'Deja vu all over again' for semiconductors as picture worsens: Deutsche Bank

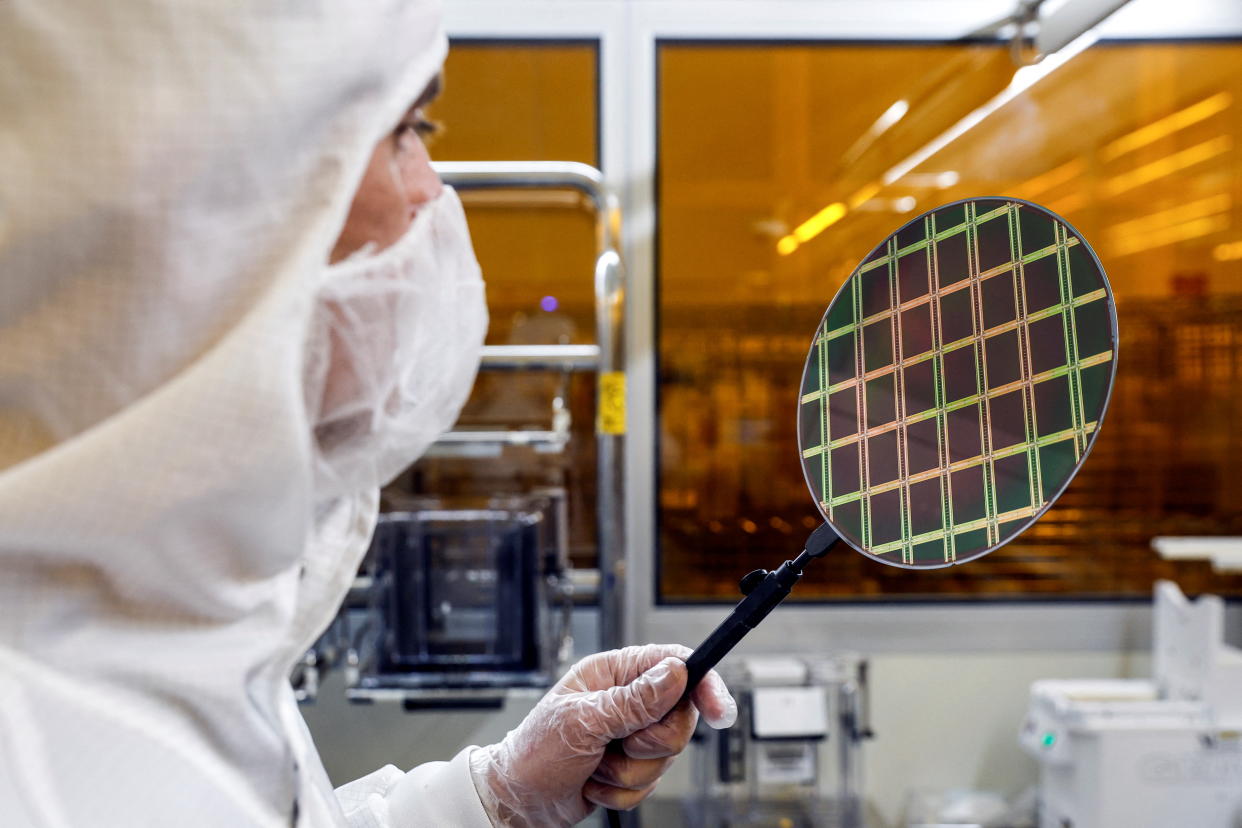

Semiconductor stocks are down big this year, and Deutsche Bank is warning about more weakness.

The bank's Q3 semiconductor industry preview, titled "Déjà vu all over again," highlighted "fears of fundamental deterioration leading to very bearish investor positioning," adding that "we expect 3Q earnings season to yield more pervasive signs of weakness, as the well-known issues in Consumer areas (PCs, Handsets, etc.) will likely spread to at least more forthcoming admissions of uncertainties rising in areas such as Data Center, Industrial and potentially even Automotive (likely least/last impacted, in our opinion)."

In terms of semiconductor stocks, the analysts added that "valuations are becoming somewhat appealing, but beyond a near-term positioning-related squeeze, we see few catalysts to drive the SOX meaningfully higher until macro/semi-sector uncertainties abate (inflation, war, US/China trade sanctions, duration/magnitude/ pervasiveness of semi down-cycle, etc."

The Philadelphia semiconductor index (^SOX), which includes the 30 largest semiconductor stocks traded in the U.S., is down 43% so far in 2022, while the S&P 500 is down 22% in the same period.

In the long term, the DB research team wrote that "we remain concerned that the combination of accelerating supply growth and 'normalizing' demand (whether driven by macro uncertainties such as the impending 2023 recession, or sector-specific dynamics such as lead-time contraction, double ordering reversing, etc.) will create rising fundamental volatility for semi companies as 2H22/23 unfolds."

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter @daniromerotv

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube