal student aid.

Other changes include the removal of the number of family members in college from the eligibility calculation and the possibility for an SAI to be a negative number for students with the most need.

The ability to have SAI be a negative number helps identify students with the greatest need.

"There will be some bumpiness ahead," Holt said. "But students and families should ask questions of schools they are interested in, especially now that campus visits are back since the pandemic."

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Read the latest financial and business news from Yahoo Finance