Declaring personal property: Take this step to avoid extra fee on Jackson County taxes

You may have noticed a postcard-sized notice in your mailbox recently about declaring your personal property for 2023. Jackson County residents have until Wednesday, March 1 to file their declaration.

Even if you missed the mailer, don’t worry — we’ve got all the information you need to avoid late fees and penalties.

How do personal property taxes work in Jackson County?

Personal property taxes apply to vehicles and other movable possessions like your boat, livestock, trailers and farm equipment.

The most common type of taxable personal property is your car or truck. You don’t have to pay property taxes on “household items” like apparel, computers, furniture or other belongings.

Personal property tax is calculated based on what you owned on Jan. 1 of a given year. That means that if you bought a car or moved to Missouri with your car on Jan. 2 or later, you won’t have to pay property tax on it until next year.

But if you owned a car on Jan. 1 — even if you sold it as soon as Jan. 2 — you will still have to pay property tax on it for 2023.

What does it mean to declare your personal property?

Every resident of Jackson County has to register their property every year. Even if you no longer own that vehicle, the property in your possession on New Year’s Day determines the taxes you will pay for 2023.

The deadline to declare your property is March 1. However, you won’t get a personal property tax bill until the end of the year. If you file after March 1, the county may charge you a late fee. The fee will depend on the value of your vehicle. You may be able to waive the fee for late declarations made before May 1.

How do I declare my personal property in Jackson County?

First, go online to the Personal Property Declarations webpage. You can also scan the QR code on the card you received in the mail, which should direct you to the application.

Next, choose “Individual Online Declaration” to reach the SmartFile site.

Create an account by entering your email address and choosing a password.

Use the PIN number located on the left-hand side of your mailed card to access your personal property account.

Select your account and follow the instructions to declare your property.

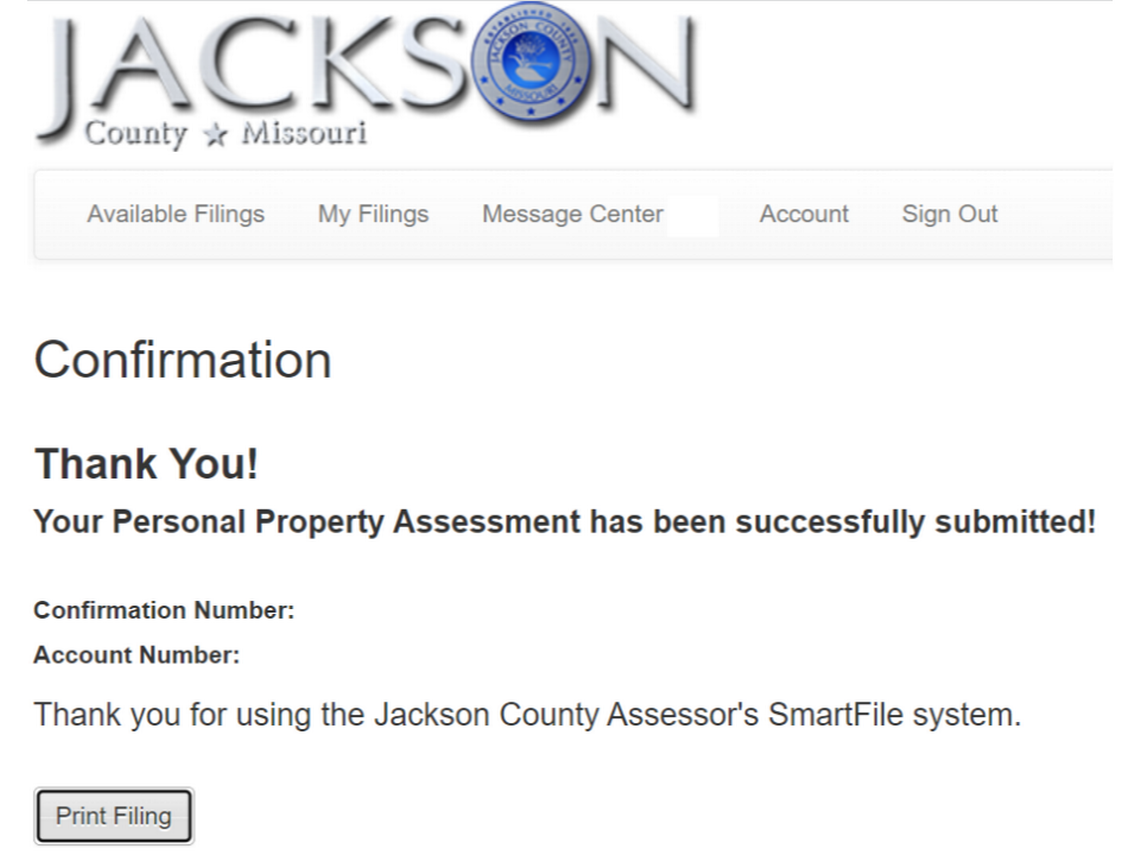

Finally, submit your declaration and save the confirmation page for your records.

If you declared your vehicle in Jackson County last year, its information should already be in your account. You will only need to make changes to your account if you sold the vehicle or purchased a new vehicle before Jan. 1.

If you only own the same vehicle you owned last year, you can skip to the “Signature” tab and enter your name and the date. Then, simply click “Submit” to complete the form.

Pro tip: Jackson County spokesperson Marshanna Smith told The Star that the most common mistake her department sees is residents trying to use the PayIt system, which is used to pay property taxes, to declare their property. Make sure you are using the SmartFile system to declare your vehicle, not the PayIt system you may have recently used to pay your bill.

What can I do if I misplaced my mailed card or never got one?

If you don’t know your PIN number, Smith said that the county’s assessment department can provide it for you.

“They may call the Assessment Department and we will provide it or they can send an email to IPP@jacksongov.org. Please note “Need Pin” in the email subject line,” Smith wrote in an email to The Star.

A banner on the assessment department’s website noted that wait times to reach the office by phone are averaging one hour due to the high volume of calls about declaration notices.

You can reach the department at 816-881-1330.

What documents do I need in order to declare my personal property?

Smith advised residents to have their title and registration available to ensure the correct make, model and Vehicle Identification Number (also called the VIN) are in the county’s system. This information can also be found on the receipt from the last time you renewed your license plates.

“We do not pull records from vehicle registrations,” Smith told The Star. That means that even if you recently registered your car in Jackson County, you still have to complete the declaration process.

However, the department’s system should have your declaration from last year on file, so you will only have to update it if you sold your vehicle or bought a new one.

What happens if I don’t declare your property by March 1?

If you don’t meet the March 1 deadline, you may have to pay a fee based on the value of your vehicle. The fee ranges from $15 to $105 depending on the value of your property. The department may waive the fee if residents declare their property before May 1, Smith told the Star.

Do you have more questions about personal property taxes in Jackson County? Ask the Service Journalism team at kcq@kcstar.com.